Hawaii Partnership Formation Questionnaire

Description

This questionnaire may also be used by an attorney as an important information gathering and issue identification tool when forming an attorney-client relationship with a new client. This form helps ensure thorough case preparation and effective evaluation of a new client’s needs. It may be used by an attorney or new client to save on attorney fees related to initial interviews.

How to fill out Partnership Formation Questionnaire?

Should you desire to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's straightforward and user-friendly search to locate the documents you need. Various templates for business and personal uses are organized by categories and claims, or keywords.

Utilize US Legal Forms to obtain the Hawaii Partnership Formation Questionnaire with just a few clicks.

Each legal document template you obtain is yours permanently. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Compete and acquire, and print the Hawaii Partnership Formation Questionnaire with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click on the Acquire button to find the Hawaii Partnership Formation Questionnaire.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/region.

- Step 2. Utilize the Review option to check the form's details. Remember to read the summary.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click the Acquire now button. Choose the pricing plan you prefer and enter your information to register for the account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Hawaii Partnership Formation Questionnaire.

Form popularity

FAQ

Yes, you can write your own partnership agreement, but it’s crucial to ensure that it complies with Hawaii's legal standards. To create a solid agreement, cover key aspects such as partner responsibilities, profit distribution, and dispute resolution. The Hawaii Partnership Formation Questionnaire can serve as a helpful resource, offering a structured approach to drafting your agreement while covering all necessary legal elements.

The format for a Hawaii tax ID typically consists of a nine-digit number, similar to the Social Security number format. This identification number is essential for tax purposes and must be obtained when forming a partnership. You can find specific instructions and assistance in the Hawaii Partnership Formation Questionnaire, which provides guidance on acquiring your tax ID.

