Hawaii Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services

Description

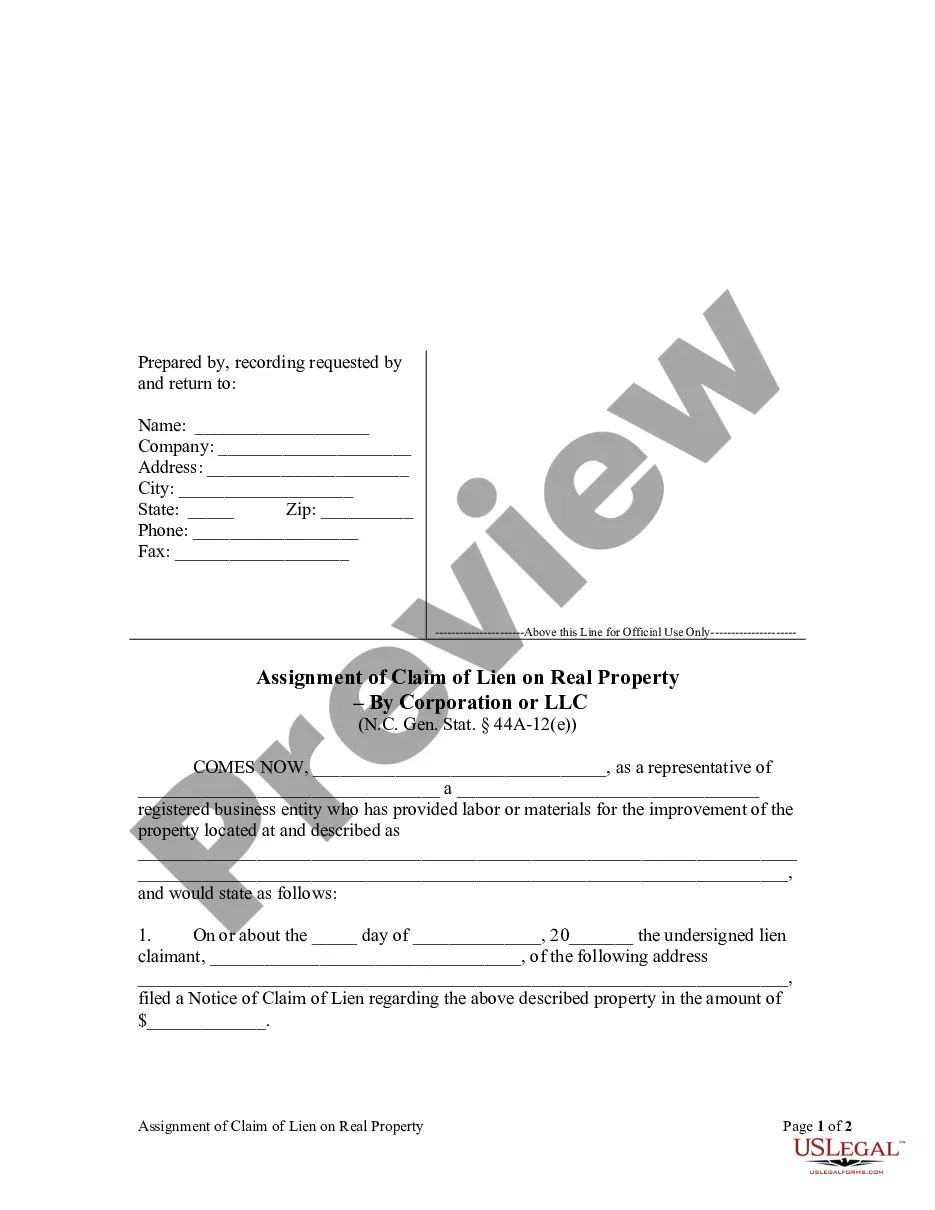

How to fill out Sub-Advisory Agreement Between Prudential Investments Fund Management, LLC And The Prudential Investment Corp. Regarding Provision Of Investment Advisory Services?

Are you inside a position the place you need paperwork for possibly organization or specific purposes just about every day? There are plenty of lawful file web templates accessible on the Internet, but finding ones you can depend on is not easy. US Legal Forms gives thousands of type web templates, such as the Hawaii Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services, that happen to be composed to meet state and federal demands.

Should you be previously knowledgeable about US Legal Forms internet site and get a free account, merely log in. Afterward, you are able to down load the Hawaii Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services design.

Unless you provide an profile and want to start using US Legal Forms, abide by these steps:

- Get the type you need and ensure it is for the proper city/area.

- Take advantage of the Review switch to examine the shape.

- Look at the description to ensure that you have chosen the correct type.

- In the event the type is not what you are seeking, utilize the Search discipline to discover the type that fits your needs and demands.

- When you obtain the proper type, click on Buy now.

- Select the prices plan you need, complete the necessary information to produce your bank account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Choose a hassle-free file format and down load your version.

Discover all of the file web templates you may have bought in the My Forms food selection. You can obtain a additional version of Hawaii Sub-Advisory Agreement between Prudential Investments Fund Management, LLC and The Prudential Investment Corp. regarding provision of investment advisory services any time, if necessary. Just click on the required type to down load or print the file design.

Use US Legal Forms, one of the most substantial collection of lawful types, to save efforts and stay away from blunders. The assistance gives appropriately made lawful file web templates which can be used for a variety of purposes. Create a free account on US Legal Forms and begin producing your way of life a little easier.

Form popularity

FAQ

Independent view. The Prudential Assurance Company Limited With-Profits Fund, as at December 2022, has a 5/5 rating for financial strength from AKG Financial Analytics Ltd, who are specialists in providing independent With-Profits ratings. This is the highest rating that AKG. Source: AKG With-Profits Report (PDF).

The Prudential Investment Plan is an investment bond where you can invest your money in a range of different funds that aim to increase the value of your investment over the medium- to long-term, so 5 to 10 years or more.

Attractive valuation As for the valuation here, it's attractive after the share price weakness this year. For 2024, analysts expect Prudential to generate earnings per share of 113 cents. That puts the forward-looking price-to-earnings (P/E) ratio at about 9.8 right now ? well below the FTSE 100 average.

Prudential is being tarred with the same brush as other companies operating predominately in Asia. Prudential's share price is down 20% since the beginning of 2023, not because of poor underlying performance but because investors have built in a discount because of where they operate.

Prudential Retirement Insurance and Annuity Company (?Prudential") is a non-fiduciary service provider hired to provide administrative and record keeping services to your plan, including in connection with Advice and Income Engines.

The purpose of the Group Responsible Investment Policy is to guide the Business Units within the Group to articulate how they consider ESG factors in their investment activities. Prudential believes that ESG considerations are increasingly important elements of good investment practices.

Fitch has also affirmed PFI's Long-Term Issuer Default Rating (IDR) at 'A' and senior unsecured debt ratings at 'A-'. The Rating Outlook is Stable. Today's rating affirmation reflects a review of current operating results including previously announced reinsurance transactions.

The company's solid financial position provides it with the flexibility to execute its transformation and invest in the long-term growth of businesses. Prudential Financial has been increasing its dividend for the past 15 years. Its dividend yield of 6.4% compares favorably with the industry's figure of 2.9%.