Hawaii Termination and Severance Pay Policy

Description

How to fill out Termination And Severance Pay Policy?

If you wish to aggregate, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms accessible online.

Take advantage of the site’s user-friendly and effective search function to locate the documents you require.

Different templates for business and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to create an account.

Step 5. Complete the purchase. You can use your Visa or MasterCard, or PayPal account to finalize the transaction.

- Utilize US Legal Forms to find the Hawaii Termination and Severance Pay Policy in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Hawaii Termination and Severance Pay Policy.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

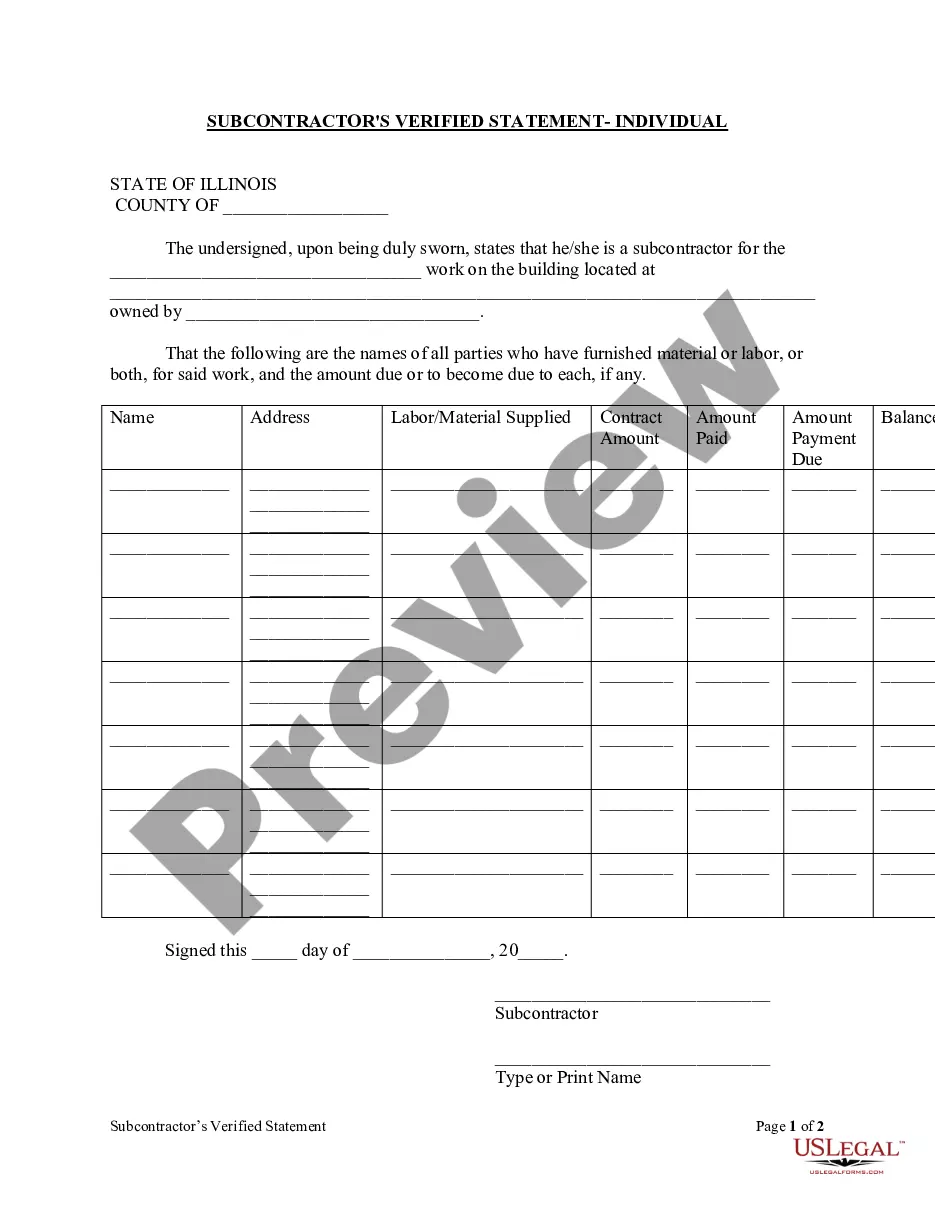

- Step 2. Use the Preview option to review the form's content. Remember to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal form template.

Form popularity

FAQ

Termination in Hawaii typically involves several criteria, including the employee's performance, adherence to company policies, and compliance with the law. Employers must follow fair practices as outlined in the Hawaii Termination and Severance Pay Policy, ensuring that the reasons for termination do not stem from unlawful activities. Employees are advised to seek clarity on these criteria to understand the fairness of their treatment during the termination process.

In Hawaii, the termination procedure usually involves clear communication from the employer regarding the reasons for the dismissal. Employers must ensure that they comply with the Hawaii Termination and Severance Pay Policy, which may include providing written notice and final paycheck details. Employees should also receive information regarding their rights and any severance benefits they might be entitled to.

Hawaii law stipulates that employers must adhere to the terms outlined in employment contracts and the Hawaii Termination and Severance Pay Policy when terminating an employee. This means providing notice or severance pay in accordance with the law or company policy. Employers must also not violate any anti-discrimination laws or retaliate against employees for asserting their rights.

In Hawaii, wrongful termination occurs when an employee is fired for reasons that violate state or federal laws. This includes discriminatory dismissals based on race, gender, or other protected categories. Additionally, if an employee is terminated for reporting illegal activities or exercising rights protected by law, such as under the Hawaii Termination and Severance Pay Policy, that can also be grounds for wrongful termination.

Not everyone receives a severance package under the Hawaii Termination and Severance Pay Policy. In general, severance pay is a discretionary benefit provided by employers, and its availability often depends on company policy and the circumstances surrounding the employee's departure. Employers typically consider factors such as tenure, reason for termination, and any existing agreements when deciding on severance. To understand your specific situation better, consider consulting the resources available on the US Legal Forms platform, which can guide you through the intricacies of job termination and severance policies in Hawaii.

To obtain a severance check under the Hawaii Termination and Severance Pay Policy, you should first review your employment contract or company policy. Typically, your employer will notify you of your eligibility for severance pay after your termination. It's essential to communicate with your HR department to ensure all paperwork is complete. Remember, understanding your rights regarding severance can help you navigate this process more smoothly.

Being Fired The difference between being laid off and fired is who is at fault. Being fired means you are terminated from your job due to something that the company deems was your fault. If you are laid off, that means the company deems that they are at fault.

Employees terminated by an employer have certain rights. An employee has the right to receive a final paycheck and the option of continuing health insurance coverage, and may even be eligible for severance pay and unemployment compensation benefits.

In Hawaii, an employee can file a private lawsuit to recover unpaid wages, civil penalties, and attorney's costs and fees. In the event that the employer willfully violated the law, liquidated damages may also be recovered.

Generally, under Haw. Rev. Stat. § 388-3, an employer must issue a final paycheck to a terminated employee immediately, or if immediate payment is not possible, no later than the next business day.