Hawaii Rejection of Goods

Description

How to fill out Rejection Of Goods?

Are you presently in a position where you need documents for either business or personal activities almost every working day.

There are numerous authentic document templates available online, but locating reliable ones is not simple.

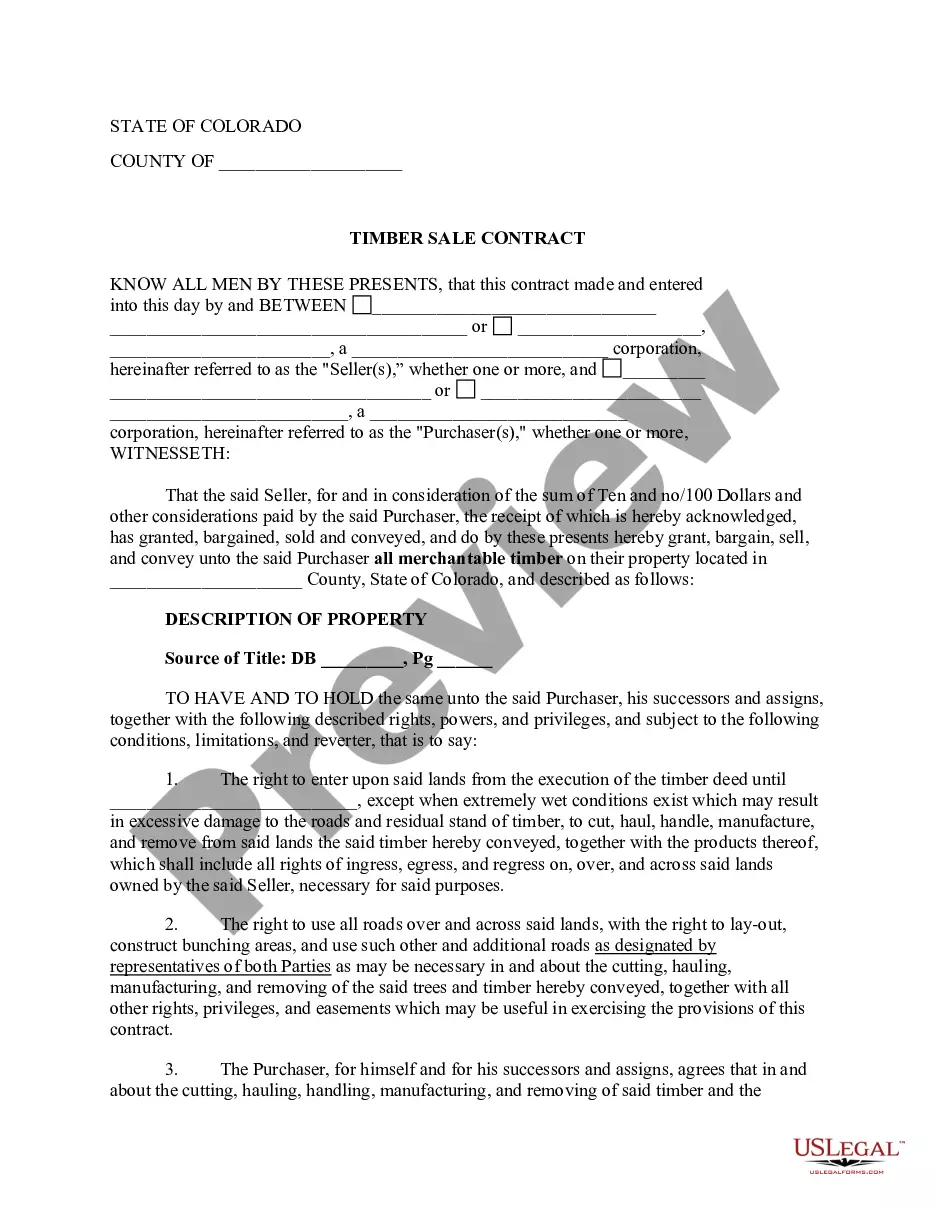

US Legal Forms provides thousands of form templates, such as the Hawaii Rejection of Goods, which can be customized to satisfy state and federal regulations.

Select the pricing plan you want, fill in the necessary details to create your account, and process the payment with your PayPal or credit card.

Choose a suitable document format and download your copy. Retrieve all the document templates you have purchased from the My documents menu. You can obtain another copy of the Hawaii Rejection of Goods anytime if required. Just select the appropriate form to download or print the document template.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Hawaii Rejection of Goods template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Make use of the Review option to evaluate the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you are looking for, use the Lookup field to find the form that suits your needs and requirements.

- Once you find the correct form, click Get now.

Form popularity

FAQ

Statute 286 57 in Hawaii outlines specific rules about vehicle registration and licensing requirements. Adhering to these rules is crucial for all vehicle operators in the state. For those involved in transactions or issues regarding vehicle goods, understanding Hawaii Rejection of Goods can be vital in addressing potential disputes effectively.

In Hawaii, the statute of limitations for debt collection typically allows creditors six years to collect a debt. This timeline ensures that debts are managed within an appropriate timeframe, offering some protection to consumers. If you are dealing with a debt collection situation, knowing the implications of Hawaii Rejection of Goods may help you handle disputes related to goods and services received.

Hawaii law allows for the removal of abandoned vehicles after a specified period. If a vehicle remains unattended on public property, it may be deemed abandoned and subject to disposal. This law impacts people who might find themselves involved in disputes over vehicles and may also connect to issues of Hawaii Rejection of Goods, especially in cases involving auto parts or salvage.

In Hawaii, failure to disperse refers to a situation where individuals do not comply with a lawful order from law enforcement to leave a specific area. Understanding this concept is important, especially for businesses knowing their rights in cases of civil unrest or public gatherings. If you have concerns about goods being disrupted during such events, consider how the Hawaii Rejection of Goods may apply.

The Hawaii N-15 form, which is used by non-resident individuals or businesses to file for Hawaii income tax, should be sent to the specified mailing address provided on the form. Ensuring that you send it to the correct address can prevent delays and issues. Additionally, in case of a Hawaii rejection of goods, take extra care with your submission to avoid complications.

The BB 1 form is known as the Business Action Notice, which is used for registering businesses and reporting information to the Hawaii Department of Taxation. This form is essential for businesses operating in the state to comply with tax regulations. If there is a concern about a Hawaii rejection of goods impacting your business registration, utilizing the BB 1 form accurately is vital.

To address an envelope for a tax return, write the recipient's name and the designated address clearly on the front. Include your return address in the top left corner to facilitate any necessary communication. Using the correct address format helps avoid delays, which can be crucial in the event of a Hawaii rejection of goods.

The G45 and G49 forms in Hawaii serve different purposes related to tax filings. G45 is the general excise tax return, while G49 is specifically for annual reconciliation. Understanding these distinctions is helpful to navigate your tax responsibilities effectively. If a Hawaii rejection of goods interferes with your obligations, consider seeking assistance with these forms.

To find the correct address for mailing your tax return, consult the official Hawaii Department of Taxation resources. The right address may vary based on whether you are filing a resident or non-resident return. Double-check all details to help ensure that you do not face complications, such as a Hawaii rejection of goods.

The destination for sending your Hawaii tax return depends on the type of tax you are filing. Generally, you should send it to the address designated by the Hawaii Department of Taxation. Ensure your return is complete and correctly filled out to avoid encountering issues related to a Hawaii rejection of goods.