Hawaii Renunciation of Legacy in Favor of Other Family Members

Description

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

It is possible to devote time on the web trying to find the authorized document design that meets the federal and state requirements you need. US Legal Forms gives a large number of authorized forms that happen to be analyzed by professionals. It is possible to download or printing the Hawaii Renunciation of Legacy in Favor of Other Family Members from our assistance.

If you already have a US Legal Forms bank account, you are able to log in and click on the Obtain button. Following that, you are able to complete, revise, printing, or indicator the Hawaii Renunciation of Legacy in Favor of Other Family Members. Every authorized document design you buy is the one you have eternally. To get one more copy of any bought kind, proceed to the My Forms tab and click on the related button.

Should you use the US Legal Forms website for the first time, stick to the straightforward recommendations beneath:

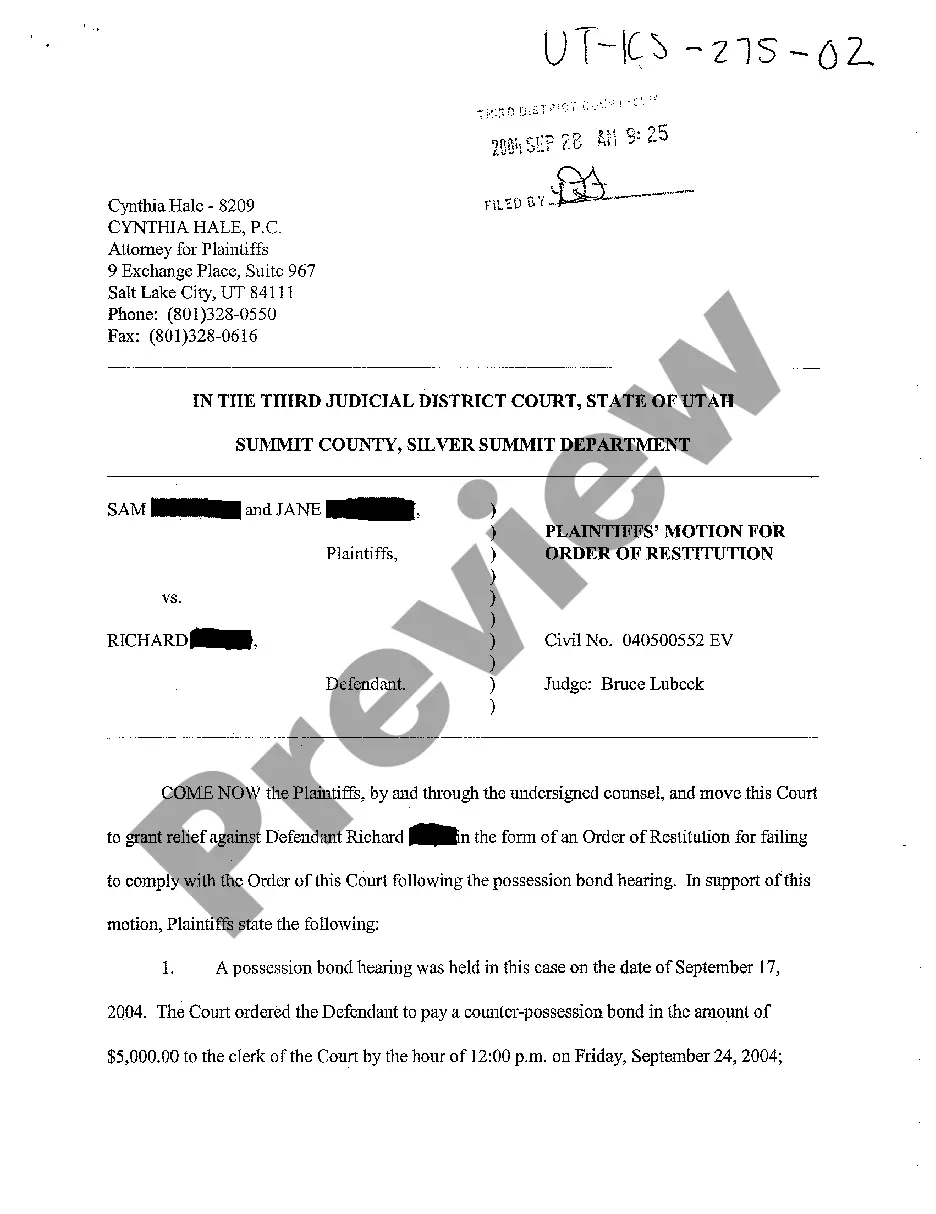

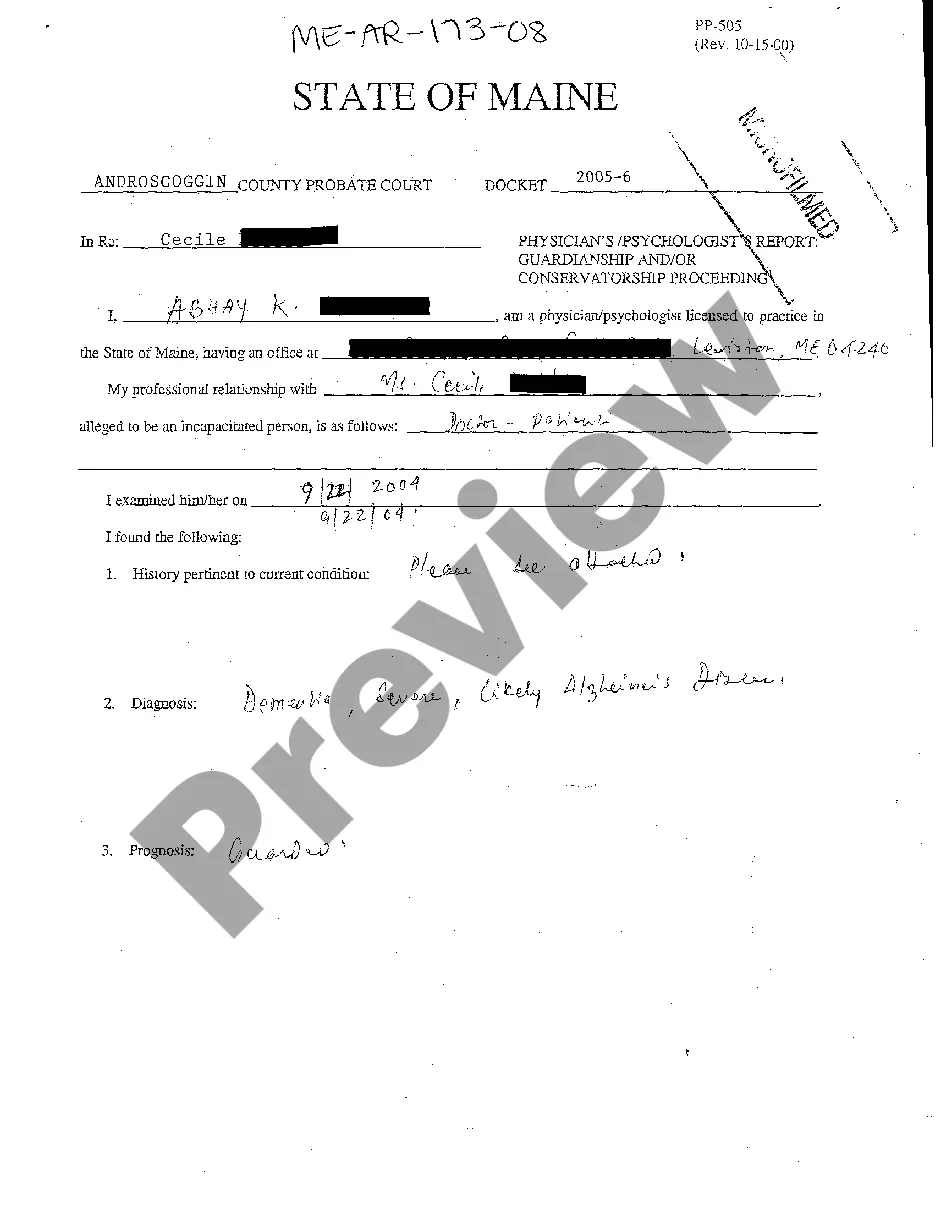

- First, make certain you have chosen the best document design for that county/town that you pick. Read the kind description to ensure you have selected the proper kind. If readily available, take advantage of the Preview button to check with the document design at the same time.

- If you would like discover one more version of your kind, take advantage of the Search industry to obtain the design that fits your needs and requirements.

- After you have located the design you need, click on Acquire now to continue.

- Choose the prices plan you need, enter your references, and sign up for a merchant account on US Legal Forms.

- Complete the deal. You should use your Visa or Mastercard or PayPal bank account to cover the authorized kind.

- Choose the file format of your document and download it to your product.

- Make changes to your document if required. It is possible to complete, revise and indicator and printing Hawaii Renunciation of Legacy in Favor of Other Family Members.