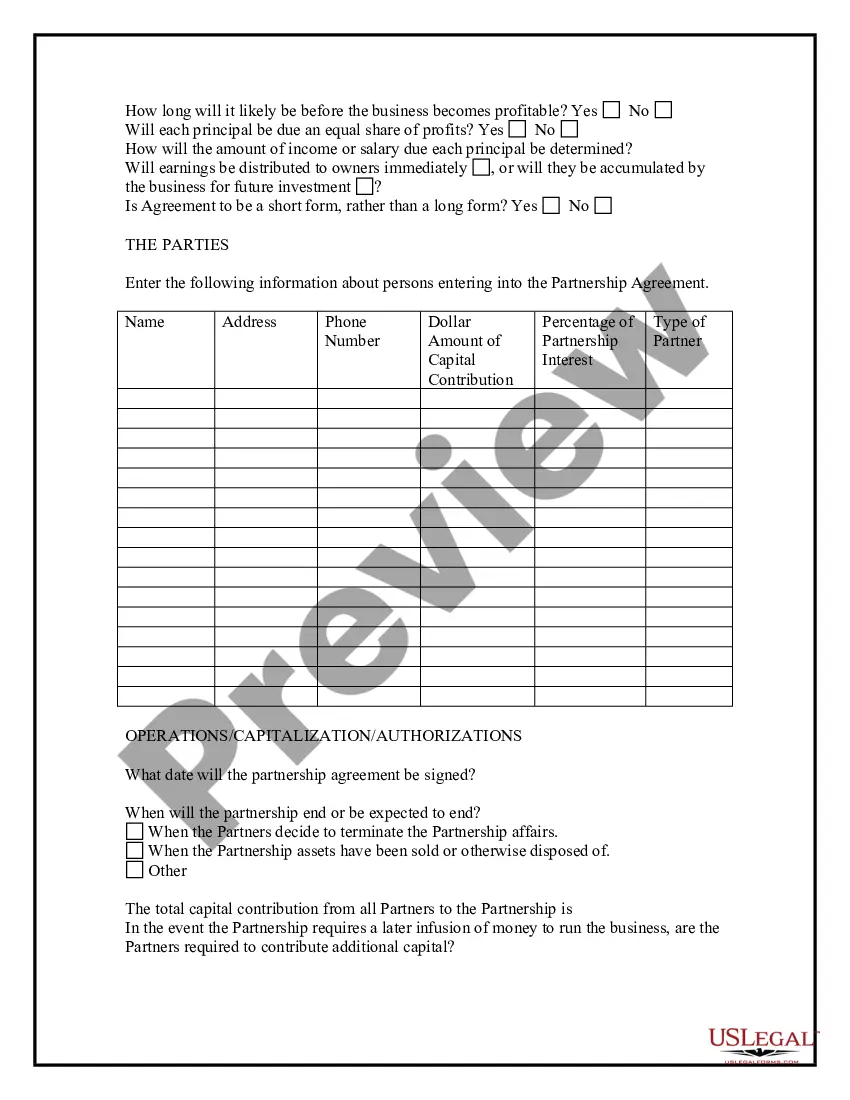

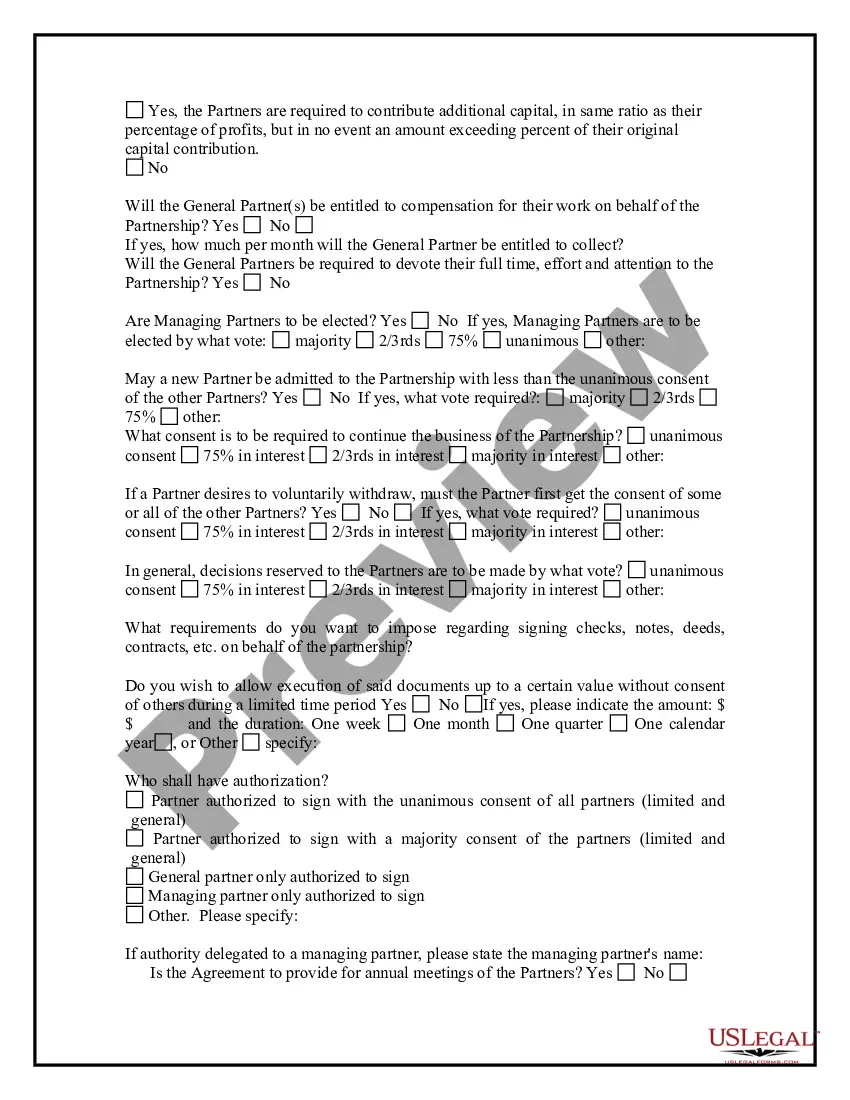

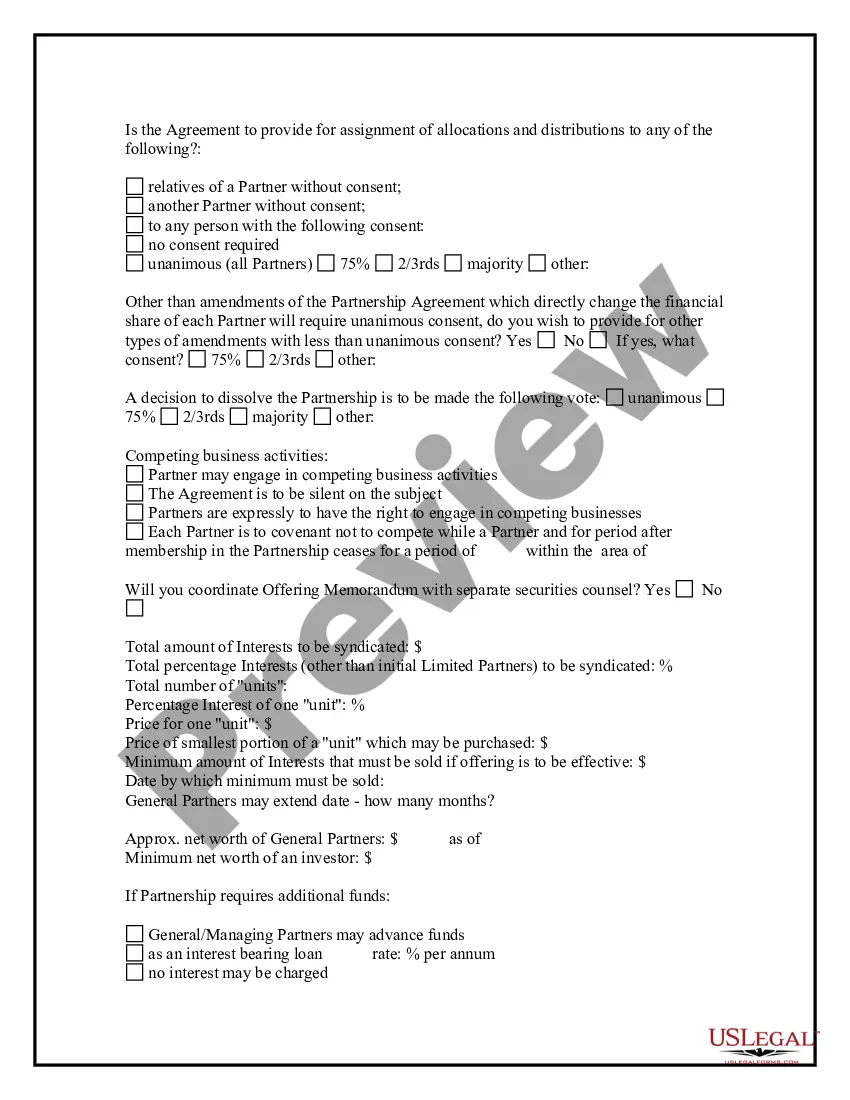

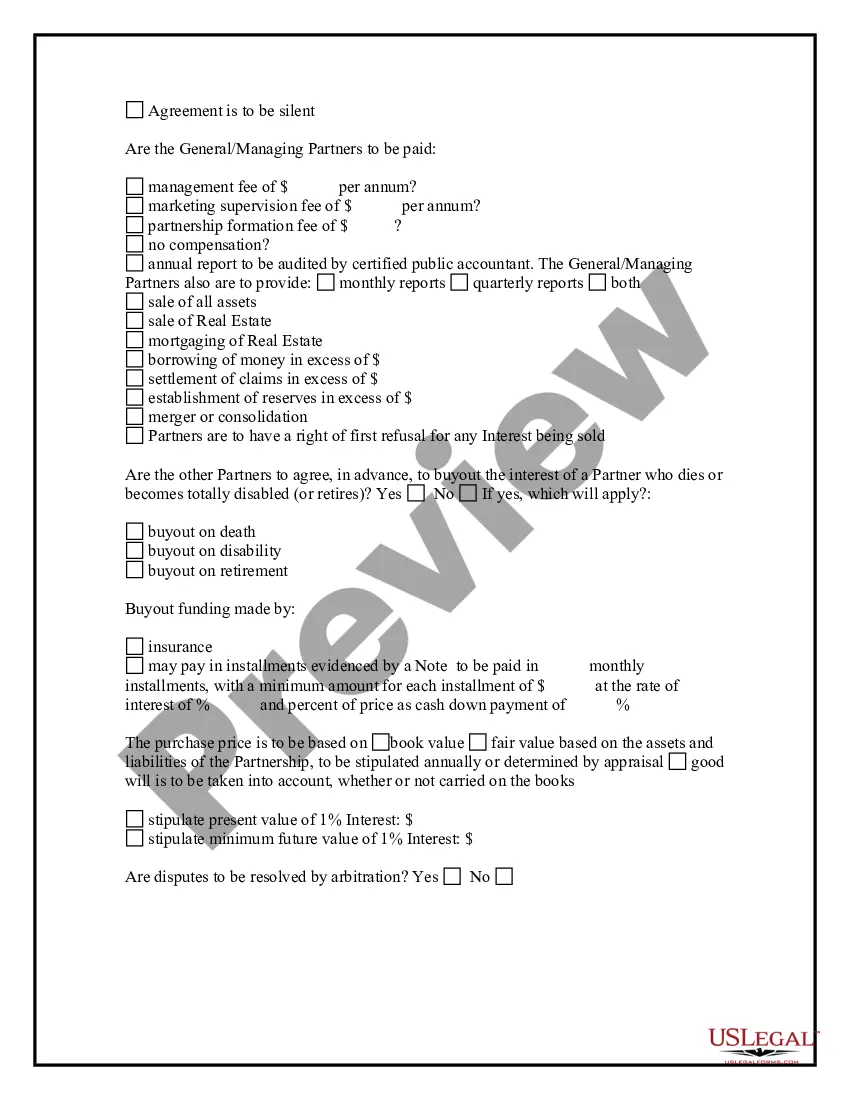

Filling out a partnership form involves providing detailed information about the partnership structure, including the names and contact details of all partners. Additionally, specify the purpose of the partnership, its duration, and how decisions will be made. Using the Hawaii Partnership Formation Questionnaire can simplify this process, ensuring you include all necessary details while adhering to Hawaii's legal standards.

To fill out a partnership agreement, start by gathering essential information about each partner, including their names, addresses, and contributions. Next, outline the roles and responsibilities of each partner, defining how profits and losses will be shared. Utilize the Hawaii Partnership Formation Questionnaire to guide you through the necessary terms, ensuring your agreement meets all legal requirements and protects each partner's interests.

