Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

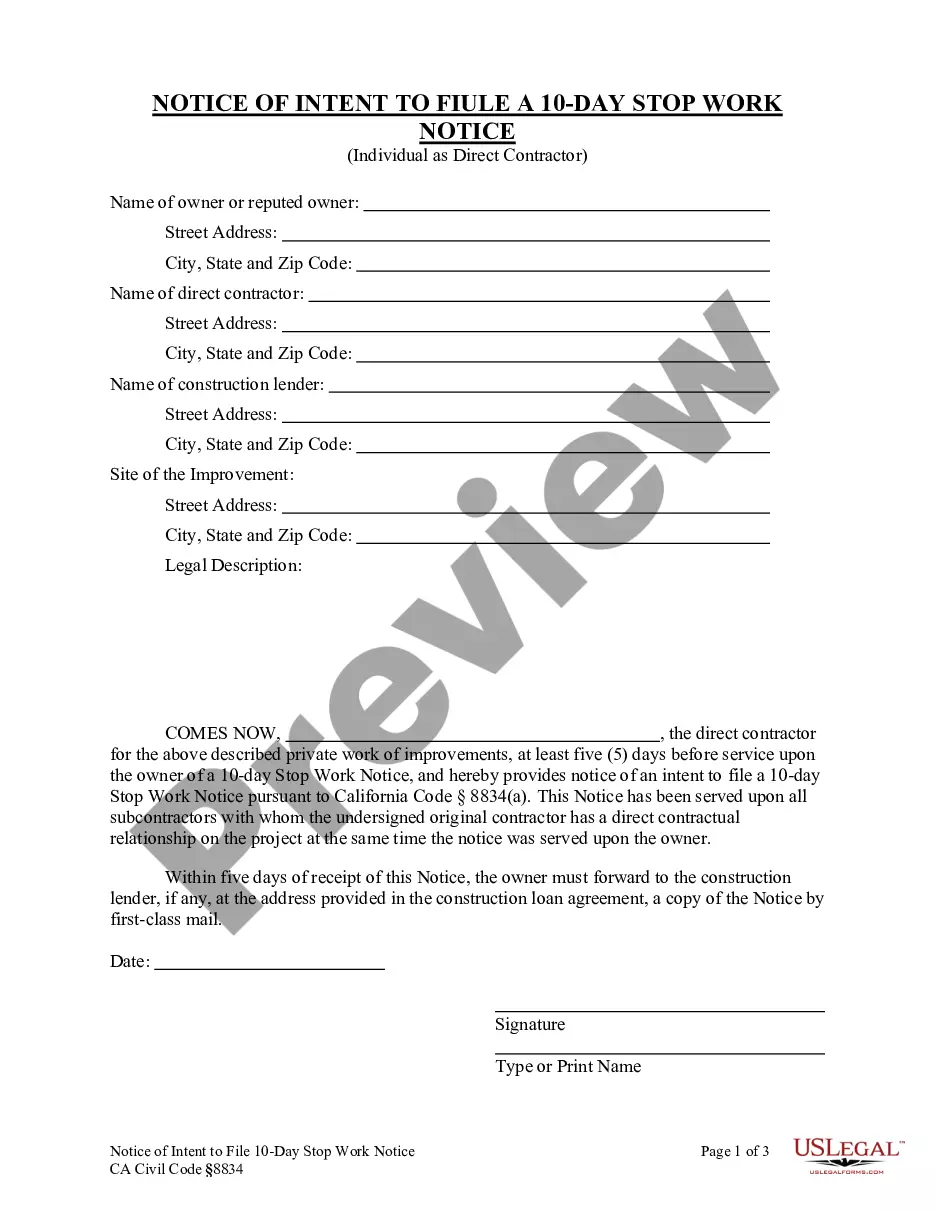

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal record templates that you can obtain or print.

By using the site, you can access thousands of documents for business and personal purposes, organized by categories, states, or keywords. You can find the most recent versions of documents such as the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate in just a few minutes.

If you currently hold a monthly subscription, Log In and obtain the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate from the US Legal Forms library. The Acquire button will appear on every form you view. You have access to all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your Visa, Mastercard, or PayPal account to finalize the transaction.

Select the format and acquire the form onto your device. Make adjustments. Fill in, modify, and print out the downloaded Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Each design you added to your purchase does not have an expiration date and is yours permanently. Therefore, if you wish to obtain or print another copy, simply access the My documents section and click on the form you need.

- If you wish to use US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure that you have selected the correct form for your city/state. Click the Preview button to review the form's details.

- Examine the form description to confirm you have selected the right form.

- If the form does not fulfill your needs, utilize the Search box at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, select the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

The rental tax rate in Hawaii varies based on different factors, including the county and type of rental property. Generally, the Transient Accommodations Tax applies to short-term rentals, while regular properties might face general obligation taxes. Engage with professionals to determine the precise tax implications for properties under the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, ensuring compliance with state regulations.

The formula for the percentage of agreement is often defined as the total sales percentage agreed upon in a lease documented in a legally binding agreement. This formula affects the financial relationship between the retailer and landlord under the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It is vital to ensure clarity and mutual understanding of this percentage for effective business operations.

The formula for a percentage lease combines a base rent with a percentage of gross sales exceeding a specified threshold. For example, if a store pays $2,000 monthly plus 6% on gross receipts over $50,000, your formula would look like this: base rent + (percentage x (gross sales - threshold)). This method is essential for the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, ensuring both you and your landlord understand financial expectations.

The lease factor percentage is a calculation used to determine the effective rent for a leased space. This percentage takes into account various factors, including operating expenses and maintenance costs. Understanding this concept can help you better navigate the terms of the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, enabling you to assess your total expenditures accurately.

45 and 49 are forms related to the Hawaii Department of Taxation. 45 is an application for a retail or wholesale license, while 49 is the one that reports sales. Understanding these forms is crucial for retail businesses that use the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of ross Receipts Real Estate, as accurate reporting can influence your lease obligations and tax responsibilities.

To calculate a lease, you typically multiply the square footage of the retail space by the lease rate per square foot. For instance, if a retail store in Hawaii charges $25 per square foot for a 1,000 square foot space, the annual lease would be $25,000. It is essential to account for any additional charges, such as the Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, which may be added based on your sales performance.

In Hawaii, lease tax refers to taxes imposed on leased properties, such as business leases or commercial rentals. If you are involved in a Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it’s crucial to understand lease tax implications. This tax can vary based on the property type, location, and lease agreement structure. Always consult with a legal advisor to ensure compliance with local regulations.

Yes, rental income is taxable in Hawaii. This includes income generated from a Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. Property owners must report this income on their state tax returns, and it is subject to both federal and state tax rates. It’s advisable to keep detailed records of all rental income and expenses for accurate reporting.

The gross receipt tax in Hawaii is a tax imposed on businesses based on their total gross income. This tax can be specifically relevant for those involved in a Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. It is essential for business owners to understand this tax, as it affects their overall financial responsibilities. Consulting a tax professional can help clarify how this tax applies to your business situation.

The general excise tax (GET) rate for rental properties in Hawaii is typically 4.712%. However, additional county surcharges may apply depending on your location. When engaging in a Hawaii Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it's essential to account for this tax as part of your overall financial strategy. Consulting with professionals will help ensure compliance.