In this form, the trustor is amending the trust, pursuant to the power and authority he/she retained in the original trust agreement. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee

Description

How to fill out Amendment Of Declaration Of Trust With Cancellation And Addition Of Sections And The Consent Of Trustee?

Selecting the appropriate legal document template can be a challenge. Clearly, there are numerous formats available online, but how do you locate the legal form you require? Utilize the US Legal Forms website. This service provides thousands of templates, such as the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, which can be utilized for both business and personal purposes. All documents are reviewed by professionals and comply with state and federal regulations.

If you are already registered, Log In to your account and click the Download button to access the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Use your account to search through the legal forms you have previously acquired. Visit the My documents section of your account to obtain another copy of the document you need.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your city/state. You can preview the form using the Preview button and read the form description to verify it is the right one for you. If the form does not suit your needs, use the Search field to locate the appropriate document. Once you are confident that the form is suitable, click the Buy now button to obtain the form. Choose the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card.

- Select the file format and download the legal document template to your device.

- Complete, modify, and print the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee after signing.

- US Legal Forms is the largest repository of legal documents where you can review various document templates.

- Utilize this service to download professionally crafted files that adhere to state requirements.

- Ensure to keep your personal account information secure when downloading documents.

Form popularity

FAQ

Settling an estate in Hawaii can vary significantly depending on the complexity of the estate and the presence of any disputes. On average, it may take several months to over a year to finalize everything. The process often involves addressing specific aspects of the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee, ensuring all legal requirements are met. Utilizing resources like US Legal Forms can help streamline this process for you.

Trustees have a fiduciary duty to act in the best interest of the beneficiaries, but this does not mean they are obligated to follow every request. They should consider the wishes and concerns of beneficiaries when making decisions, particularly when addressing a Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Open communication can foster a better relationship between trustees and beneficiaries, minimizing potential conflicts.

Beneficiaries in Hawaii have several important rights, including the right to receive information about the trust and its assets. They also have the right to hold the trustee accountable, especially concerning the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Understanding these rights is crucial for beneficiaries to ensure they receive what they are entitled to. Engaging with legal services can help clarify these rights further.

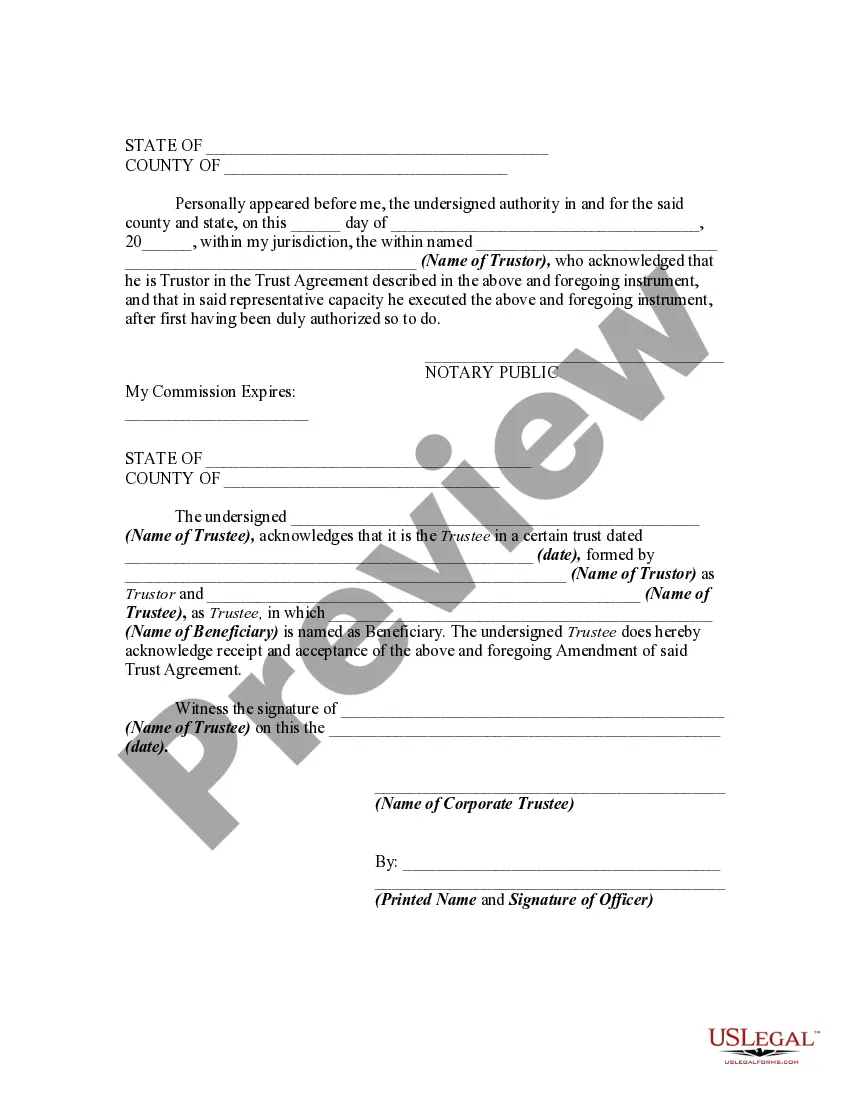

An amendment to the trust agreement is a formal alteration to the terms of an existing trust. This can include adding or removing sections, which is central to the Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Amendments allow the trust to adapt to changing circumstances while maintaining its overall purpose. It's essential to follow proper procedures when making these changes to ensure they are legally binding.

