Hawaii Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock

Description

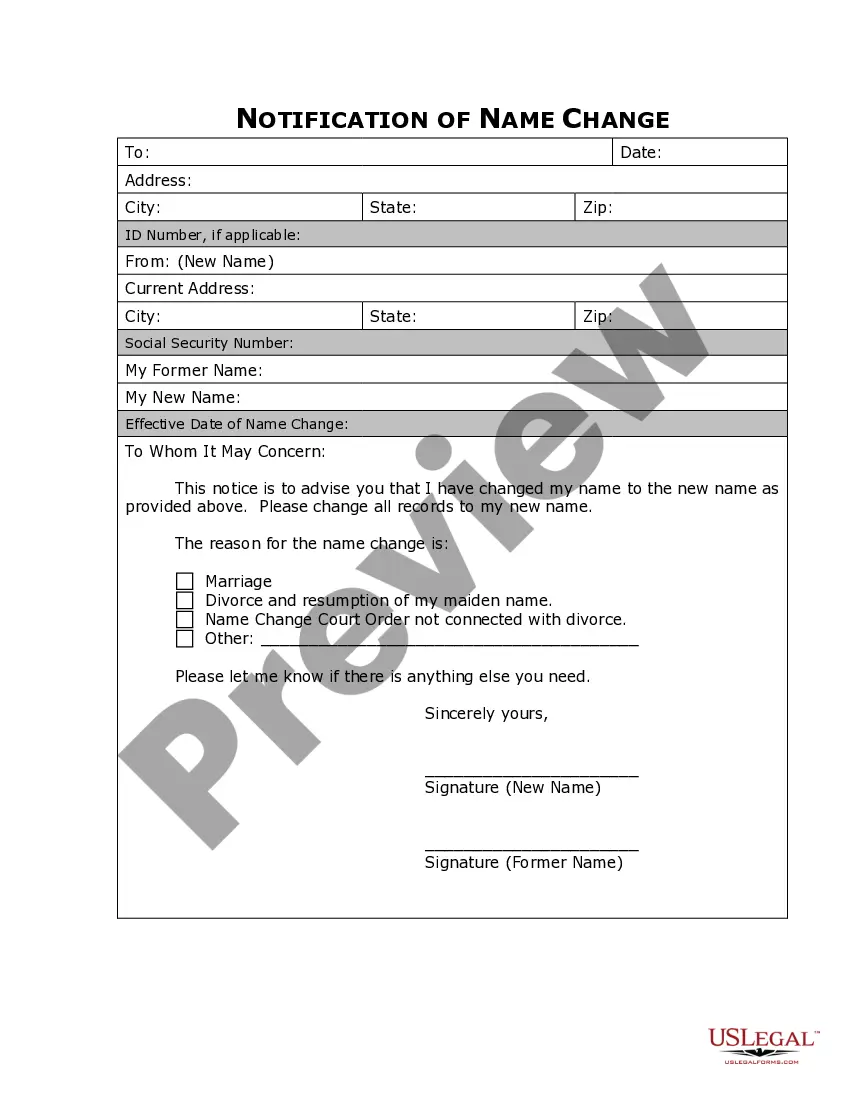

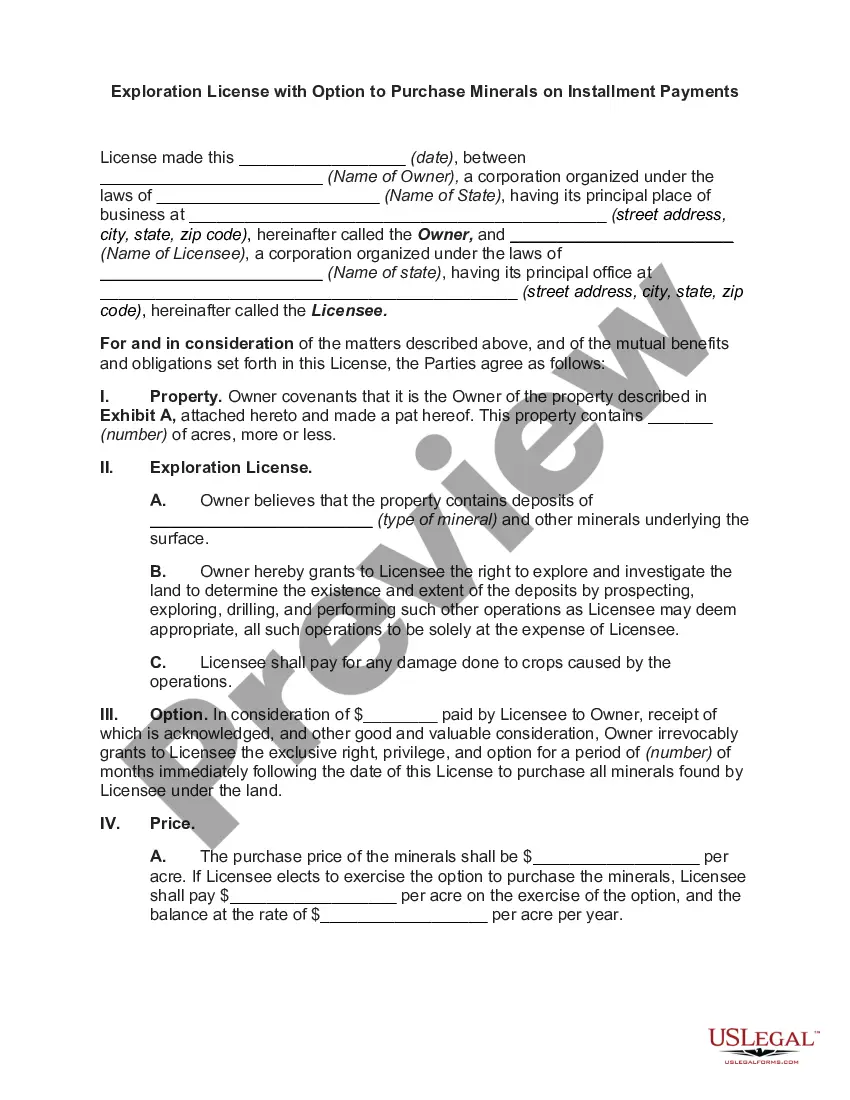

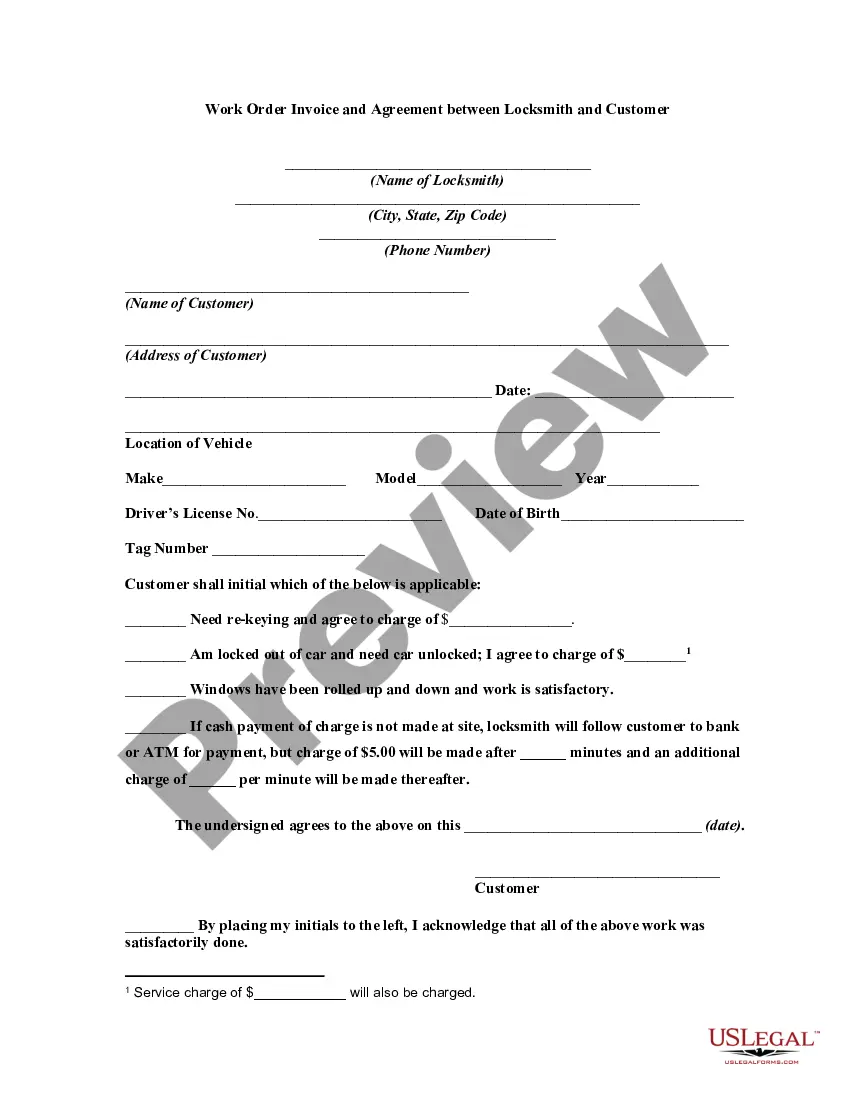

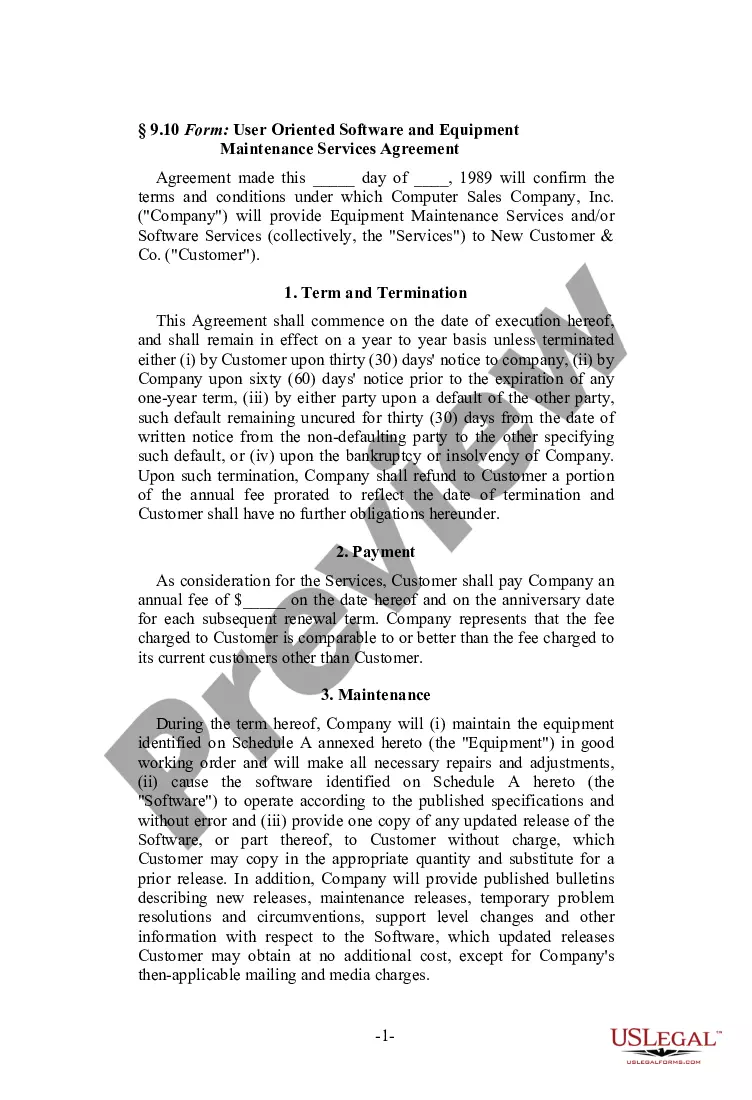

How to fill out Amendment Of Restated Certificate Of Incorporation To Change Dividend Rate On $10.50 Cumulative Second Preferred Convertible Stock?

Choosing the best legitimate papers design can be a battle. Obviously, there are plenty of templates accessible on the Internet, but how do you obtain the legitimate kind you will need? Utilize the US Legal Forms website. The assistance gives 1000s of templates, like the Hawaii Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock, that you can use for company and private requirements. Each of the kinds are checked out by pros and fulfill state and federal demands.

If you are presently authorized, log in in your profile and click on the Download button to have the Hawaii Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock. Use your profile to check from the legitimate kinds you possess acquired previously. Check out the My Forms tab of the profile and acquire an additional copy from the papers you will need.

If you are a new customer of US Legal Forms, here are simple instructions that you can adhere to:

