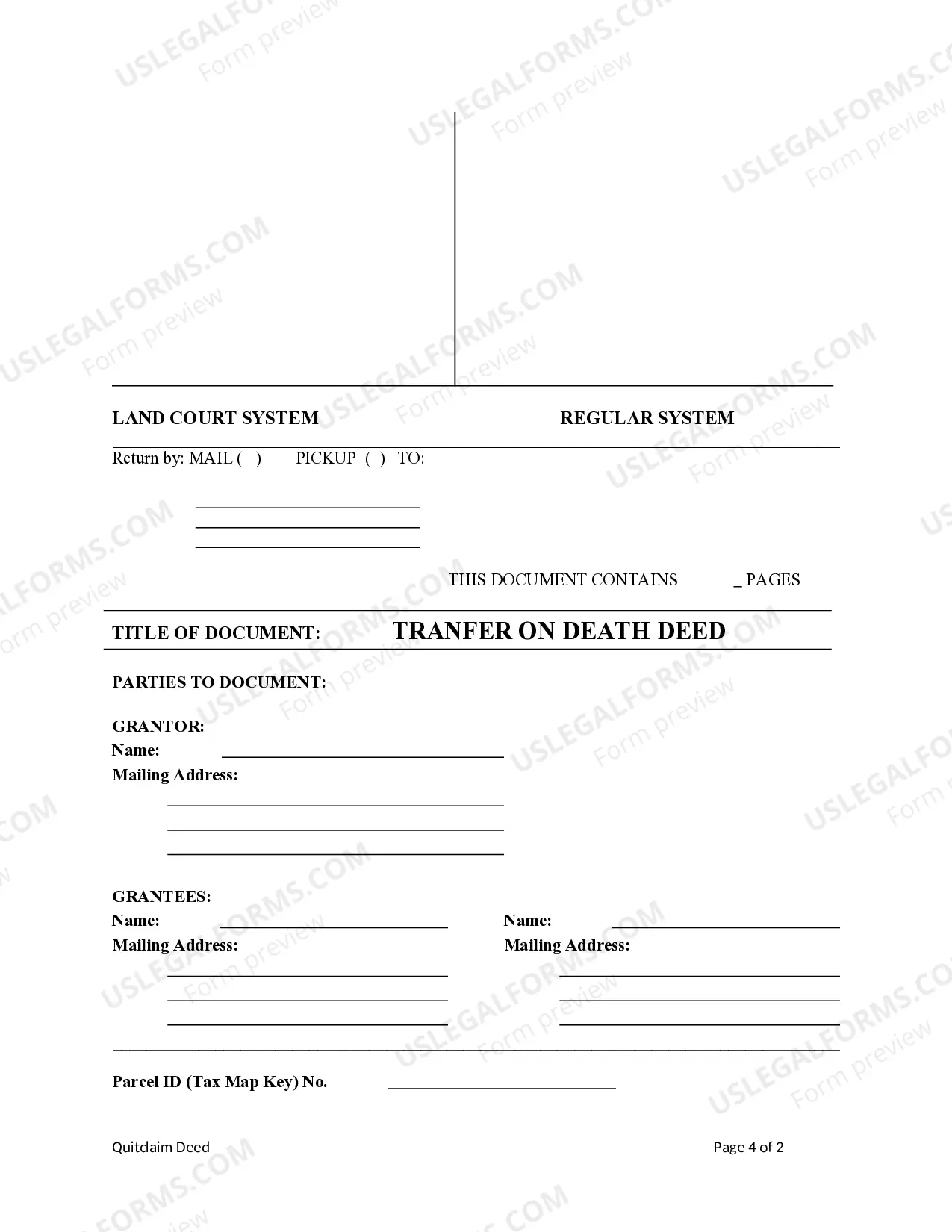

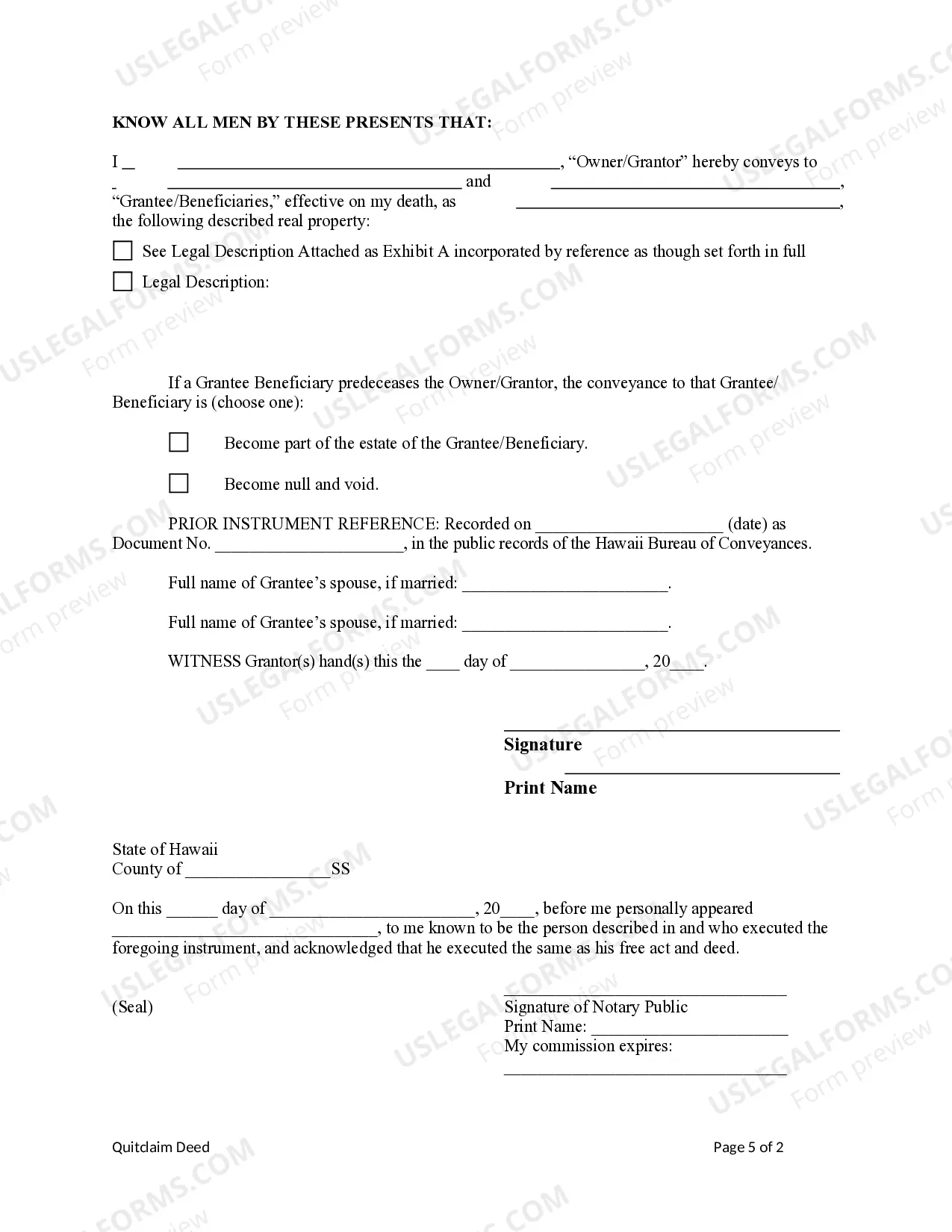

This form is a Transfer on Death Deed where the Grantor is an individual and the Grantees are two individuals or Husband and Wife. This transfer is revocable by Grantor until death and effective only upon the death of the Grantor. This deed complies with all state statutory laws.

Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife

Description

How to fill out Hawaii Transfer On Death Quitclaim Deed From Individual To Two Individuals Or Husband And Wife?

