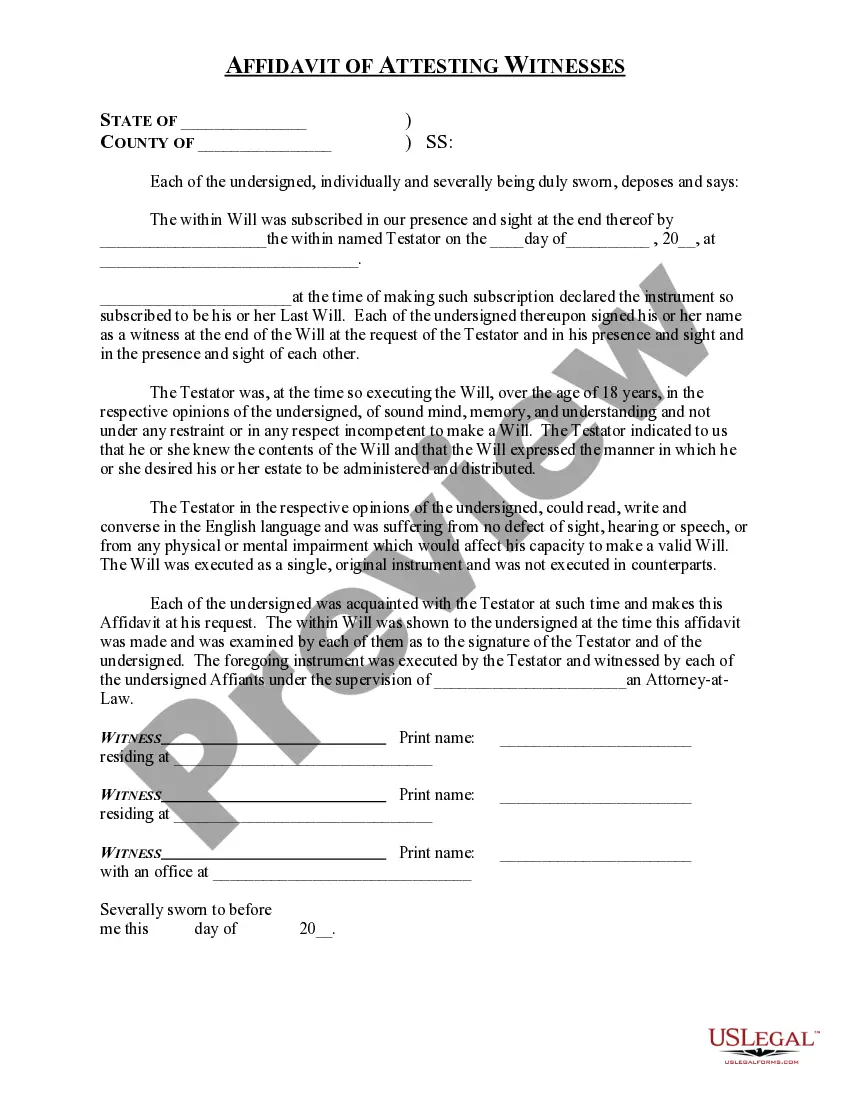

Young men 18 through 26 must register for the draft. If they do not, then they face potential criminal penalties and loss of federal and state benefits. There is not currently a draft. If there were a draft, then young men who are registered would be classified in accordance with the Selective Service law. Certain exemptions are available. Such exemptions include people performing essential war work, certain agricultural workers, certain heads of families with children, ministers of religion, divinity students, and National Guard members.

Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader

Description

How to fill out General Form Of Affidavit For Exemption From The Draft By A Minister Or Similar Religious Leader?

Selecting the finest official document template can be challenging.

Undoubtedly, there are numerous templates accessible online, but how do you find the official form you need.

Utilize the US Legal Forms website.