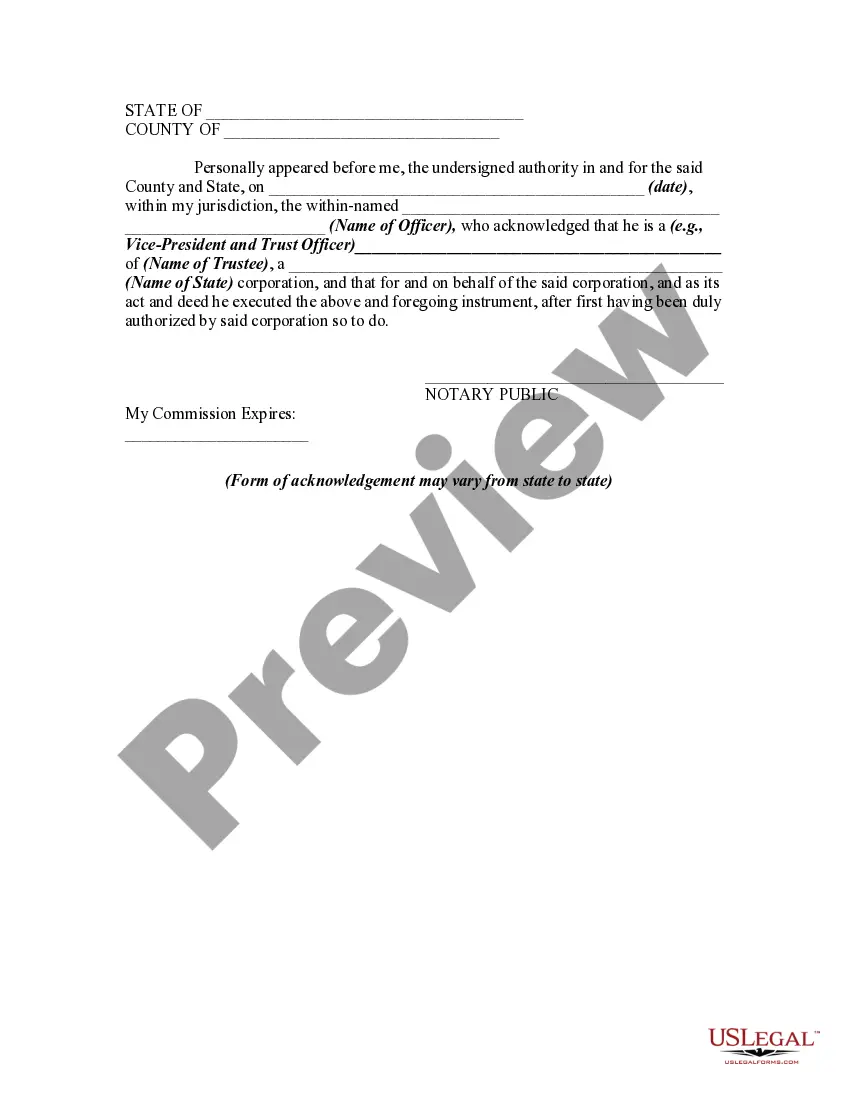

In Hawaii, a trust does not necessarily need to be notarized to be valid; however, having the trust notarized can provide added security and legitimacy. This is especially beneficial when you are implementing a Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee. Notarization can help prevent disputes and ensure all parties recognize the authority of the trustee. Consulting with a professional can help clarify your specific needs.

Rule 73 in Hawaii probate addresses the procedures for filing a petition regarding the distribution of trust property. This ensures that all beneficiaries are treated fairly and have an opportunity to voice any concerns. The Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee can play a critical role in clarifying these distributions. Understanding these rules can simplify the probate process, making it less daunting.

In Hawaii, a trustee must notify beneficiaries within a reasonable time following the trust’s creation or any amendments. The Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee requires that beneficiaries receive prompt notice of any changes to the trust. This helps ensure transparency and keeps beneficiaries informed about their interests. Utilizing services like US Legal Forms can guide you through this notification process.

To file an amended Hawaii state tax return, you will need to complete Form N-101A, which allows you to correct your previous tax filing. When you submit this amended return, ensure that you include all necessary documents to support your changes. This process can often intersect with areas related to your trust, especially if changes impact tax liabilities. Our platform provides clear instructions and access to the forms required for effectively amending your Hawaii amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.

In Hawaii, the G49 form must be filed with the Department of Taxation. This form is crucial for those looking to amend their tax records, and it plays a role in your overall trust management. For a smooth process, it’s recommended to confirm the specific filing location or method with the department. Our platform offers resources that can help you navigate the requirements for filing your Hawaii Amendment of Declaration of Trust with Cancellation and Addition of Sections and the Consent of Trustee.

The N11 form in Hawaii is typically used to amend a Declaration of Trust, especially when you want to make significant changes. This includes the cancellation and addition of sections that may need the consent of the trustee. By altering the trust in this way, you ensure that it remains valid and reflects your current intentions. Using our platform, you can easily access the necessary forms and guidance to effectively manage your Hawaii Amendment of Declaration of Trust.