Hawaii Subordination Agreement (Deed of Trust to Storage Agreement)

Description

How to fill out Subordination Agreement (Deed Of Trust To Storage Agreement)?

Are you currently in the place the place you will need documents for possibly organization or person uses just about every working day? There are tons of authorized papers web templates available online, but finding versions you can rely on isn`t simple. US Legal Forms delivers a huge number of kind web templates, like the Hawaii Subordination Agreement (Deed of Trust to Storage Agreement), that happen to be composed to satisfy federal and state demands.

Should you be previously informed about US Legal Forms site and also have your account, just log in. After that, you are able to acquire the Hawaii Subordination Agreement (Deed of Trust to Storage Agreement) design.

Should you not provide an accounts and want to begin using US Legal Forms, follow these steps:

- Discover the kind you require and ensure it is for the correct town/region.

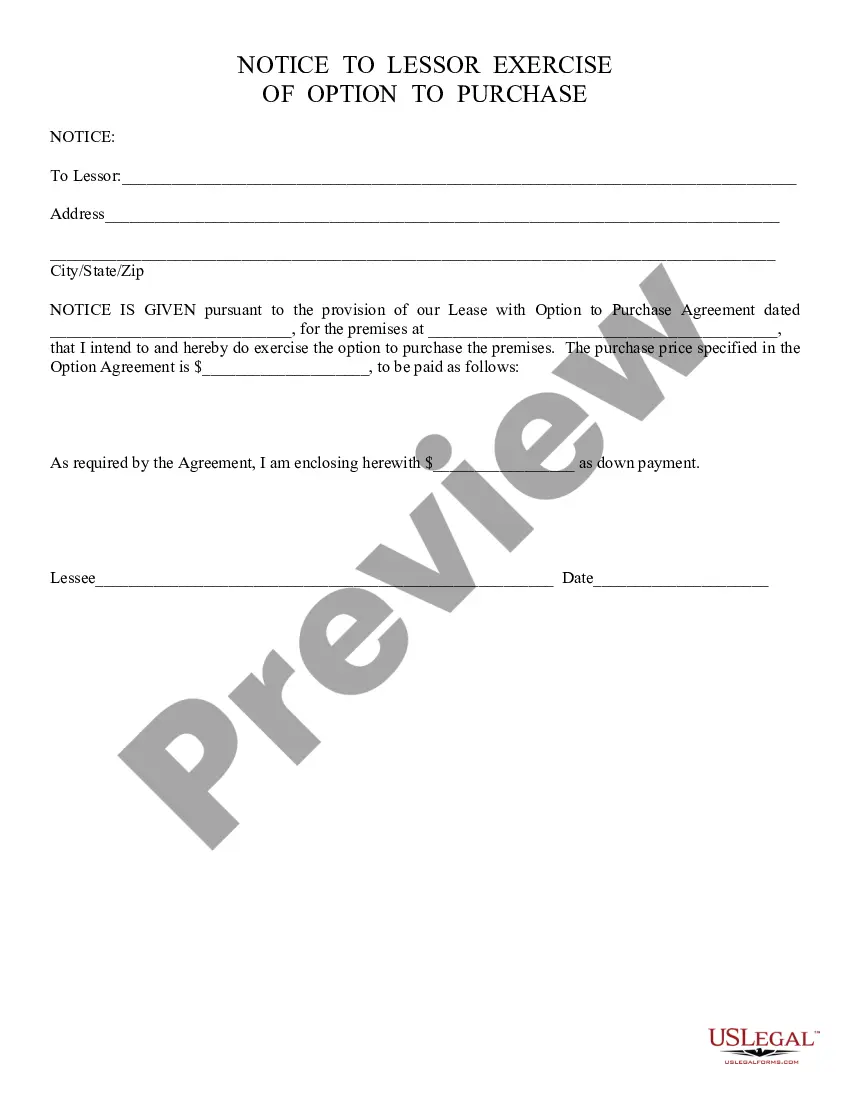

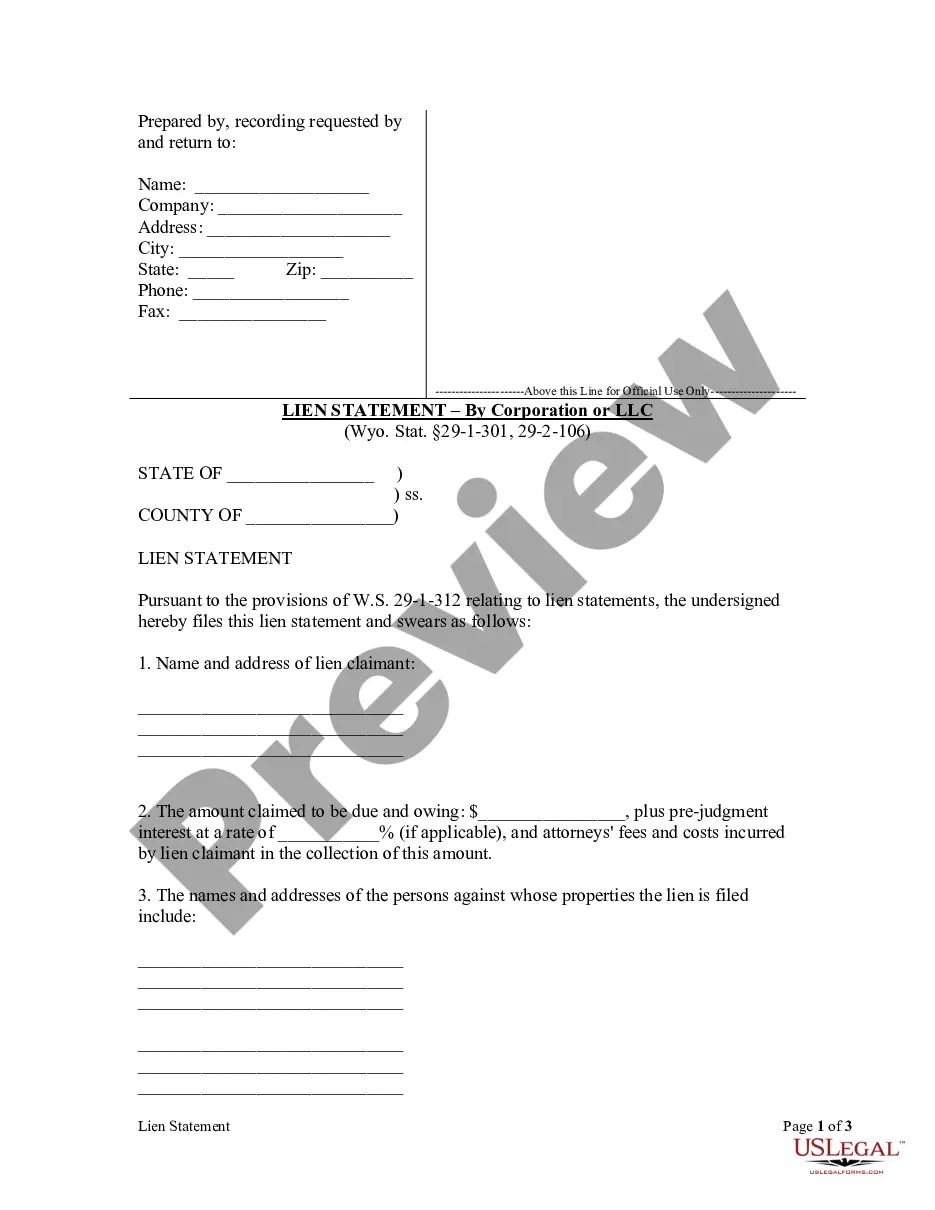

- Use the Preview button to examine the form.

- Read the explanation to ensure that you have selected the proper kind.

- If the kind isn`t what you`re seeking, take advantage of the Research industry to discover the kind that fits your needs and demands.

- Whenever you find the correct kind, click on Get now.

- Opt for the prices plan you would like, submit the desired details to generate your money, and pay money for an order using your PayPal or Visa or Mastercard.

- Select a practical paper formatting and acquire your backup.

Locate all of the papers web templates you might have bought in the My Forms menu. You can aquire a extra backup of Hawaii Subordination Agreement (Deed of Trust to Storage Agreement) anytime, if necessary. Just click the needed kind to acquire or produce the papers design.

Use US Legal Forms, one of the most substantial selection of authorized forms, to save efforts and avoid mistakes. The services delivers expertly produced authorized papers web templates that you can use for a range of uses. Produce your account on US Legal Forms and begin creating your lifestyle a little easier.

