Hawaii Notice of Adverse Action - Non-Employment - Due to Credit Report

Description

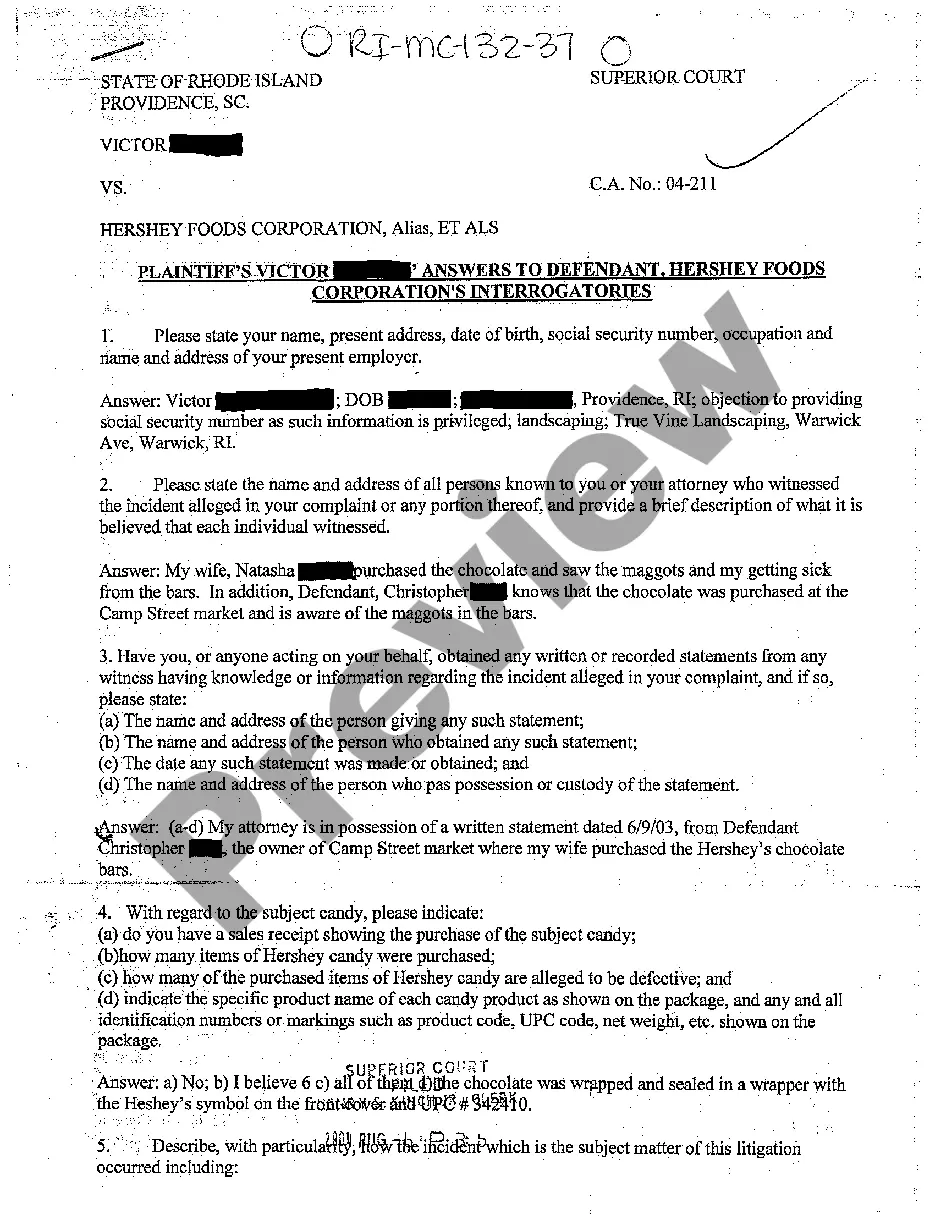

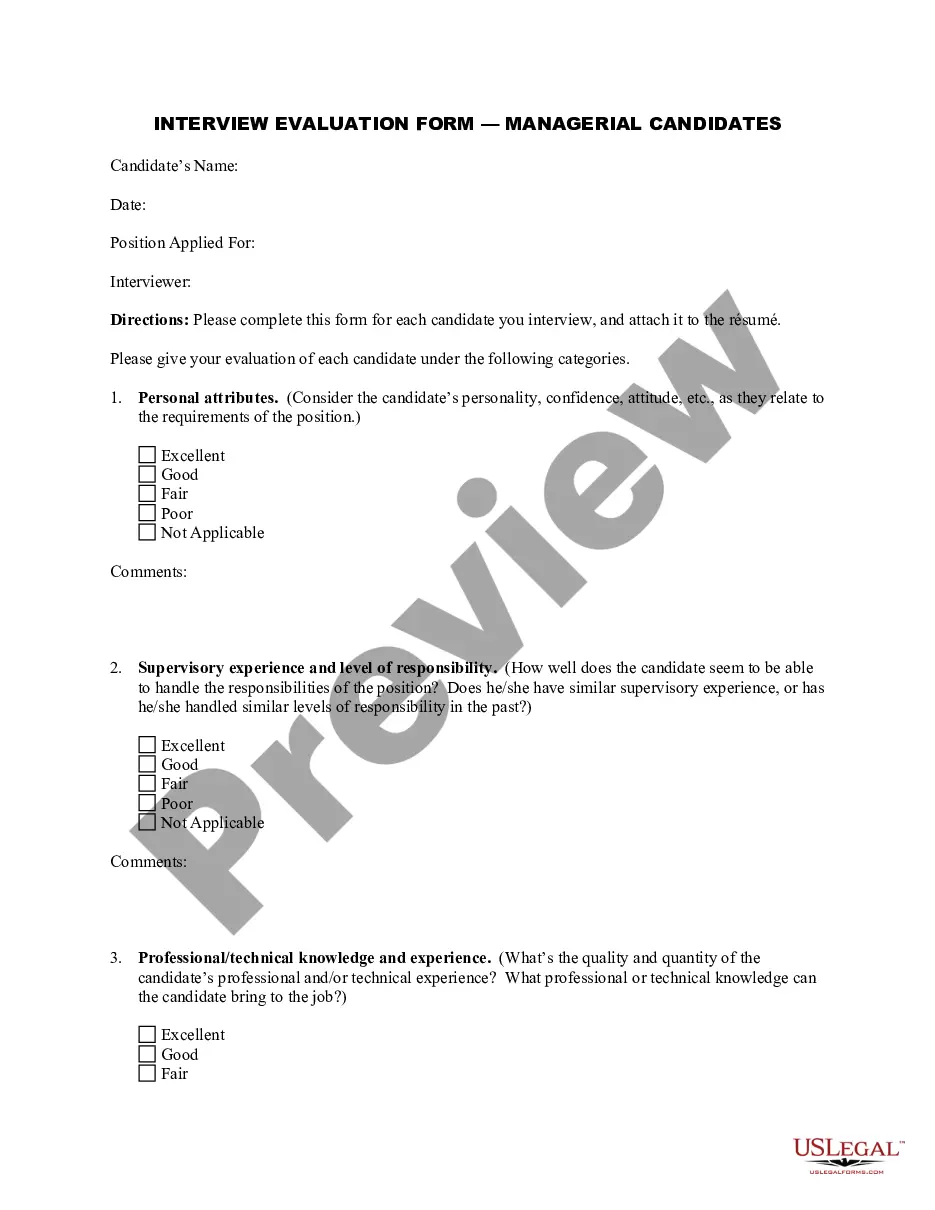

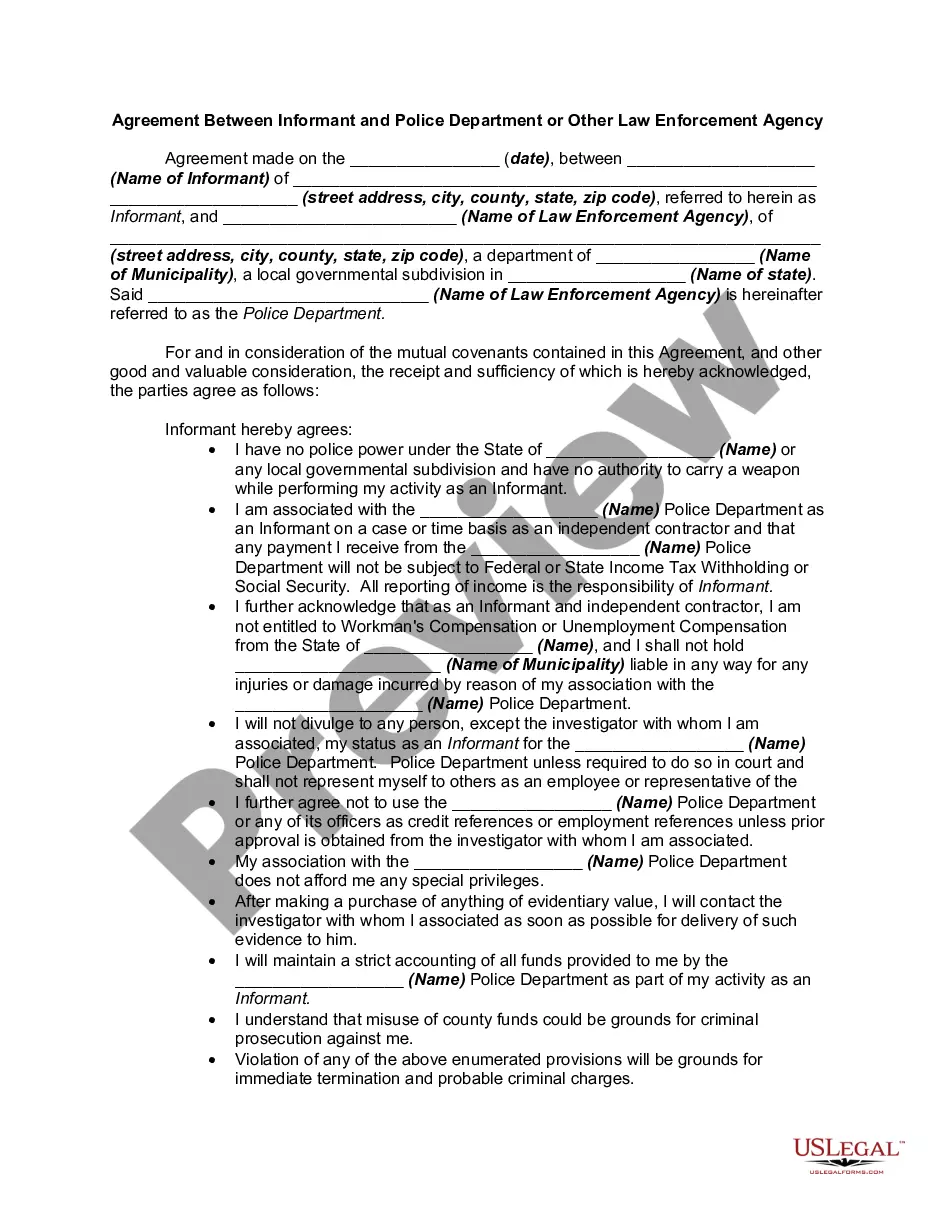

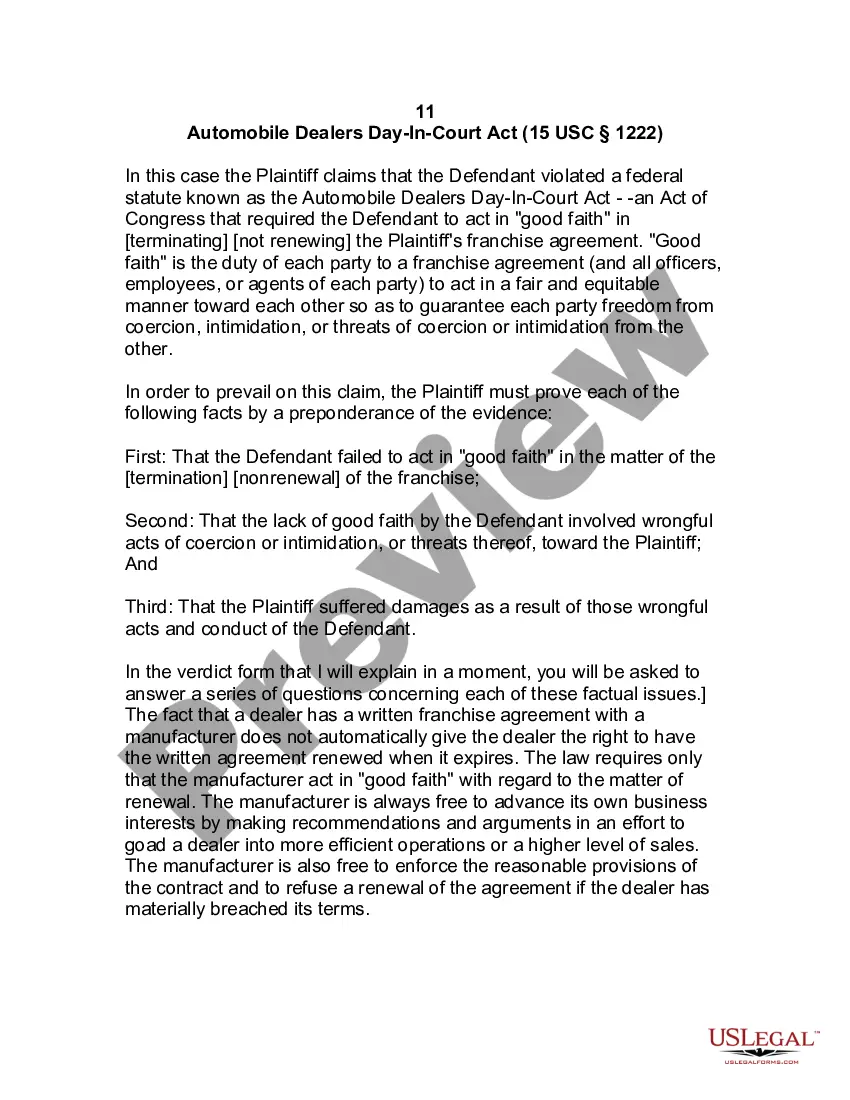

How to fill out Notice Of Adverse Action - Non-Employment - Due To Credit Report?

If you wish to thoroughly access, download, or print sanctioned document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's user-friendly search functionality to find the documents you require. Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Utilize US Legal Forms to obtain the Hawaii Notice of Adverse Action - Non-Employment - Due to Credit Report in just a few clicks.

Every legal document template you purchase is yours permanently. You have access to each form you downloaded in your account.

Browse the My documents section and select a form to print or download again. Complete and download, and print the Hawaii Notice of Adverse Action - Non-Employment - Due to Credit Report with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and then click the Obtain button to get the Hawaii Notice of Adverse Action - Non-Employment - Due to Credit Report.