Hawaii Purchase Agreement by a Corporation of Assets of a Partnership

Description

How to fill out Purchase Agreement By A Corporation Of Assets Of A Partnership?

Finding the appropriate legal document template can be quite challenging. Of course, there are numerous templates available online, but how can you find the legal form you need? Utilize the US Legal Forms website.

The service offers a wide array of templates, including the Hawaii Purchase Agreement by a Corporation of Assets of a Partnership, suitable for both business and personal use. All forms are verified by professionals and comply with state and federal regulations.

If you are currently registered, Log In to your account and click the Acquire button to download the Hawaii Purchase Agreement by a Corporation of Assets of a Partnership. Use your account to browse the legal forms you have obtained previously. Go to the My documents tab of your account to retrieve another copy of the document you need.

Complete, modify, print, and sign the acquired Hawaii Purchase Agreement by a Corporation of Assets of a Partnership. US Legal Forms is the largest library of legal forms where you can access a variety of document templates. Utilize the service to obtain professionally crafted documents that adhere to state requirements.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview button and read the form description to make sure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- Once you are confident that the form is suitable, click the Purchase now button to obtain the form.

- Select your desired pricing plan and enter the required information. Create your account and place an order using your PayPal account or credit card.

- Choose the file format and download the legal document template to your system.

Form popularity

FAQ

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An asset purchase requires the sale of individual assets. A share purchase requires the purchase of 100 percent of the shares of a company, effectively transferring all of the company's assets and liabilities to the purchaser.

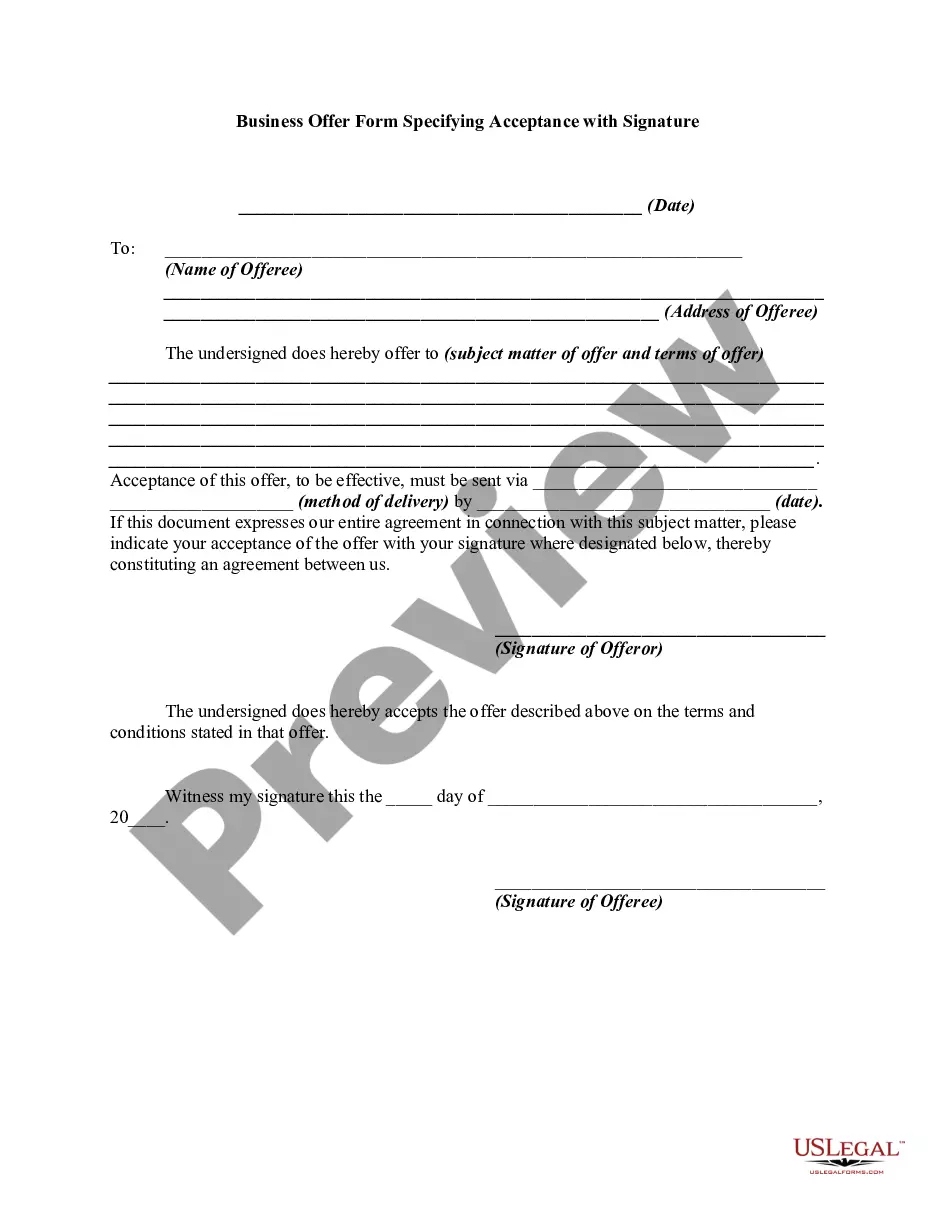

How to Write a Business Purchase Agreement?Step 1 Parties and Business Information. A business purchase agreement should detail the names of the buyer and seller at the start of the agreement.Step 2 Business Assets.Step 3 Business Liabilities.Step 4 Purchase Price.Step 6 Signatures.

An asset purchase involves just the assets of a company. In either format, determining what is being acquired is critical. This article focuses on some of the important categories of assets to consider in a business purchase: real estate, personal property, and intellectual property.

An asset purchase agreement, also known as an asset sale agreement, business purchase agreement, or APA, is a written legal instrument that formalizes the purchase of a business or significant business asset. It details the structure of the deal, price, limitations, and warranties.

What is a Definitive Agreement? A definitive agreement may be known by other names such as a purchase and sale agreement, a stock purchase agreement or an asset purchase agreement. Regardless of its name, it is the final agreement that spells out details agreed upon by buyer and seller.

What is an asset purchase? This is an agreement between a buyer and seller to acquire a company's assets. The buyer can cherry pick which assets it wants and leave the rest behind. Assets can be both tangible, such as offices and equipment, and intangible, such as intellectual property and corporate name.

Purchasing shares is generally considered to benefit the seller, while purchasing assets is considered a benefit to the buyer. Asset transactions can allow the purchaser to be sheltered from any unforeseen liabilities. In share purchases, the buyer takes on these liabilities, and the transaction is inherently riskier.

In an asset purchase, the buyer agrees to purchase specific assets and liabilities. This means that they only take on the risks of those specific assets. This could include equipment, fixtures, furniture, licenses, trade secrets, trade names, accounts payable and receivable, and more.

An asset purchase involves the purchase of the selling company's assets -- including facilities, vehicles, equipment, and stock or inventory. A stock purchase involves the purchase of the selling company's stock only.