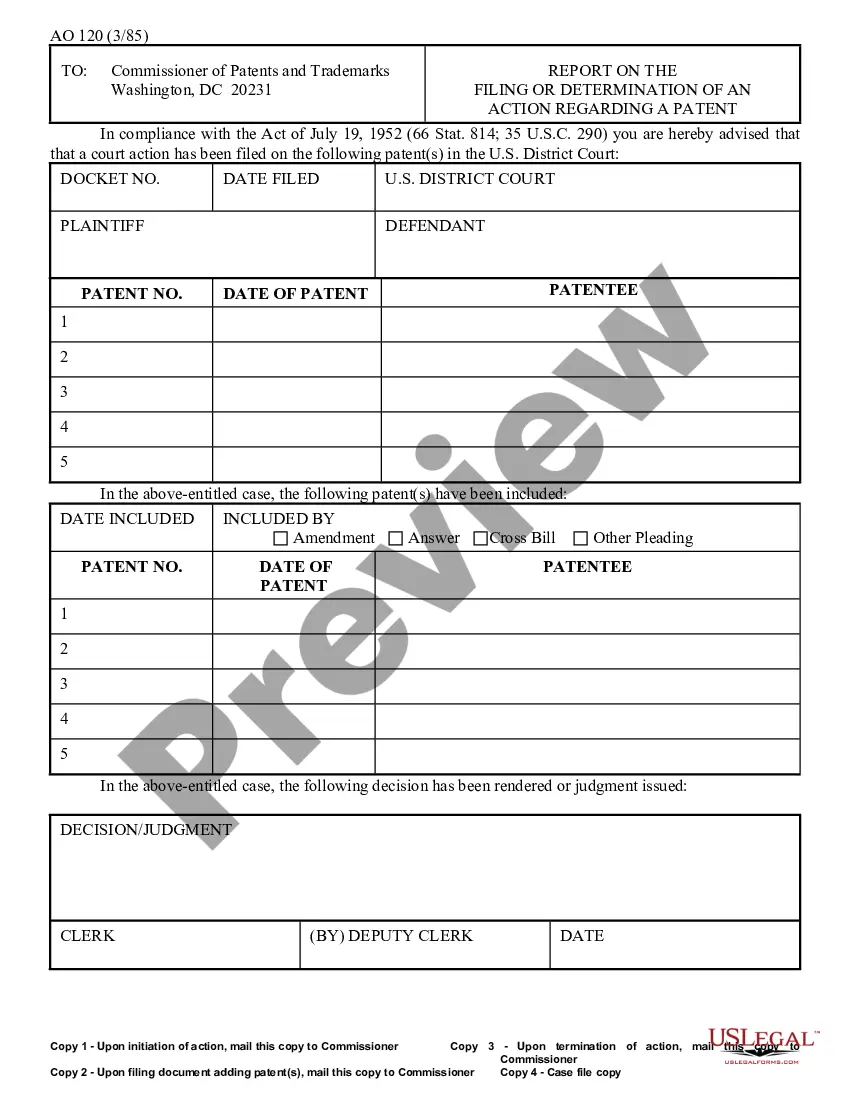

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

Have you been within a position the place you need to have documents for either organization or individual purposes just about every day time? There are plenty of legal papers web templates available on the Internet, but finding versions you can rely is not straightforward. US Legal Forms gives 1000s of develop web templates, just like the Hawaii Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage, that happen to be written in order to meet state and federal specifications.

In case you are previously familiar with US Legal Forms web site and possess a free account, simply log in. After that, you are able to down load the Hawaii Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage web template.

Unless you have an accounts and wish to begin to use US Legal Forms, follow these steps:

- Discover the develop you require and ensure it is for the appropriate metropolis/county.

- Use the Preview option to examine the form.

- Read the outline to actually have chosen the proper develop.

- In case the develop is not what you are trying to find, make use of the Lookup industry to get the develop that suits you and specifications.

- Whenever you get the appropriate develop, click Acquire now.

- Choose the costs plan you desire, complete the specified info to create your bank account, and pay money for your order utilizing your PayPal or charge card.

- Select a hassle-free paper structure and down load your backup.

Discover all of the papers web templates you might have bought in the My Forms food list. You can obtain a extra backup of Hawaii Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage whenever, if possible. Just click on the necessary develop to down load or print out the papers web template.

Use US Legal Forms, the most extensive selection of legal kinds, to save lots of time as well as stay away from faults. The assistance gives appropriately produced legal papers web templates that you can use for a range of purposes. Produce a free account on US Legal Forms and start generating your way of life easier.

Form popularity

FAQ

A Loan Agreement, also known as a term loan, demand loan, or a loan contract, is a contract that documents a financial agreement between two parties, where one is the lender and the other is the borrower. This contract specifies the amount of the loan, any interest charges, the repayment plan, and payment dates.

A Promissory Note Due on a Specific Date is a loan contract that enables a lender and borrower to agree on a set date for repayment. By giving a clear deadline to the borrower, this lending document can help to ensure that the loan will be repaid in full and on time.

A mortgage maturity date is the exact date that the borrower is expected to make their final mortgage payment. The maturity date is usually the same length as your loan's term and falls on the day of the year that you closed on your loan.

A loan agreement is made between the creditor (the lender) and the borrower (the debtor), although it is generally prepared by the lender's legal counsel in order to ensure the legal enforceability of the contract.

A promissory note is a formal contract As a legally binding document, borrowers must abide by the terms they agree to when they sign. If they fail to do so, the lender has a legally legitimate written record that proves the debt exists and the borrower has agreed to repay the loan.

Loan maturity date refers to the date on which a borrower's final loan payment is due. Once that payment is made and all repayment terms have been met, the promissory note that is a record of the original debt is retired. In the case of a secured loan, the lender no longer has a claim to any of the borrower's assets.

A promissory note is a written and signed promise to repay a sum of money in exchange for a loan or other financing. A promissory note typically contains all the terms involved, such as the principal debt amount, interest rate, maturity date, payment schedule, the date and place of issuance, and the issuer's signature.

A loan covenant (a promise) is an agreement stipulating the terms and conditions of loan policies between a borrower and a lender.