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Make sure you have selected the form for your specific state/region.

- Step 2. Use the Preview option to review the form's details. Don't forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variants in the legal form template.

- Step 4. Once you find the form you need, click the Get now button. Choose the payment plan you prefer and enter your credentials to register for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Hawaii Notice of Adverse Action - Non-Employment - Due to Credit Report.

Form popularity

FAQ

Employers check your credit to find out how you manage your finances. If you have excessive debts or lots of late payments on your credit report, they can rescind your job offer. Read on to learn more about why your employer might do this and how you should respond if they do.

Is Employment Listed in Your Credit Report? Credit reports contain more information than just your credit accounts, they can show your current and past employers. Do Employers Check Credit Scores? Although they can't check your credit score, a potential employer may look at a modified version of your credit report.

Does an employer credit check hurt your credit score? Your credit score won't be affected by a potential employer conducting a credit check on you. An employment inquiry is treated like a soft inquiry, Ulzheimer says. Not visible to other parties (other than you) and not considered in credit scoring systems.

Provide your potential employer with valid reasons for your poor credit reports, such as identity theft or financial circumstances beyond your control. Write a formal letter of explanation outlining the reasons that you previously provided for your poor credit rating and send it to your employer.

Lawmakers are motivated by a number of well-founded concerns: although credit history is not relevant to employment, employment credit checks create barriers to opportunity and upward mobility, can exacerbate racial discrimination, and can lead to invasions of privacy.

The employment information on your Equifax credit report is provided by you or by your lenders and creditors. Employment information is typically reported from credit applications and is not regularly updated. This information is not used by lenders, creditors or employers in making their decisions.

Why Your Employment Is in Your Credit Report In fact, an employer is on your report because you provided that information on an application for credit. The paperwork for loans, credit cards and finance companies typically have a field for you to submit information about your job.

Key Takeaways. Employers can rescind job offers for almost any reason unless that reason is discriminatory, e.g., based on disability, gender, race, etc. There can be legal consequences for employers for revoking an offer.

You can request that the employment listing be removed from your report by going online to dispute your credit report information. Simply follow the steps in the online process to dispute the employer listing. Your personal report will also include a toll-free telephone number you can call for assistance.

Thanks to the Fair Credit Reporting Act (FCRA), employers can't go checking your credit history behind your back. They must have written consent before pulling an applicant's credit history.