Hawaii Statement to Add to Credit Report

Description

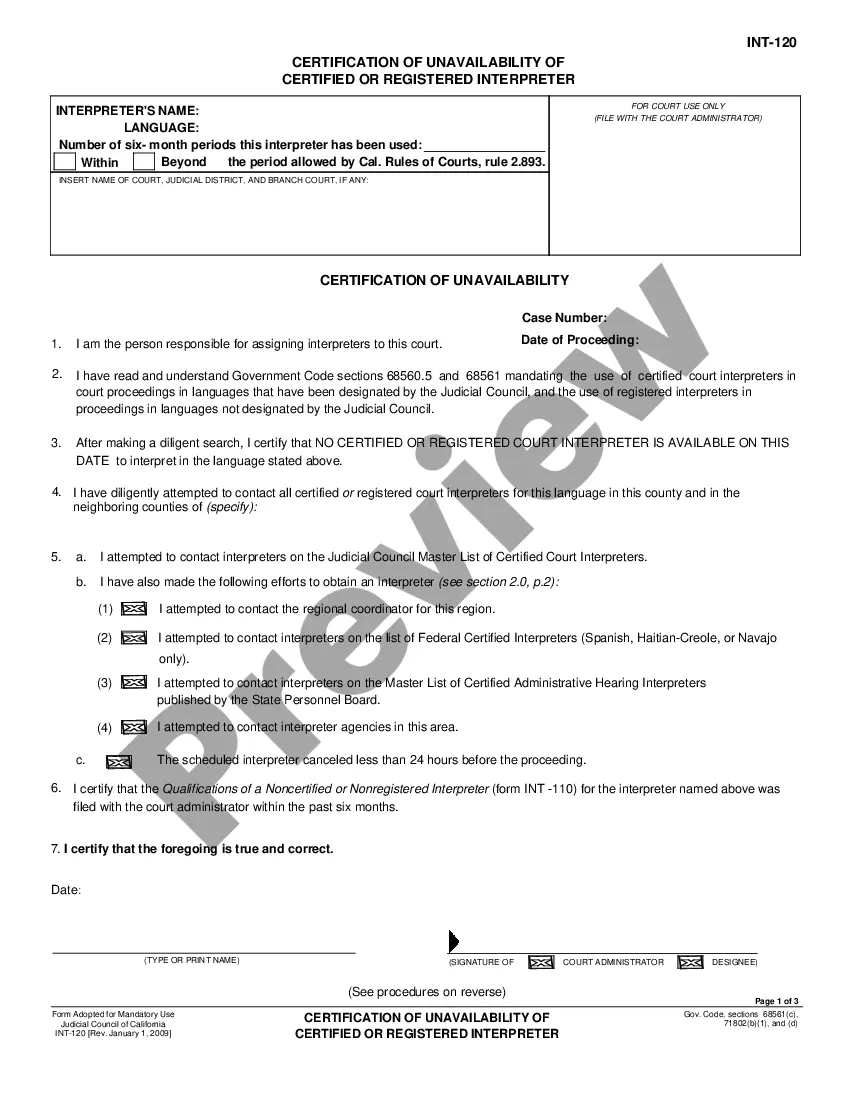

How to fill out Statement To Add To Credit Report?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a wide variety of legal form templates that you can download or print. Through the site, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the most recent forms such as the Hawaii Statement to Add to Credit Report in just seconds.

If you already have a subscription, Log In and retrieve the Hawaii Statement to Add to Credit Report from your US Legal Forms library. The Download button will appear on every form you review. You can access all previously downloaded forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are simple instructions to get started: Make sure you have selected the correct form for your area/county. Click on the Review option to evaluate the form's content. Check the form details to confirm that you have selected the right document. If the form does not fit your requirements, use the Search box at the top of the page to find one that does. If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose the payment plan you prefer and provide your details to create an account. Process the payment. Use your credit card or PayPal account to finalize the payment. Select the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Hawaii Statement to Add to Credit Report.

- Every template you save in your account has no expiration date and is yours indefinitely.

- To download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Hawaii Statement to Add to Credit Report with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and needs.

Form popularity

FAQ

To add a statement to your credit report, you typically need to contact the credit reporting agency directly. You can submit your Hawaii Statement to Add to Credit Report either online or by mail, following their specific guidelines. Ensure your statement is clear and concise, as this will make it more effective. For a seamless process, consider using US Legal Forms to help you prepare your statement properly.

You can indeed add a note to your credit file, which serves to clarify specific aspects of your credit history. The Hawaii Statement to Add to Credit Report allows you to express your side of the story, helping to provide context to lenders. This added information can be beneficial when applying for loans or credit. Platforms like US Legal Forms can assist you in creating this note correctly.

Yes, you can add a statement to your credit report, which can help clarify your credit history. The Hawaii Statement to Add to Credit Report is a useful tool for explaining any discrepancies or negative marks. This statement can aid creditors in understanding your financial situation better, potentially improving your chances for credit approval. For assistance in drafting your statement, consider using US Legal Forms.

Building your credit from 500 to 700 can take time, usually several months to a few years, depending on various factors. Consistent on-time payments, reducing debt, and maintaining low credit utilization can significantly impact your score. Remember, the Hawaii Statement to Add to Credit Report can also play a role in explaining any past issues. Utilizing services like US Legal Forms can provide the necessary resources to help you manage and improve your credit effectively.

Yes, you can include a statement on your credit report, but it typically must adhere to certain guidelines. The Hawaii Statement to Add to Credit Report can be up to 100 words, allowing you to explain your circumstances. This statement can provide context to creditors, helping them understand your credit history better. To add this statement, consider using platforms like US Legal Forms for guidance.

To be eligible for the $1000 tax credit in Hawaii, you must meet specific criteria set by the state, including having a qualifying solar energy system installed. This credit is aimed at homeowners who invest in renewable energy solutions. Ensure you have your Hawaii Statement to Add to Credit Report ready, as it may help demonstrate your eligibility and financial commitment.

Yes, you can file your Hawaii state taxes online through the Hawaii Department of Taxation's official website or other authorized e-filing services. Online filing is convenient and secure, allowing you to submit your tax documents, including your Hawaii Statement to Add to Credit Report, quickly and efficiently.

The N11 form in Hawaii is a tax form used for reporting real property taxes. It includes information on property ownership and any applicable exemptions. If you’re applying for solar credits, keep your Hawaii Statement to Add to Credit Report nearby, as it may provide useful financial information during the reporting process.

To claim your solar tax credit, complete Form 5695 and provide it with your tax return. This form requires details about your solar installation and its costs. Having your Hawaii Statement to Add to Credit Report can help confirm your expenses, ensuring you maximize the benefits of your tax credit.

To claim the Hawaii solar tax credit, fill out IRS Form 5695 and include it with your federal tax return. Make sure to calculate the total costs associated with your solar installation accurately. Your Hawaii Statement to Add to Credit Report can be beneficial, as it provides a clear record of your expenses, ensuring you receive the maximum credit available.