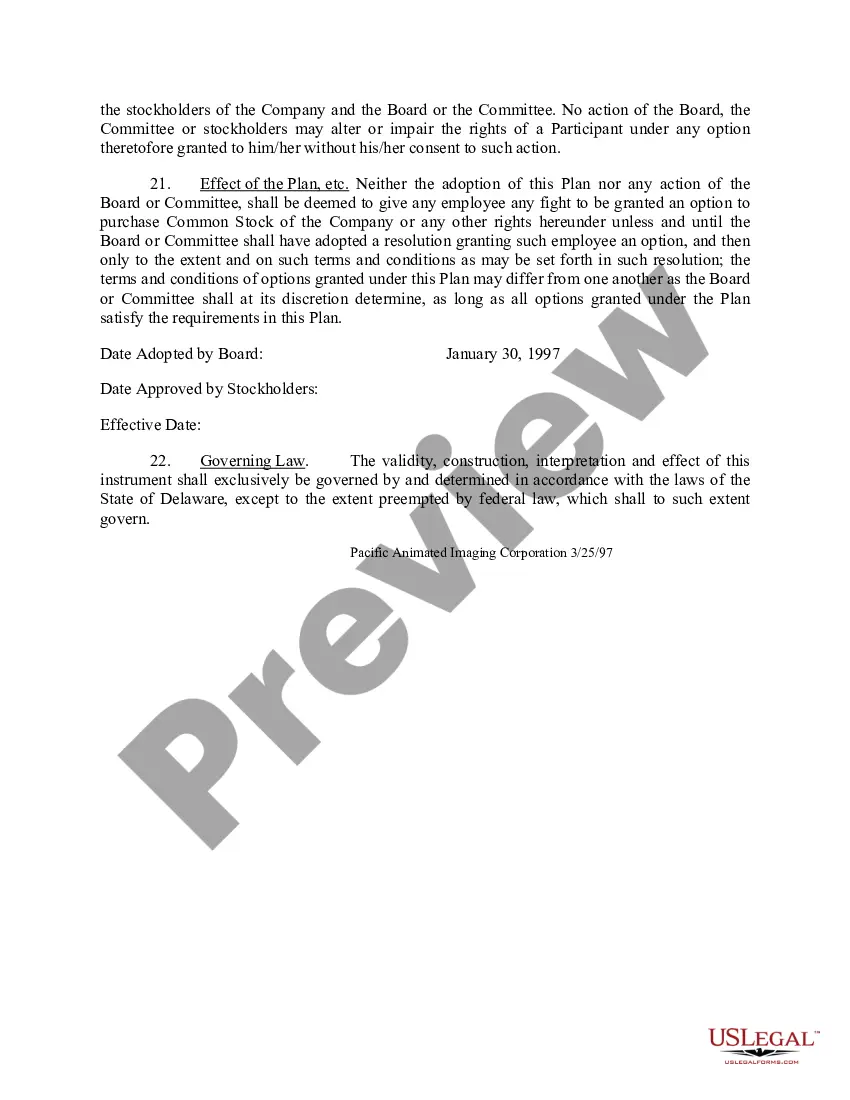

Hawaii Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.

Description

How to fill out Stock Option Plan To Approve Incentive Stock Option Plan Of Pacific Animated Imaging Corp.?

Finding the right legal file web template can be a struggle. Of course, there are plenty of web templates available on the net, but how would you get the legal kind you will need? Take advantage of the US Legal Forms website. The assistance gives a large number of web templates, for example the Hawaii Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp., that can be used for business and private needs. All of the varieties are checked by specialists and meet federal and state demands.

If you are currently registered, log in to your account and click on the Acquire option to find the Hawaii Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp.. Make use of your account to search through the legal varieties you have bought formerly. Go to the My Forms tab of your own account and have another duplicate of the file you will need.

If you are a new end user of US Legal Forms, listed here are easy directions so that you can follow:

- Very first, make certain you have chosen the correct kind to your area/area. It is possible to look through the form utilizing the Review option and read the form explanation to guarantee this is basically the right one for you.

- If the kind is not going to meet your requirements, use the Seach field to discover the appropriate kind.

