Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock

Description

How to fill out Marketing Agreement With Cooperative Association For Sale Of Livestock?

Selecting the correct valid document template may pose challenges.

Certainly, there are numerous templates available on the web, but how can you find the right document you need.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, suitable for business and personal use.

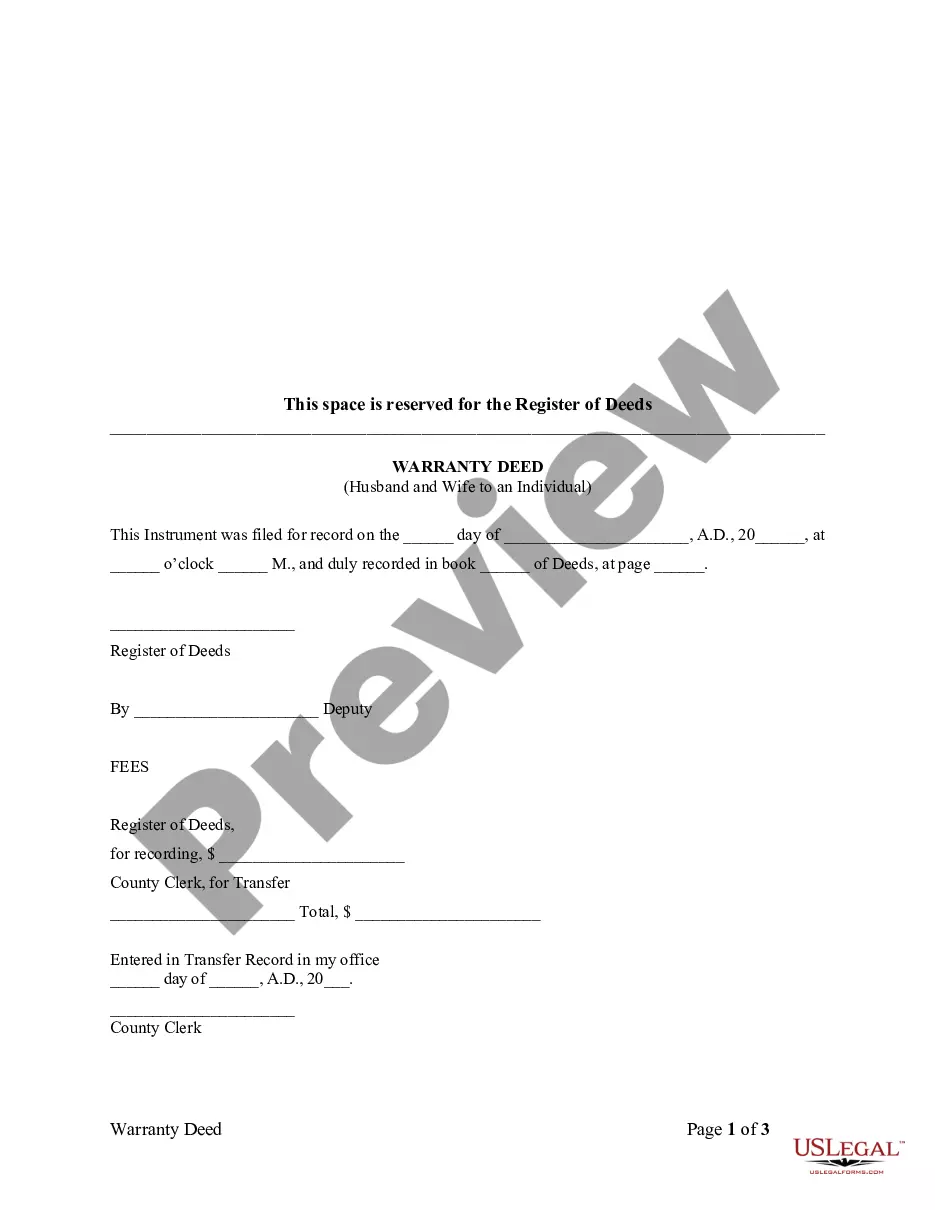

You can examine the document using the Preview button and review the document details to ensure this is indeed suitable for you.

- All the documents are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click on the Download button to locate the Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock.

- Use your account to search for the legal documents you have previously acquired.

- Go to the My documents tab in your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have selected the correct document for your state/region.

Form popularity

FAQ

The G49 form, which reports the General Excise tax, should be filed with the Hawaii Department of Taxation. You can submit it online through their electronic filing system or mail it directly to their office. If you are involved in a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, ensure you follow the correct filing procedures as this helps maintain proper compliance. For additional guidance, resources like US Legal Forms can assist in providing the necessary documentation.

In Hawaii, the General Excise (GE) tax returns are typically filed quarterly or semi-annually, depending on your business's income. If you are part of a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, adhering to these filing schedules is crucial to remain compliant. Always be mindful of deadlines to avoid penalties. If you need help with this process, consider platforms like US Legal Forms for reliable tax form solutions.

To become tax exempt in Hawaii, you must apply for an exemption certificate with the Hawaii Department of Taxation. If your organization qualifies, such as those involved in a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, you can significantly reduce your tax obligations. Ensure you provide the necessary documentation and meet specific criteria. This process can seem complex, but resources are available to guide you.

Excise exemption refers to the relief from paying certain taxes on specific goods or services. In Hawaii, businesses engaged in selling livestock under a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock may qualify for this exemption. This reduces the overall tax burden, helping livestock producers operate more profitably. It is beneficial to consult with a tax professional to navigate these regulations effectively.

To file your Hawaii estimated taxes, you typically use Form N- 200V. This form allows you to report the estimated tax you owe throughout the year. If you are involved in a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, timely payment of estimated taxes is essential for avoiding penalties and ensuring smooth operations.

Certain organizations, like non-profits and specific government entities, may qualify for exemptions from Hawaii general excise tax. If your business activities fall under a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, it’s crucial to understand your eligibility for these exemptions. Consulting with a tax expert can provide clarity on your specific situation.

Yes, you may need to file both G45 and G49 forms, depending on your business activities. The G45 form is for periodic tax returns, while the G49 form is for your annual summary. If you have a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, you must file both to report your income adequately and comply with state laws.

General excise reconciliation in Hawaii involves comparing your collected taxes with your reported liabilities. This process ensures that you understand your tax obligations, especially if you operate under a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock. Keeping accurate records during this reconciliation helps you avoid penalties and overpayments.

The Hawaii tax G-49 form is a general excise tax annual return. This form summarizes your general excise tax activities for the year. If you engage in business activities under a Hawaii Marketing Agreement with Cooperative Association for Sale of Livestock, you will need to file this form accurately to remain in compliance with state tax laws.