Hawaii Agreement for the Use of Property of a Named Church

Description

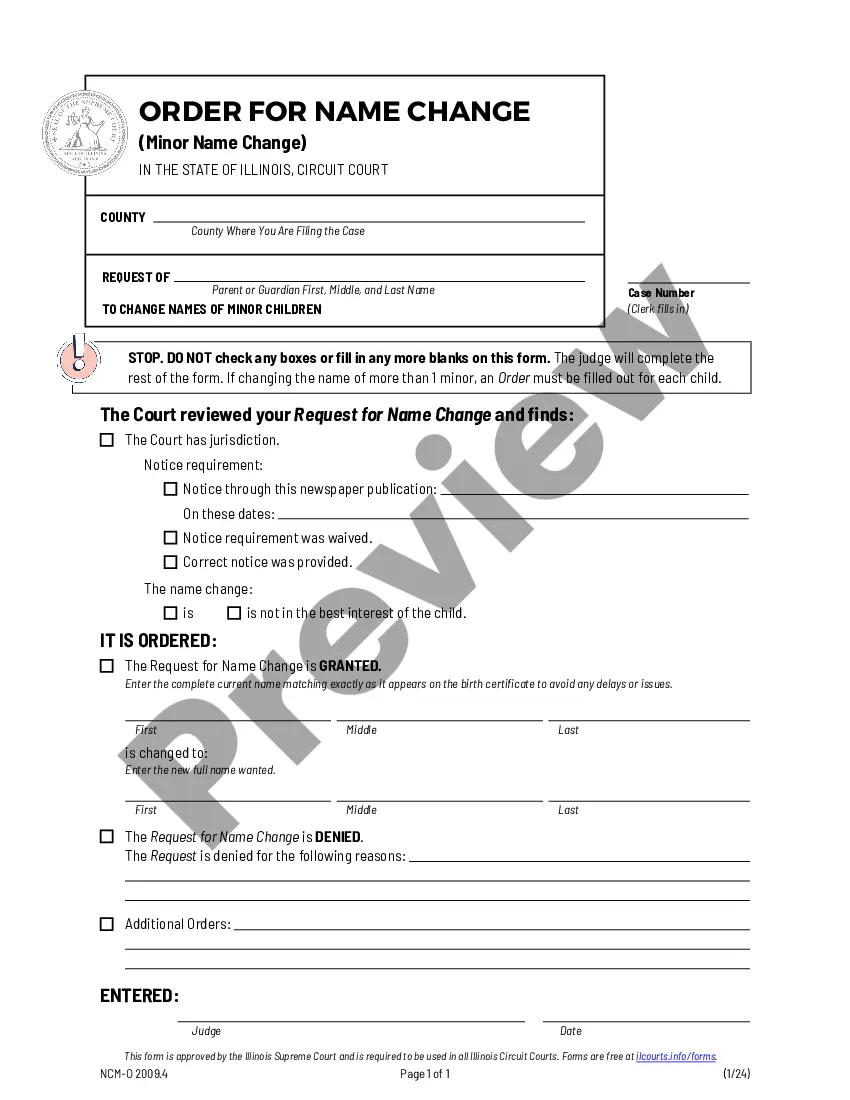

How to fill out Agreement For The Use Of Property Of A Named Church?

Are you currently in a scenario where you need documentation for both business or personal reasons almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust is challenging.

US Legal Forms offers a vast array of form templates, including the Hawaii Agreement for the Use of Property of a Designated Church, crafted to comply with state and federal regulations.

Once you find the right form, click Purchase now.

Select the pricing plan you prefer, provide the necessary information to create your account, and complete the purchase using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Hawaii Agreement for the Use of Property of a Designated Church template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you require and ensure it is for the correct city/state.

- Utilize the Preview button to examine the document.

- Read the description to ensure you have chosen the correct form.

- If the form is not what you are looking for, utilize the Search bar to find the form that fits your needs.

Form popularity

FAQ

Yes, if your church operates under the Hawaii general excise tax, you should file both G 45 and G 49. G 45 helps keep track of monthly or quarterly income, while G 49 reconciles your annual total. Proper filing is crucial for compliance, especially for organizations leveraging the Hawaii Agreement for the Use of Property of a Named Church, allowing them to focus on their mission.

Sales tax is charged on the sale of goods to consumers, while general excise tax is assessed on businesses for activities including sales, services, and rental income. In Hawaii, the general excise tax is widespread and applies to most transactions at 4% statewide. Understanding these distinctions is important for churches operating under the Hawaii Agreement for the Use of Property of a Named Church, ensuring they meet tax obligations.

The G 45 and G 49 forms serve different purposes in Hawaii's tax system. G 45 is for general excise tax returns filed quarterly, while G 49 is an annual reconciliation form. If your church engages in activities covered under the Hawaii Agreement for the Use of Property of a Named Church, knowing when to file these forms can streamline your tax reporting process.

Certain entities like nonprofits and government organizations may qualify for general excise tax exemptions in Hawaii. For churches, this means they can focus resources on community support rather than tax burdens. Churches engaged in activities outlined in the Hawaii Agreement for the Use of Property of a Named Church can benefit from these exemptions if they meet specific criteria.

The tat tax in Hawaii, commonly referred to as the transient accommodations tax, applies to short-term rentals and accommodations. This tax is typically charged on vacation rentals and hotels, benefiting Hawaii's tourism infrastructure. As a property owner associated with a church, understanding this tax helps ensure compliance when renting out church facilities under the Hawaii Agreement for the Use of Property of a Named Church.

Yes, nonprofits can be tax exempt in Hawaii. To qualify, organizations must meet specific criteria set by the IRS and state laws. This tax-exempt status allows nonprofits to operate without paying certain local and state taxes, vital for many churches. Understanding the Hawaii Agreement for the Use of Property of a Named Church can help guide churches in navigating these regulations.

Churches may be exempt from local property taxes in Hawaii, provided they meet specific criteria. Utilizing a Hawaii Agreement for the Use of Property of a Named Church can assist in demonstrating that the property is used for exempt purposes. It simplifies the process for churches seeking tax relief. Knowing the legal requirements and completing the necessary agreements can lead to significant financial benefits.

Yes, church property is generally treated as private property, even though it serves public functions. The Hawaii Agreement for the Use of Property of a Named Church can specify how the property is utilized while maintaining its status as private. This distinction means churches have certain rights and responsibilities for their property. Ensuring clarity about property status helps protect the church's interests.

The ownership of church property typically rests with the church organization according to its governing documents. However, in the case of a Hawaii Agreement for the Use of Property of a Named Church, the specific terms can dictate property use and maintenance. This agreement also helps clarify ownership when multiple parties are involved. Understanding ownership is crucial for both legal and operational purposes.

Yes, Hawaii is a deed state, meaning that property ownership is established through the recording of a deed. When a church enters a Hawaii Agreement for the Use of Property of a Named Church, it clarifies the ownership and use of the property involved. This agreement protects the interests of the church and its members by outlining specific terms. Clear documentation ensures everyone understands their rights and responsibilities.