- When you are sure that the form is acceptable, select the Purchase now option to find the kind.

- Choose the costs program you want and enter in the necessary info. Create your account and purchase an order with your PayPal account or credit card.

- Opt for the document file format and download the legal file web template to your product.

- Complete, modify and print and signal the attained Hawaii Stock Option Plan to approve Incentive Stock Option Plan of Pacific Animated Imaging Corp..

US Legal Forms is the largest collection of legal varieties in which you can discover a variety of file web templates. Take advantage of the service to download professionally-created files that follow state demands.

Form popularity

FAQ

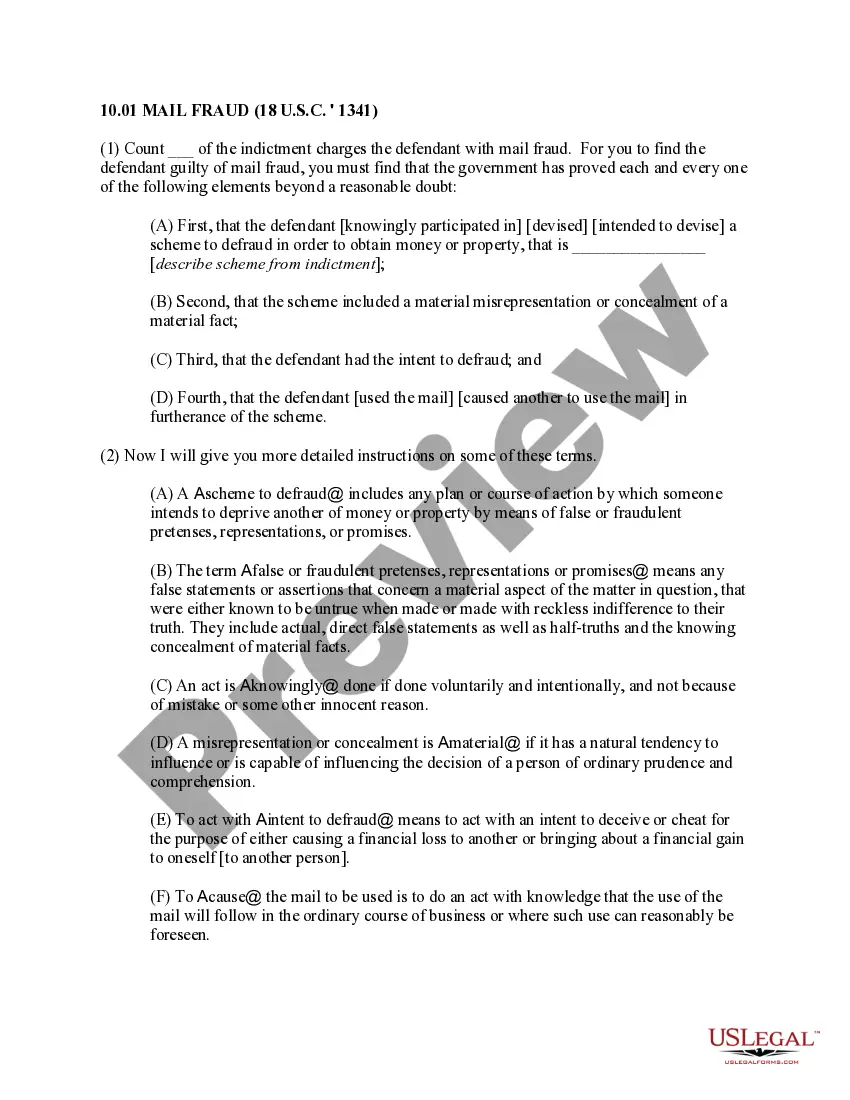

You meet the holding period requirement if you don't sell the stock until the end of the later of: The 1-year period after the stock was transferred to you, or. The 2-year period after the option was granted.

There are many requirements on using ISOs. First, the employee must not sell the stock until after two years from the date of receiving the options, and they must hold the stock for at least a year after exercising the option like other capital gains. Secondly, the stock option must last ten years.

In this situation, you sell your ESPP shares more than one year after purchasing them, but less than two years after the offering date. This is a disqualifying disposition because you sold the stock less than two years after the offering (grant) date.