Access one of the most comprehensive collections of sanctioned documents.

US Legal Forms is essentially a platform to locate any state-specific form in just a few clicks, including Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife templates.

No need to invest hours searching for a court-acceptable template. Our certified experts guarantee you receive current samples every time.

If everything is accurate, click on the Buy Now button. After selecting a pricing plan, set up an account. Make your payment via credit card or PayPal. Download the document to your device by clicking on the Download button. That’s it! You should complete the Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife form and review it. To ensure accuracy, consult your local legal advisor for assistance. Join and effortlessly navigate over 85,000 valuable templates.

- To leverage the forms library, select a subscription, and register an account.

- If you have created it, just Log In and hit the Download button.

- The Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife template will promptly be saved in the My documents section (a section for each form you download on US Legal Forms).

- To establish a new account, follow the simple steps below.

- If you need to use a state-specific document, ensure you select the correct state.

- If possible, review the description to understand all details of the document.

- Utilize the Preview feature if it is available to examine the document’s details.

Form popularity

FAQ

Filling out a Quitclaim Deed to add a spouse involves specific steps, including correctly identifying the current property owner and the new co-owner. You will need to include details about the property and specify that the deed is transferring interest to both individuals as joint owners. When utilizing the Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife, consider consulting uslegalforms for templates and guidance to ensure your paperwork aligns with local laws and requirements, making the process seamless.

Yes, Hawaii does allow transfer on death deeds, which can be a beneficial estate planning tool. This option enables property owners to designate one or more beneficiaries who will automatically receive the property upon the owner's death. The Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife can streamline the process and minimize legal hurdles for your heirs, making it a practical choice for many homeowners.

Choosing between a Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife and designating beneficiaries involves careful consideration. A TOD deed effectively avoids probate and distributes property directly to designated individuals, while a traditional beneficiary designation may offer more flexibility. Depending on your family situation and estate plans, it can be valuable to consult with professionals to determine the best route for you.

With a Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife, one key negative is the limited control over the property during the owner's lifetime. The owner cannot change beneficiaries without executing a new deed, which can be a barrier in changing circumstances. Furthermore, such deeds may not account for complex family dynamics, potentially leading to unintended conflicts.

One issue with TOD accounts is that they can create confusion about ownership and asset distribution. With a Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife, the intentions of the original owner may not be clear, leading to potential disputes among heirs. Moreover, if the named beneficiaries predecease the owner, the deed may need to be revised, which can be cumbersome.

A Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife does not necessarily avoid inheritance tax in Hawaii. While the deed helps bypass the probate process, the property may still be subject to taxation based on its value at the time of transfer. It is essential to consult with a tax professional to understand the tax implications of transferring property in this manner.

A Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife might not be suitable for everyone. One potential disadvantage is that it does not protect the property from creditors. Additionally, it can complicate the process of obtaining loans against the property since lenders may hesitate to extend credit on a property with a TOD deed in place.

One disadvantage of a transfer on death deed is that it cannot be revoked or changed easily once executed, which may create challenges if your circumstances or intentions change. Additionally, a Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife does not offer protection against creditors, meaning that your beneficiaries might have to deal with outstanding debts after your passing. It's crucial to weigh these potential drawbacks against the benefits before proceeding.

Yes, Hawaii does permit transfer on death deeds, providing a way for individuals to leave property directly to beneficiaries without going through probate. This can be particularly beneficial for those looking to simplify the transfer of assets, such as a Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife. It's essential to follow state regulations to ensure that the deed is valid and enforceable.

You don’t need a lawyer to create a transfer on death deed in Hawaii, but seeking legal assistance can ensure your deed is correctly drafted and recorded. A Hawaii Transfer on Death Quitclaim Deed from Individual to Two Individuals or Husband and Wife must meet specific requirements to be effective, and a lawyer can help avoid common pitfalls. Using legal forms from platforms like UsLegalForms can also streamline the process and ensure compliance.