This provision provides for the assignor to except from this assignment and reserve an overriding royalty interest of all oil, gas, casinghead gas, and other minerals that may be produced from the lands under the terms of the Leases that are the subject of this assignment.

Hawaii Reservation of Overriding Royalty Interest

Description

How to fill out Reservation Of Overriding Royalty Interest?

Are you in a situation that you need to have paperwork for possibly business or person purposes just about every day? There are a lot of lawful file templates accessible on the Internet, but finding ones you can rely on is not easy. US Legal Forms gives a large number of kind templates, much like the Hawaii Reservation of Overriding Royalty Interest, which are composed in order to meet state and federal specifications.

When you are already familiar with US Legal Forms internet site and get an account, just log in. Following that, you are able to acquire the Hawaii Reservation of Overriding Royalty Interest format.

If you do not offer an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the kind you want and ensure it is to the right town/area.

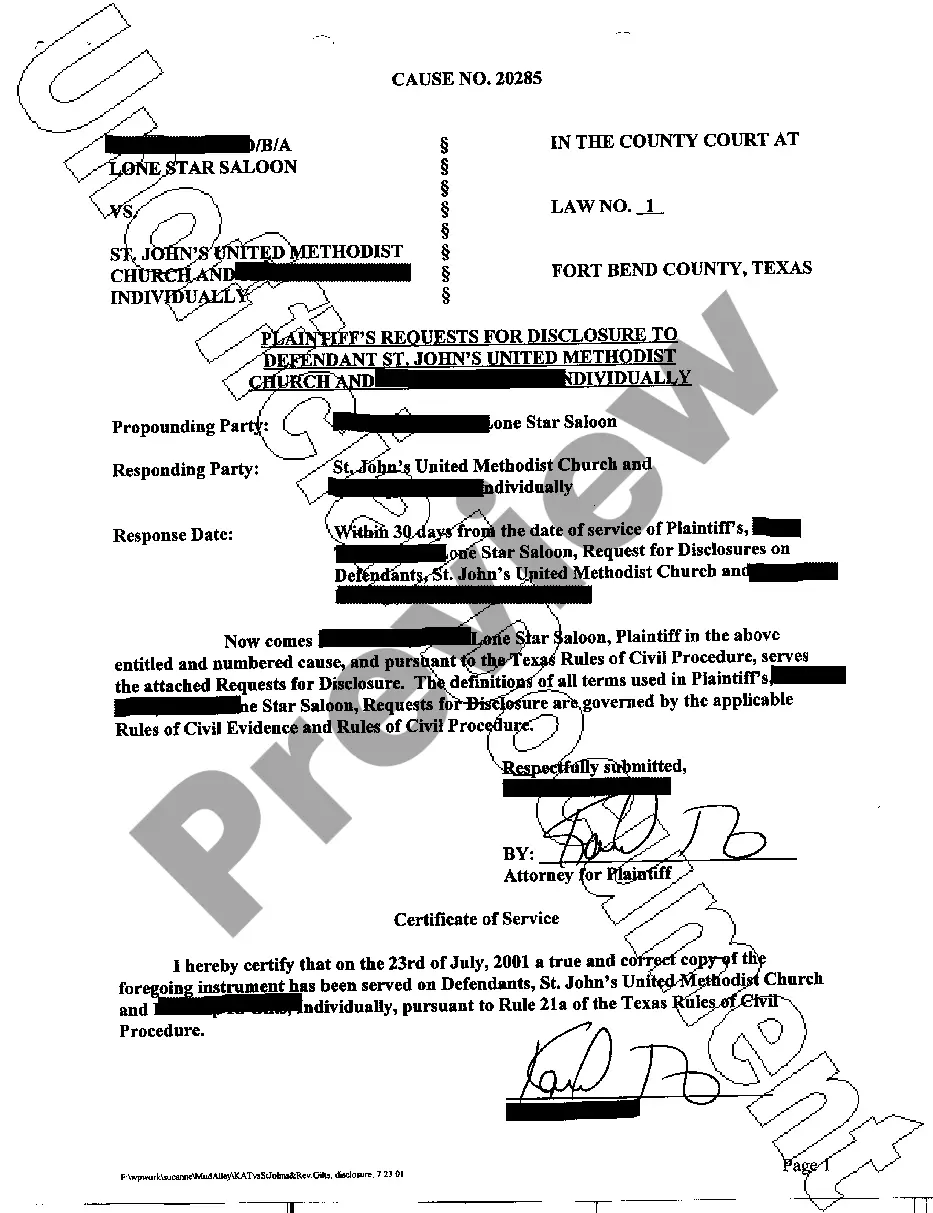

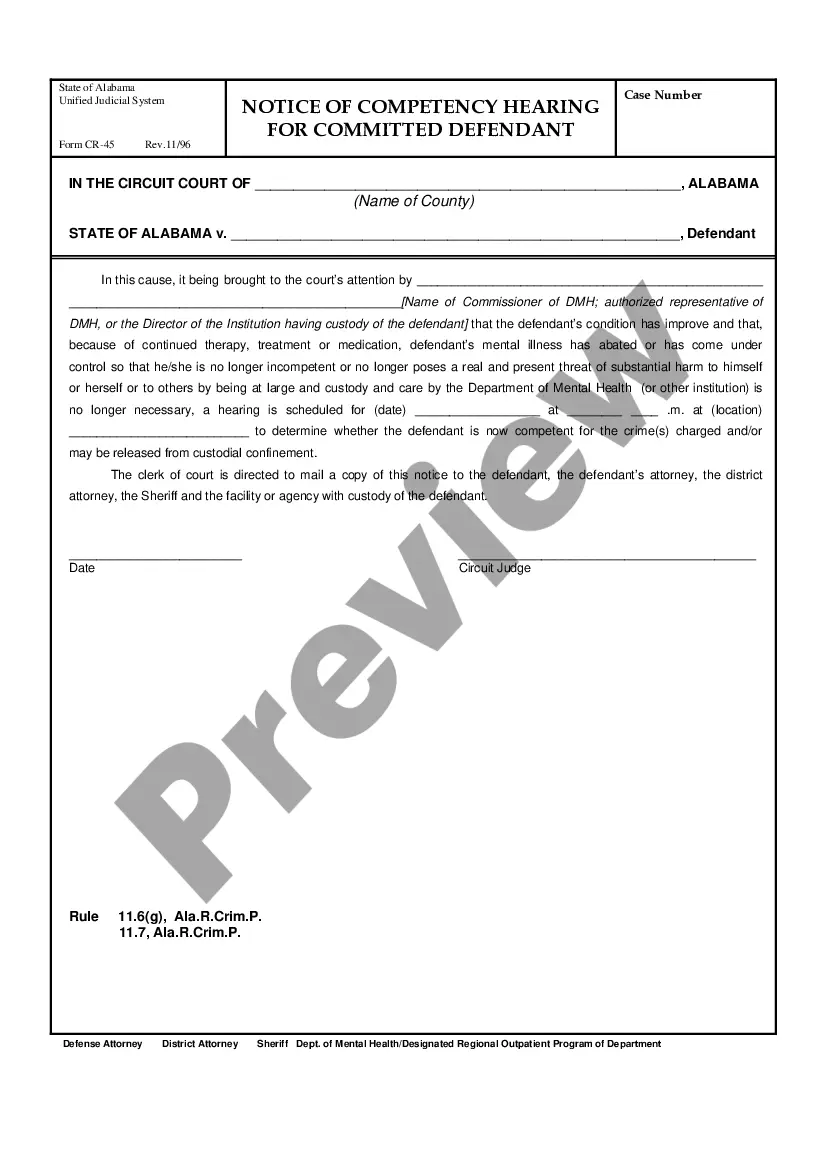

- Take advantage of the Preview key to check the form.

- See the description to ensure that you have selected the right kind.

- In case the kind is not what you`re trying to find, utilize the Lookup discipline to get the kind that suits you and specifications.

- Once you obtain the right kind, click Get now.

- Choose the rates strategy you want, fill in the required info to produce your money, and pay money for the transaction utilizing your PayPal or Visa or Mastercard.

- Select a convenient file file format and acquire your duplicate.

Find each of the file templates you have bought in the My Forms food list. You can aquire a extra duplicate of Hawaii Reservation of Overriding Royalty Interest any time, if needed. Just click the essential kind to acquire or printing the file format.

Use US Legal Forms, the most extensive collection of lawful varieties, to save lots of efforts and stay away from blunders. The support gives skillfully manufactured lawful file templates which can be used for a range of purposes. Create an account on US Legal Forms and initiate producing your way of life easier.

Form popularity

FAQ

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.

Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

ORRIs are created out of the working interest in a property and do not affect mineral owners. An overriding royalty interest (ORRI) is often kept or assigned to a geologist, landman, brokerage, or any entity that was able to reserve an interest in the properties.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

You may convey overriding royalty interest on either an Assignment of Record Title Interest (Form 3000-3), a Transfer of Operating Rights (Form 3000-3a), or on a private assignment. We only require filing of one signed copy per assignment plus a nonrefundable filing fee found at 43 CFR 3000.12.