- First, be sure you have chosen the correct kind for the city/state. It is possible to check out the shape making use of the Preview button and read the shape description to guarantee it will be the best for you.

- If the kind does not fulfill your expectations, take advantage of the Seach industry to find the right kind.

- When you are positive that the shape is acceptable, go through the Purchase now button to have the kind.

- Pick the costs strategy you need and enter the required details. Make your profile and purchase your order with your PayPal profile or credit card.

- Choose the file format and acquire the legitimate papers design in your device.

- Total, revise and printing and indication the attained Hawaii Amendment of Restated Certificate of Incorporation to change dividend rate on $10.50 cumulative second preferred convertible stock.

US Legal Forms is definitely the largest collection of legitimate kinds where you will find different papers templates. Utilize the company to acquire skillfully-produced files that adhere to status demands.

Form popularity

FAQ

The process of adding a member to a Hawaii LLC may involve amending the company's articles of organization to include the new member. Depending on the terms in the agreement, current LLC members may need to vote on it for the amendment to pass.

What is Amended and Restated? ?Amended? means that the document has ?changed?? that someone has revised the document. ?Restated? means ?presented in its entirety?, ? as a single, complete document. ingly, ?amended and restated? means a complete document into which one or more changes have been incorporated.

To make amendments to your Hawaii corporation, you provide Form DC-3, Hawaii Articles of Amendment to the State of Hawaii Department of Commerce, Business Registration Division (BREG). The articles of amendment can be filed by mail, fax, or in person.

To make amendments to your Delaware Stock Corporation, you submit the completed State of Delaware Certificate of Amendment of Certificate of Incorporation form to the Department of State by mail, fax or in person, along with the filing fee and the Filing Cover Memo. Non-stock corporations use a separate amendment form.

To amend articles of organization for a Hawaii LLC, submit the Hawaii Articles of Amendment of Limited Liability Company to the Hawaii Department of Commerce, Business Registration Division (BREG). You'll need to include the amendment, your original articles, a $25 fee and a $1 state archives fee.

How to Amend Articles of Incorporation Review the bylaws of the corporation. ... A board of directors meeting must be scheduled. ... Write the proposed changes. ... Confirm that the board meeting has enough members attending to have a quorum so the amendment can be voted on. Propose the amendment during the board meeting.