Form popularity

FAQ

The order of subordination is determined based on the type of loan against your property. If you only have one home mortgage and no other liens, you'll find that mortgage subordination won't come into play until you have more than one lien on your home.

Security subordination means that the subordinated lender agrees that its security interest in the shared collateral is fully subordinated to the security interest of the senior lender.

Subordination agreements may be included in existing deeds of trust or may be outlined in an independent contract. In situations where two deeds of trust are being recorded concurrently, the lien priority is typically handled by instructing the title company as to which security instrument will be recorded first.

A subordination clause is a clause in an agreement that states that the current claim on any debts will take priority over any other claims formed in other agreements made in the future.

A subordination agreement prioritizes debts, ranking one behind another for purposes of collecting repayment from a debtor in the event of foreclosure or bankruptcy. A second-in-line creditor collects only when and if the priority creditor has been fully paid.

Despite its technical-sounding name, the subordination agreement has one simple purpose. It assigns your new mortgage to first lien position, making it possible to refinance with a home equity loan or line of credit. Signing your agreement is a positive step forward in your refinancing journey.

Subordination agreement is a contract which guarantees senior debt will be paid before other ?subordinated? debt if the debtor becomes bankrupt.

Since it's recorded after any HELOCs or second mortgages you already have in place, the first mortgage would naturally take a lower lien position. Most lenders won't allow this, so this could cause you to lose your loan approval if the second mortgage holder won't agree to subordinate.

A Subordination Agreement focuses on creditor priorities and security claims, providing legal certainty to creditors when assessing repayment risk.