Obtain and printing a large number of document themes making use of the US Legal Forms site, that provides the biggest selection of authorized forms. Use professional and express-specific themes to handle your small business or specific needs.

Form popularity

FAQ

There are no federal probate laws. Probate in Hawaii is necessary when a person dies owning any real estate in his or her name alone, no matter how small the value of the real estate. Probate is also required when the total value of all ?personal property? owned in his or her name alone is worth more than $100,000.

A Revocable Living Trust A trust can be a great mechanism to avoid probate and is the recommended method. While there are some upfront fees for creating a trust, the fees are typically much less than probate costs. Generally, you, as trustee, retain control of the assets held within the trust during your lifetime.

The laws of intestacy establish a specific order of priority for the distribution of assets. Typically, a surviving spouse and children are given priority, followed by other close relatives, such as parents and siblings. If there are no surviving relatives, the assets may escheat to the state.

In the law of inheritance, wills and trusts, a disclaimer of interest (also called a renunciation) is an attempt by a person to renounce their legal right to benefit from an inheritance (either under a will or through intestacy) or through a trust.

Under Hawaii law, if you die without a will, your spouse will get the first $200,000, plus three-fourths of any balance of the intestate estate and your parents would get one-fourth.

Beneficiaries may file a lawsuit in Probate Court to assert their rights pertaining to a trust and may ask the Probate Court to: (1) Appoint or remove a trustee; (2) Review trustees' fees and to review and settle interim or final accounts; (3) Ascertain beneficiaries, to determine any question arising in the ...

Under Hawaii inheritance law, if you die with children but no surviving spouse, your children inherit everything. If you die with a surviving spouse and children with that spouse, your spouse inherits your entire intestate estate and your children get nothing.