Hawaii Term Nonparticipating Royalty Deed from Mineral Owner

Description

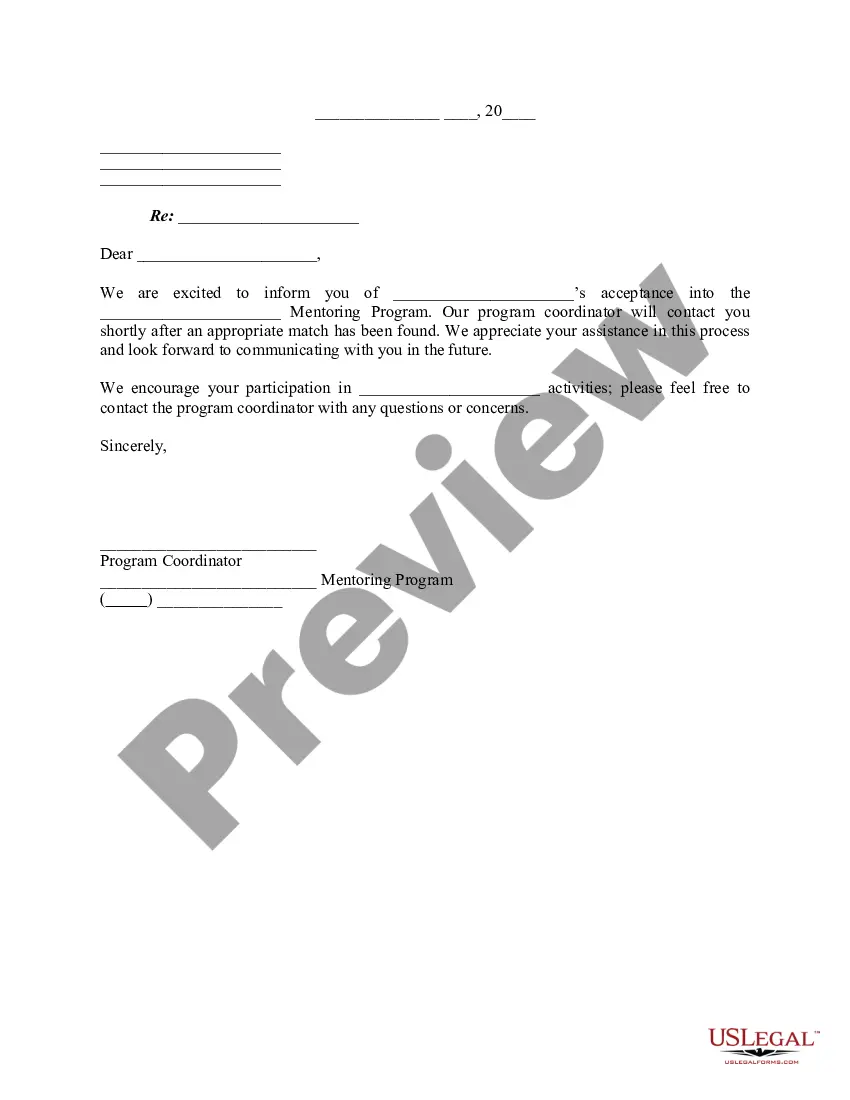

How to fill out Term Nonparticipating Royalty Deed From Mineral Owner?

If you want to total, obtain, or print out legitimate file themes, use US Legal Forms, the most important assortment of legitimate varieties, that can be found on the Internet. Utilize the site`s simple and easy practical research to obtain the papers you want. Numerous themes for enterprise and specific purposes are sorted by classes and states, or keywords and phrases. Use US Legal Forms to obtain the Hawaii Term Nonparticipating Royalty Deed from Mineral Owner within a couple of mouse clicks.

In case you are previously a US Legal Forms client, log in to the profile and then click the Download switch to get the Hawaii Term Nonparticipating Royalty Deed from Mineral Owner. You can also gain access to varieties you in the past saved in the My Forms tab of your own profile.

Should you use US Legal Forms the first time, refer to the instructions beneath:

- Step 1. Be sure you have selected the form for that correct city/region.

- Step 2. Use the Review solution to examine the form`s articles. Don`t forget to read through the information.

- Step 3. In case you are not happy with all the form, utilize the Lookup area towards the top of the display screen to locate other types of the legitimate form web template.

- Step 4. After you have identified the form you want, click the Acquire now switch. Pick the rates plan you prefer and include your accreditations to register for an profile.

- Step 5. Approach the deal. You can utilize your Мisa or Ьastercard or PayPal profile to finish the deal.

- Step 6. Select the file format of the legitimate form and obtain it on your own device.

- Step 7. Total, change and print out or indicator the Hawaii Term Nonparticipating Royalty Deed from Mineral Owner.

Every legitimate file web template you get is the one you have permanently. You have acces to every single form you saved with your acccount. Select the My Forms area and pick a form to print out or obtain yet again.

Compete and obtain, and print out the Hawaii Term Nonparticipating Royalty Deed from Mineral Owner with US Legal Forms. There are thousands of expert and status-distinct varieties you can utilize to your enterprise or specific requirements.

Form popularity

FAQ

Surface rights are what you own on the surface of the property. These include the space, the buildings and the landscaping. Mineral rights, on the other hand, cover the specific resources beneath the surface. In areas designated for mining, it's common for surface rights and mineral rights to be separate.

With a mineral deed, the holder usually has responsibility for development and production of the extraction on the property. That risk comes with the potential reward of the majority of the profit that comes from it. With a royalty deed, the holder does not usually bear the risk of the development and production.

There are 6 types of mineral rights, including mineral interest (MI), royalty interest (RI), overriding royalty interest (ORRI), working Interest (WI), non-operated working interest, and net profits interest.

Mineral rights deeds are not the same as royalty deeds. Royalty deeds do not allow for surface access, or for the initiation of the extraction and sale of minerals. A royalty owner will only benefit economically if the mineral owner decides to produce and sell the minerals.

A quick overview of the differences between mineral rights and royalty interests shows a mineral interest is a real property interest obtained by severing the minerals from the surface and a royalty interest grants an owner a portion of the production revenue generated.