Reduced ISO tax implications: To qualify for favorable tax treatment for ISOs, you need to hold your shares for one year after exercising them and two years after you're granted the stock options. By exercising your stock options early, you can get a head start on the one-year holding period.

You report the taxable income only when you sell the stock. And, depending on how long you own the stock, that income could be taxed at capital gain rates ranging from 0% to 23.8% (for sales in 2023)?typically a lot lower than your regular income tax rate.

To receive the incentive, you must hold (keep) ISOs for at least one year after exercise and two years after the grant date. If you hold your stock for at least a year after purchase, you will pay the lower capital gains tax rate on the increase in value.

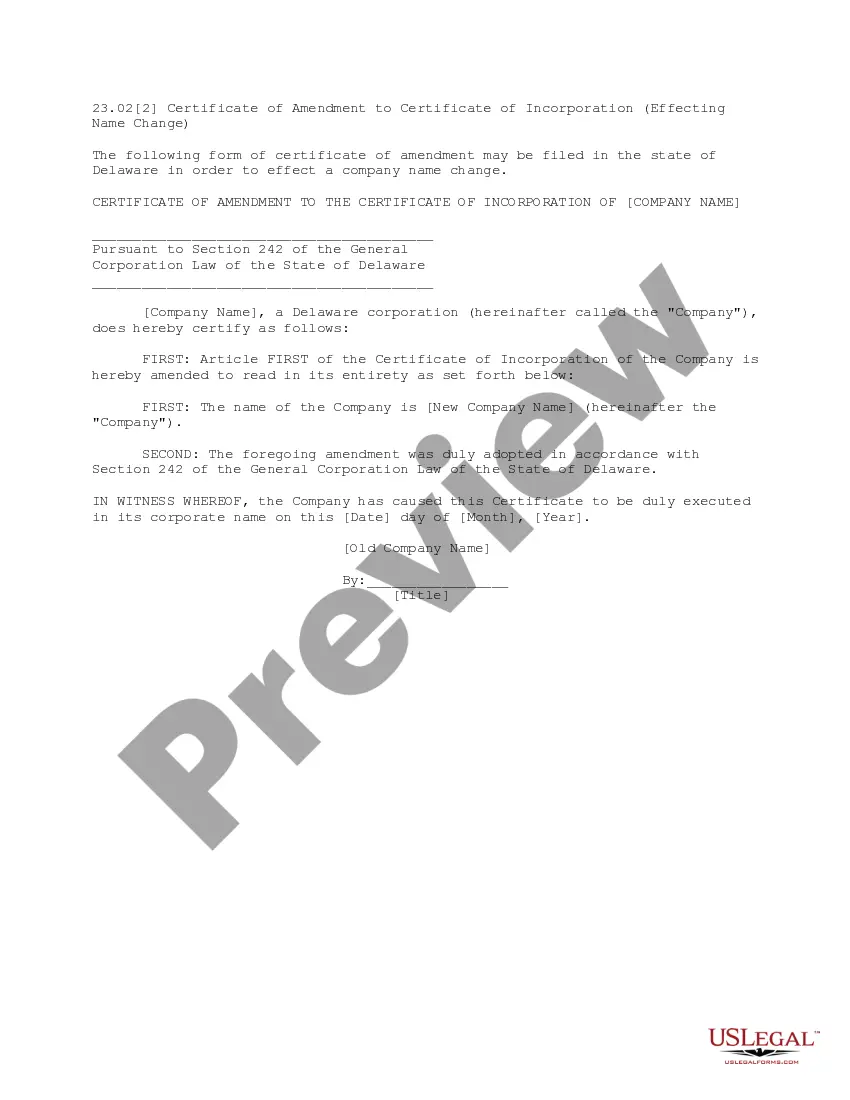

The option plan must be approved by the stockholders within 12 months before or after the plan is adopted (see also Explanation: §423, Shareholder Approval Requirement) (IRC § 422(b)(1); Reg. §1.422-3).

An incentive stock option (ISO) is a corporate benefit that gives an employee the right to buy shares of company stock at a discounted price with the added benefit of possible tax breaks on the profit.