No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Hawaii Acceptance of Claim and Report of Past Experience with Debtor

Description

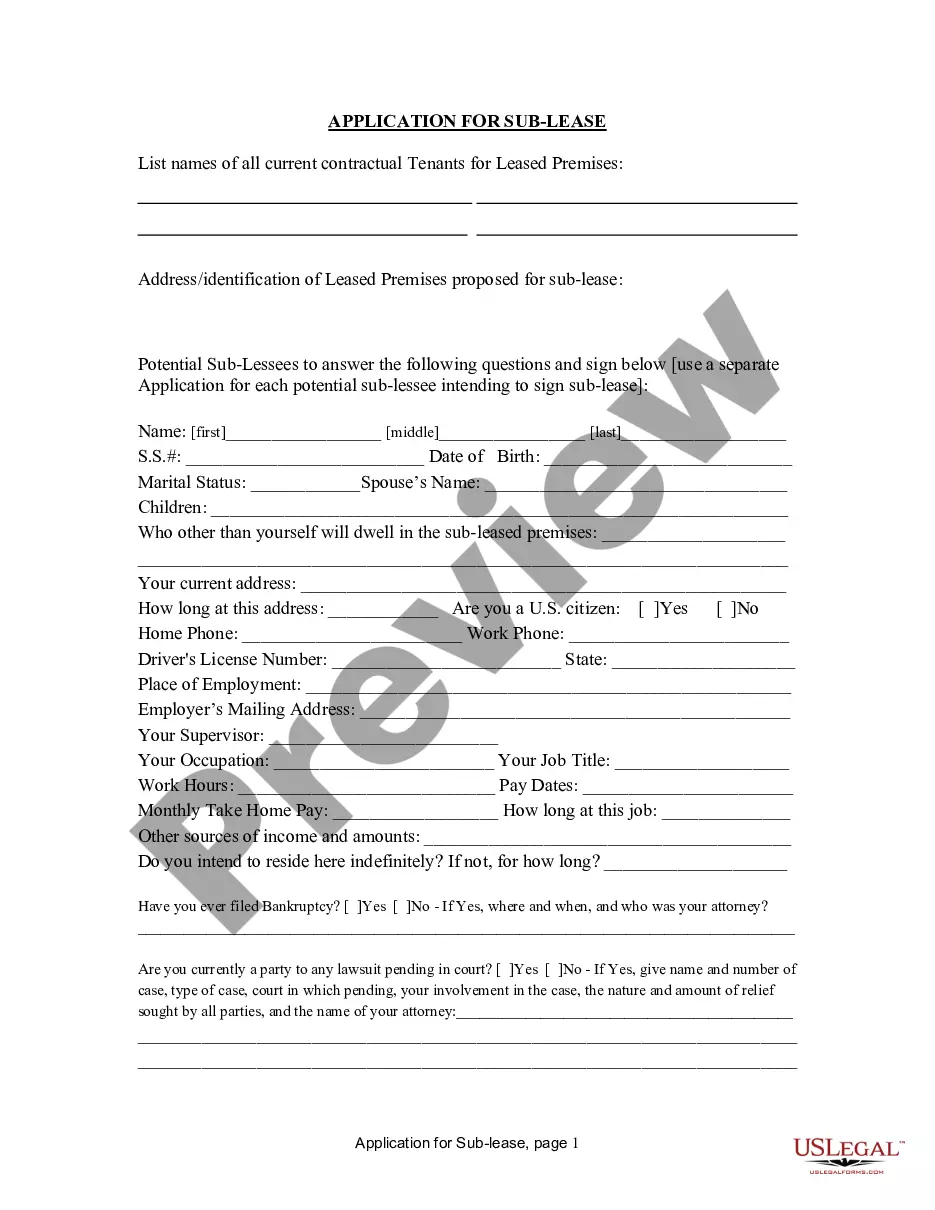

How to fill out Acceptance Of Claim And Report Of Past Experience With Debtor?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the site, you can find thousands of forms for business and personal use, organized by categories, states, or keywords.