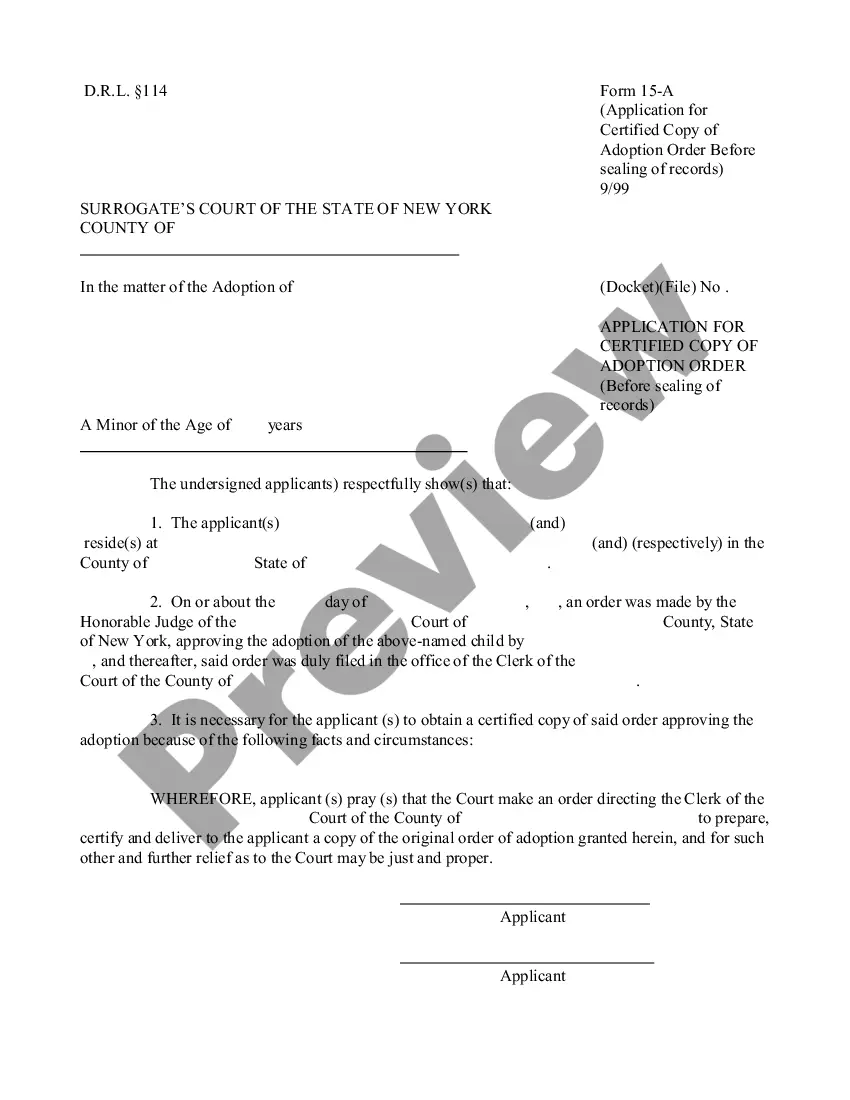

If you are a new user of US Legal Forms, here are simple steps to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Review button and check the form details to confirm it is suitable for you. If the form does not meet your expectations, use the Search field to find the appropriate form. Once you are certain that the form is acceptable, click the Buy Now button to obtain the form. Choose the pricing plan that suits you and enter the necessary information. Create your account and place an order using your PayPal account or Visa or Mastercard. Select the file format and download the official document template to your device. Complete, modify, print, and sign the acquired Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader. US Legal Forms is the largest repository of official forms where you can find numerous document templates. Use the service to obtain professionally-crafted documents that meet state requirements.

- The service offers a wide selection of templates, including the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader, suitable for business and personal purposes.

- All forms are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to download the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader.

- Use your account to browse the legal forms you have obtained in the past.

- Visit the My documents tab of your account to retrieve another copy of the document you need.

Form popularity

FAQ

Form 1099-G in Hawaii is used to report certain government payments, including unemployment compensation. If you received unemployment benefits in Hawaii, you should expect this form, as it summarizes your total benefits received for the year. It's important to understand that if you have been granted an exemption, like the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader, it will not affect your reporting obligations. Properly reporting this information helps you avoid potential tax issues down the line.

To file your estimated taxes in Hawaii, you should use Form N-103. This form allows you to report your estimated tax liability for the year. Additionally, if you are a minister or a similar religious leader, you may benefit from the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader for your specific situation. Using the correct form will help ensure compliance with state tax regulations.

In Hawaii, the general excise tax is often confused with sales tax, but they are different. The general excise tax is imposed on the gross income of businesses and is collected at every stage of production and distribution, whereas sales tax is typically charged to the consumer at the point of sale. Awareness of these distinctions is important for those involved in the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader when managing their financial responsibilities.

The G-45 tax in Hawaii refers to the general excise tax that businesses are required to report either monthly or quarterly. This tax is applied to most business activities within the state. If you’re a minister or similar religious leader aiming to file the Hawaii General Form of Affidavit for Exemption from the Draft, knowing about the G-45 tax can help you navigate your tax obligations effectively.

The G-45 form is a monthly or quarterly general excise tax return, while the G-49 is an annual summary of these transactions. Essentially, the G-45 provides a more frequent account of earnings, whereas the G-49 compiles this information for the entire year. Understanding these differences is beneficial, especially if you are involved with the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader, as these forms can impact your overall tax strategy.

The Hawaii tax G-49 form is a general excise tax return that must be filed by businesses that earn income in Hawaii. This form allows taxpayers to report their gross income and calculate their owed taxes accordingly. If you're seeking the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader, it’s essential to understand the G-49, as it plays a role in the overall tax filing process for individuals in Hawaii.

Filing a G45 in Hawaii is a process where you report your general excise tax on a periodic basis. You will need to gather your sales data, complete the G45 form, and submit it to the Department of Taxation. Utilizing resources online, like the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader, can help ensure your compliance with tax regulations while focusing on your religious commitments.

To become tax exempt in Hawaii, you typically need to apply for a tax exemption certificate through the state’s Department of Taxation. This process often requires documentation proving your nonprofit or religious status, including details about your ministry. The Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader can also be a valuable resource in securing tax-exempt status for your religious purposes.

Excise exemption refers to the relief from paying certain taxes on goods, services, or specific transactions, which can significantly benefit ministries and religious organizations. Understanding excise exemption is crucial for ministers and similar religious leaders who wish to maximize their contributions to community services. Obtaining the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader can aid in navigating these exemptions effectively.

The 1098 F form in Hawaii is a tax document that deals with specific financial transactions, typically relevant to educational institutions. It is used to report qualified tuition and related expenses to both the IRS and the taxpayer. To understand how to utilize this form in relation to your financial situation or religious duties, you might explore the Hawaii General Form of Affidavit for Exemption from the Draft by a Minister or Similar Religious Leader.