Hawaii Product Sales Order Form

Description

How to fill out Product Sales Order Form?

Are you currently in a circumstance where you require documentation for either business or personal purposes almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms provides thousands of form templates, including the Hawaii Product Sales Order Form, designed to meet state and federal requirements.

Once you locate the appropriate form, click Buy now.

Select the payment plan you want, complete the necessary information to create your account, and make your purchase using PayPal or a credit card.

- If you are already familiar with the US Legal Forms website and have your account, simply Log In.

- Then, you can download the Hawaii Product Sales Order Form template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it’s for the correct city/county.

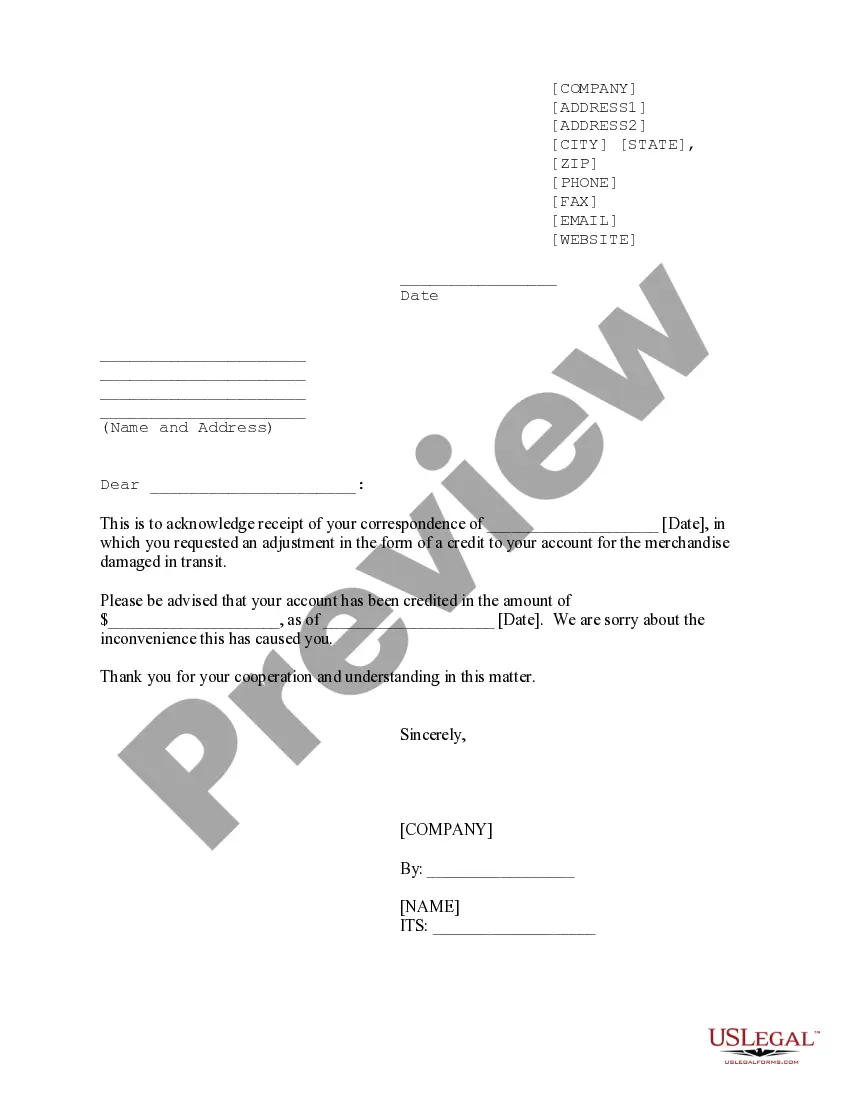

- Use the Preview button to review the document.

- Check the details to make sure you have selected the right form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Hawaii form N-15 is a tax return form for part-year residents and non-residents. It allows these individuals to report income earned during their time in Hawaii. If you engage in product sales, your income may need to be listed here in relation to your Hawaii Product Sales Order Form.

The G-49 is the annual or so called "reconciliation" form which is filed annually. The G-49 is used to report annual sales and correct any errors or differences between your periodic reporting on G-45 and your finalized annual sales.

Businesses that have run payroll in Hawaii in the past can find their Tax ID on notices received from the Hawaii Department of Taxation, such as the Withholding Tax Return (Form HW-14), or by calling the agency at (800) 222-3229. The Hawaii Withholding ID number format is WH-000-000-0000-01 (or -02).

Hawaii Tax Online is the convenient and secure way to e-file tax returns, make payments, view letters, manage your accounts, and conduct other common transactions online with the Hawaii Department of Taxation.

Form G-45 is due on or before the 20th day of the calendar month following the end of the filing period. For example, if your filing period ends on January 31st, then your return will be due on February 20th. Form G-49 is due on or before the 20th day of the fourth month following the close of the tax year.

Pay individual income tax. Pay a balance due on your Individual Income Tax Return for the current tax year, and prior years through tax year 2003.

Forms G-45, G-49, and GEW-TA-RV-6 can be filed and payments made electronically through the State's Internet portal. For more information, go to tax.hawaii.gov/eservices/. The GET is a tax imposed on the gross income you receive from any business activity you have in Hawaii.

If you believe that an employee has claimed excess allowances for the employee's situation (generally more than 10) or misstated the employee's marital status, you must send a copy of the Form HW-4 for that employee to the Hawaii Department of Taxation, P. O. Box 3827, Honolulu, Hawaii 96812-3827.

PURPOSE OF FORMRegister for various tax licenses and permits with the Department of Taxation (DOTAX) and to obtain a corresponding Hawaii Tax Identification Number (Hawaii Tax I.D.

General Excise Tax The tax is imposed on the gross income received by the person en- gaging in the business activity. Activities subject to the tax include wholesaling, retailing, farming, services, construction contracting, rental of per- sonal or real property, business interest income, and royalties.