You can locate the latest forms such as the Hawaii Acceptance of Claim and Report of Past Experience with Debtor in just minutes.

If the form does not meet your needs, use the Search field at the top of the screen to find one that does.

When you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your details to sign up for an account.

- If you have a subscription, Log In to acquire the Hawaii Acceptance of Claim and Report of Past Experience with Debtor from the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms from the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple steps to help you get started.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to review the form's content.

Form popularity

FAQ

To respond to a debt claim, start by reviewing the details of the claim thoroughly. Ensure you understand the basis of the claim against you and gather any documentation relevant to the creditor's assertions. The Hawaii Acceptance of Claim and Report of Past Experience with Debtor process allows you to formally present your side of the story, providing essential context and any evidence that supports your position. Utilizing platforms like US Legal Forms can guide you through the necessary steps and help you prepare a solid response.

Writing an answer to a summons for debt requires addressing each point made in the complaint clearly and concisely. You'll want to state your defenses and any counterclaims you may have. For a structured approach, consider using templates or guidance provided by resources such as uslegalforms, which can help you respond effectively while integrating insights from the Hawaii Acceptance of Claim and Report of Past Experience with Debtor.

Local authorities in Hawaii generally have 30 days to respond to a complaint. This response period allows them the necessary time to assess the allegations seriously. If you are in a situation where you've raised issues with a local authority regarding debts, staying informed about their timeline is crucial, especially when thinking through the Hawaii Acceptance of Claim and Report of Past Experience with Debtor.

Rule 26 in Hawaii relates to the disclosure and discovery process, which governs how parties gather evidence before trial. This rule emphasizes the importance of transparency and cooperation between parties in preparing for court. Understanding Rule 26 can significantly benefit individuals involved in debt disputes, helping ensure you are fully equipped to present your case.

If you do not respond to a complaint in Hawaii, the court may issue a default judgment in favor of the plaintiff. This means the plaintiff could win their case without you being able to defend yourself. To prevent such outcomes, it's advisable to engage promptly and utilize tools like the Hawaii Acceptance of Claim and Report of Past Experience with Debtor for guidance.

In Hawaii, you typically have 20 days to respond to a complaint after you receive it. This timeline is critical, as missing the deadline may lead to a default judgment against you. If you need assistance in crafting your response, consider resources provided by uslegalforms, as they can help you understand your obligations under the Hawaii Acceptance of Claim and Report of Past Experience with Debtor.

Yes, a debtor can file a proof of claim in bankruptcy proceedings to assert their entitlement to a share of the debtor’s assets. This document must be filed within the deadlines established by the court. For those wishing to understand the nuances, utilizing the Hawaii Acceptance of Claim and Report of Past Experience with Debtor can help clarify the process and ensure proper submission.

Rule 45 in Hawaii pertains to the issuance of subpoenas, which are legal documents requiring a person to testify or produce evidence. Understanding this rule helps in navigating legal procedures concerning evidence and witness testimonies during court proceedings. If you are dealing with debts or claims, familiarizing yourself with these regulations can be beneficial when you prepare for court or respond to a debt collector.

To beat a debt collector in court, you need to gather and organize all relevant documents, such as the original debt agreement and any communication you have had. It's crucial to understand your rights under the Fair Debt Collection Practices Act and prepare a solid defense that outlines your position clearly. Engaging with resources like the Hawaii Acceptance of Claim and Report of Past Experience with Debtor can provide insight into how to structure your case effectively.

Typically, the creditor files the proof of claim when they wish to assert their right to payment against a debtor's estate. In the context of Hawaii Acceptance of Claim and Report of Past Experience with Debtor, this filing acts as a formal request to be recognized by the bankruptcy court. Creditors should ensure they follow the correct procedures and deadlines for filing. Using platforms like USLegalForms can simplify the process, ensuring all necessary forms are accurately completed.