Hawaii Telecommuting Worksheet

Description

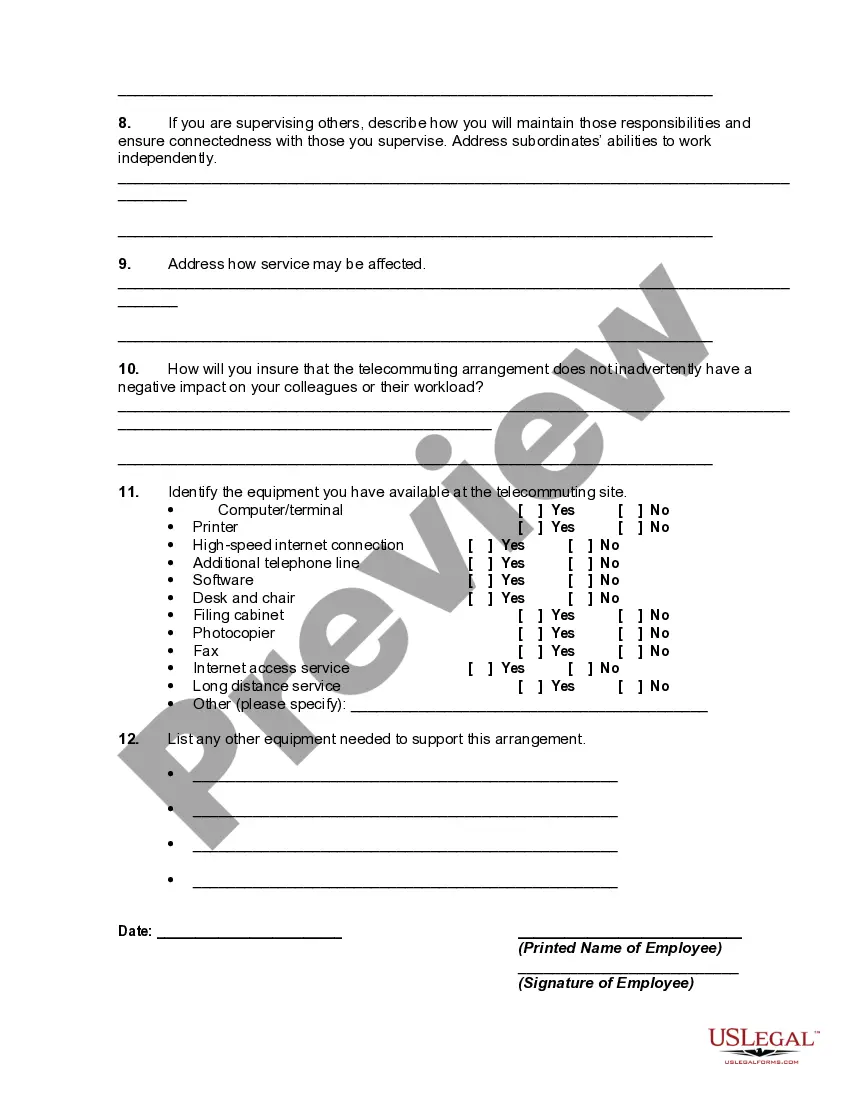

How to fill out Telecommuting Worksheet?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal form templates that you can download or print.

By utilizing the website, you can discover numerous forms for both business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Hawaii Telecommuting Worksheet within moments.

If you already have a subscription, Log In to download the Hawaii Telecommuting Worksheet from the US Legal Forms library. The Download button will appear on every form you view. You have access to all previously saved forms in the My documents section of your account.

Complete the purchase. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, print, and sign the downloaded Hawaii Telecommuting Worksheet. Each template you add to your account has no expiration date and is yours indefinitely. Thus, if you wish to download or print another copy, simply access the My documents section and click on the form you need. Retrieve the Hawaii Telecommuting Worksheet with US Legal Forms, one of the most extensive collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs.

- Ensure you have selected the appropriate form for your city/state.

- Click the Preview button to review the form's details.

- Read the description of the form to confirm it is the right one.

- If the form does not meet your needs, use the Search box at the top of the page to find one that does.

- Once you are satisfied with the form, finalize your choice by clicking the Buy now button.

- Select your preferred pricing plan and provide your details to register for an account.

Form popularity

FAQ

Form N-288A is specifically for individuals who are nonresidents and need to report their income earned in Hawaii. This form provides a clear outline of what you should report and helps determine the appropriate tax owed. By utilizing the Hawaii Telecommuting Worksheet, you can ensure that your information is accurately captured and submitted.

Form N-288A is a tax return for nonresidents who earn income in Hawaii. This form allows you to report your Hawaii source income accurately and calculate any tax owed. Using the Hawaii Telecommuting Worksheet can streamline this process, especially for those working remotely or from other states.

To file Form N-11, which is essential for Hawaii resident income tax returns, you need to submit it to the Hawaii Department of Taxation. You can file your taxes electronically via their online portal or send a physical copy to the designated address. If you're working remotely, the Hawaii Telecommuting Worksheet might assist you in calculating your taxes accurately.

Taxable income not subject to withholding Interest, dividends, capital gains, self-employment and gig economy income and IRA (including certain Roth IRA) distributions.

In normal times, employees who telecommute from a home office on a regular basis will create nexus for their employer in most states. 16 states and the District of Columbia will not assert nexus on this basis during the COVID-19 emergency.

Taxable income not subject to withholding - Interest income, dividends, capital gains, self employment income, IRA (including certain Roth IRA) distributions. Adjustments to income - IRA deduction, student loan interest deduction, alimony expense.

When you file as exempt from withholding with your employer for federal tax withholding, you don't make any federal income tax payments during the year. (A taxpayer is still subject to FICA tax.)

Remote workers whose companies are based in in seven states will incur a tax liability in their state of residence as well as in the state in which their company is located due to convenience rules. These include Arkansas, Connecticut, Delaware, Massachusetts, Nebraska, New York, and Pennsylvania.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Texas is one of nine states that doesn't have an individual income tax. It generates revenue from sales and use tax, property and corporate income taxes. The other states that don't charge an individual income tax are: Alaska.