Unless limited or prohibited by the articles or bylaws, action required or permitted by the RNPCA to be approved by the members may be approved without a meeting of members if the action is approved by members holding at least eighty percent (80%) of the voting power. The action must be evidenced by one or more consents in the form of a record bearing the date of signature and describing the action taken, signed by those members representing at least eighty percent (80%) of the voting power, and delivered to the corporation for inclusion in the minutes or filing with the corporate records.

Hawaii Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting

Description

How to fill out Consent To Action By The Board Of Trustees Of A Non-Profit Church Corporation In Lieu Of Meeting?

Have you ever found yourself in a circumstance where you require documents for both business or particular purposes nearly every day.

There are numerous legal document templates available online, but obtaining versions you can depend on isn’t easy.

US Legal Forms provides a vast collection of document templates, such as the Hawaii Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting, which are designed to comply with state and federal regulations.

Once you find the correct document, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient document format and download your version. You can access all the document templates you have purchased in the My documents section. You can download an additional version of the Hawaii Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting at any time if needed. Just click on the required document to download or print the template. Use US Legal Forms, the most extensive collection of legal forms, to save time and minimize errors. The service offers professionally drafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start simplifying your life.

- If you are already aware of the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Consent to Action by the Board of Trustees of a Non-Profit Church Corporation in Lieu of Meeting template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is for the correct area/state.

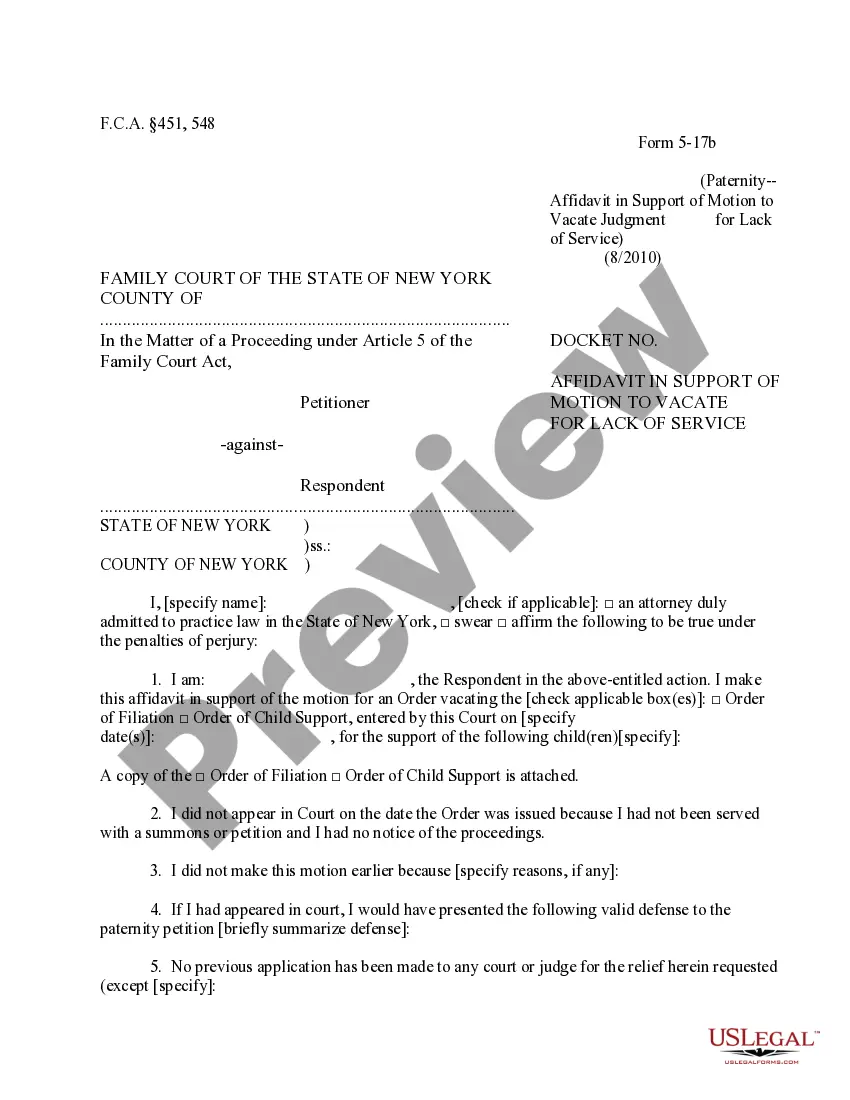

- Utilize the Preview feature to review the form.

- Check the synopsis to ensure you have selected the correct document.

- If the form isn’t what you’re looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

Nonprofits often look for ways to reward their volunteers for their services. There is no tax problem when a volunteer is given rewards of nominal value such as free food and drink at a thank-you party or a certificate of appreciation. However, more substantial rewards could result in taxable income to the volunteers.

Per IRS, individuals can give up to $14,000 annually to others without the donee needing to pay taxes. This rule applies to gifting between individuals.

Common Mistakes by Nonprofit Boards and How to Avoid ThemKeep the focus on providing guidance and strategic direction.Not understanding mission and vision.Lack of awareness of tax legislation.Operating with outdated governance documents.Little knowledge of what makes a nonprofit tick.More items...?02-Jul-2019

Board members don't do their duty to give, get AND get off! This means giving personally financially, expertise, time getting others to contribute the same, and getting off the board when it's time.

Token Gift A gift given by a 501(c)(3) nonprofit to a donor in exchange for a donation, where the value of the gift doesn't exceed the maximum limit for insubstantial value as determined by the IRS. This amount, indexed by inflation, stands at $11.30 for 2021. Examples include coffee mugs, t-shirts, etc.

Nonprofit Boards: 7 Key Responsibilities for Good GovernanceEnsure Effective Organizational Planning.Provide Sufficient Resources.Make Sure the Organization Fulfills Legal Obligations.Provide Proper Financial Oversight.Select and Evaluate the Executive Director.Improve the Organization's Public Standing.More items...?

Some nonprofits offer their donors a premium (a small gift) when they make a contribution at a certain level or become members of the organization. Offering your donors a gift has several benefits.

A 501(c)(3) charitable organization can certainly make grants and donations to benefit a "worthy individual" who falls under the purview of the organization's mission statement.

Your board of directors is the primary decision maker for your nonprofit and is responsible for overseeing its management. As a result, your board should approve any decision involving significant financial, legal, or tax issues, or any major program-related matter.

Board members are the fiduciaries who steer the organization towards a sustainable future by adopting sound, ethical, and legal governance and financial management policies, as well as by making sure the nonprofit has adequate resources to advance its mission.