Hawaii state withholding tax is the tax that employers must withhold from their employees' wages and certain payments to non-residents. This tax helps ensure that individuals meet their tax obligations to the state. If you are forming a partnership, the Hawaii Partnership Formation Questionnaire can provide valuable insights into how state withholding tax applies to your partnership.

To register your business name in Hawaii, you must file the appropriate forms with the Department of Commerce and Consumer Affairs. This process includes checking name availability and submitting the necessary registration documents. The Hawaii Partnership Formation Questionnaire can assist you in understanding the steps involved in registering your partnership name.

Hawaii requires partnerships to withhold taxes on income distributed to non-resident partners. The specific withholding rates depend on the type of income being distributed. By using the Hawaii Partnership Formation Questionnaire, you can gather essential details to ensure compliance with these requirements.

In Hawaii, the partnership withholding tax is a tax that partnerships must withhold from their non-resident partners' share of income. This tax is intended to ensure that non-residents meet their tax obligations to the state. To navigate these requirements effectively, consider utilizing the Hawaii Partnership Formation Questionnaire as a guide.

The 1% and 2% withholding taxes refer to the rates applied to certain payments made to non-resident partners in a partnership. These rates are part of Hawaii's efforts to manage tax compliance for out-of-state entities. Completing the Hawaii Partnership Formation Questionnaire can help clarify how these rates may apply to your specific partnership situation.

To avoid the 30% withholding tax, ensure that your partnership qualifies for exemptions under IRS regulations. You can provide the necessary documentation to prove your partnership's status and eligibility. Using the Hawaii Partnership Formation Questionnaire can help you gather the required information to streamline this process.