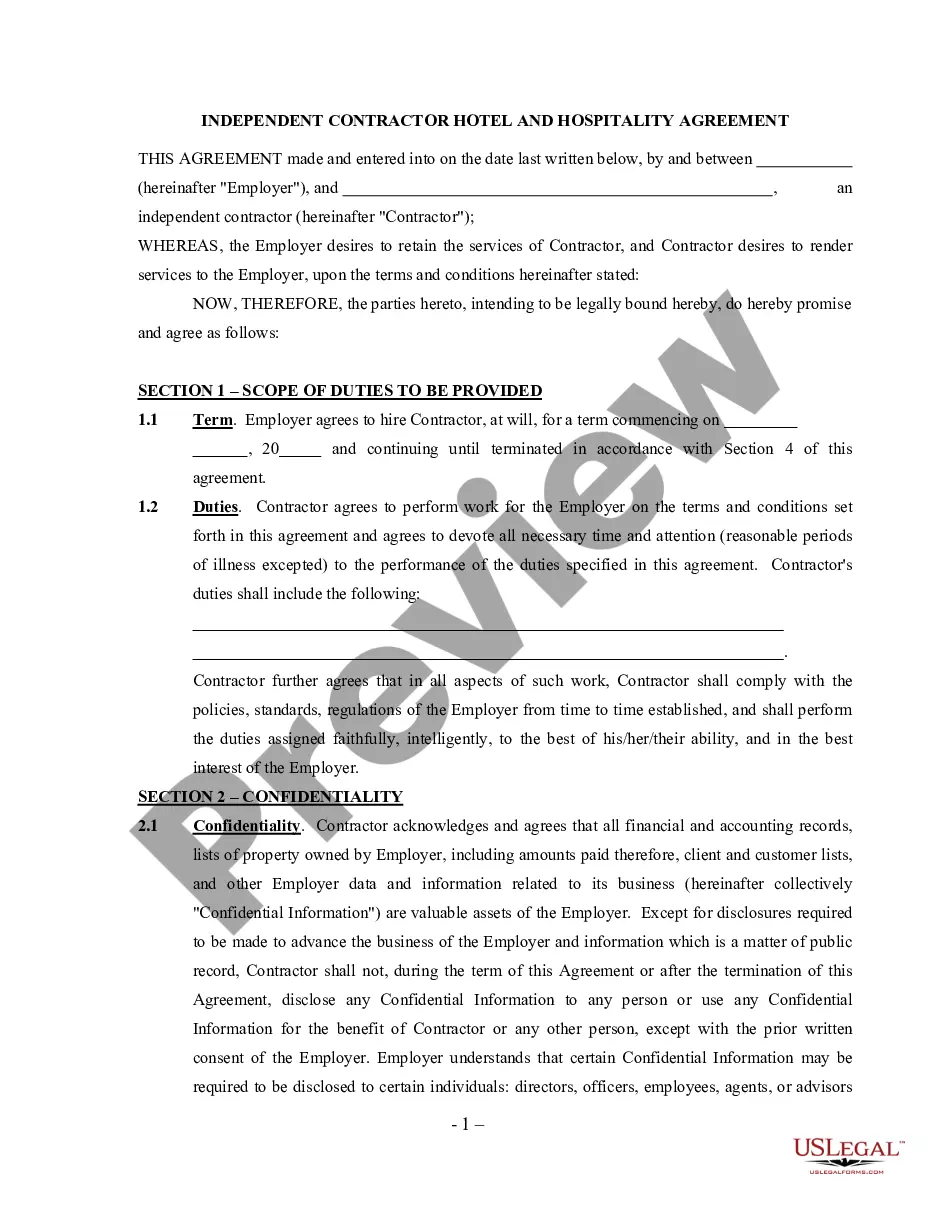

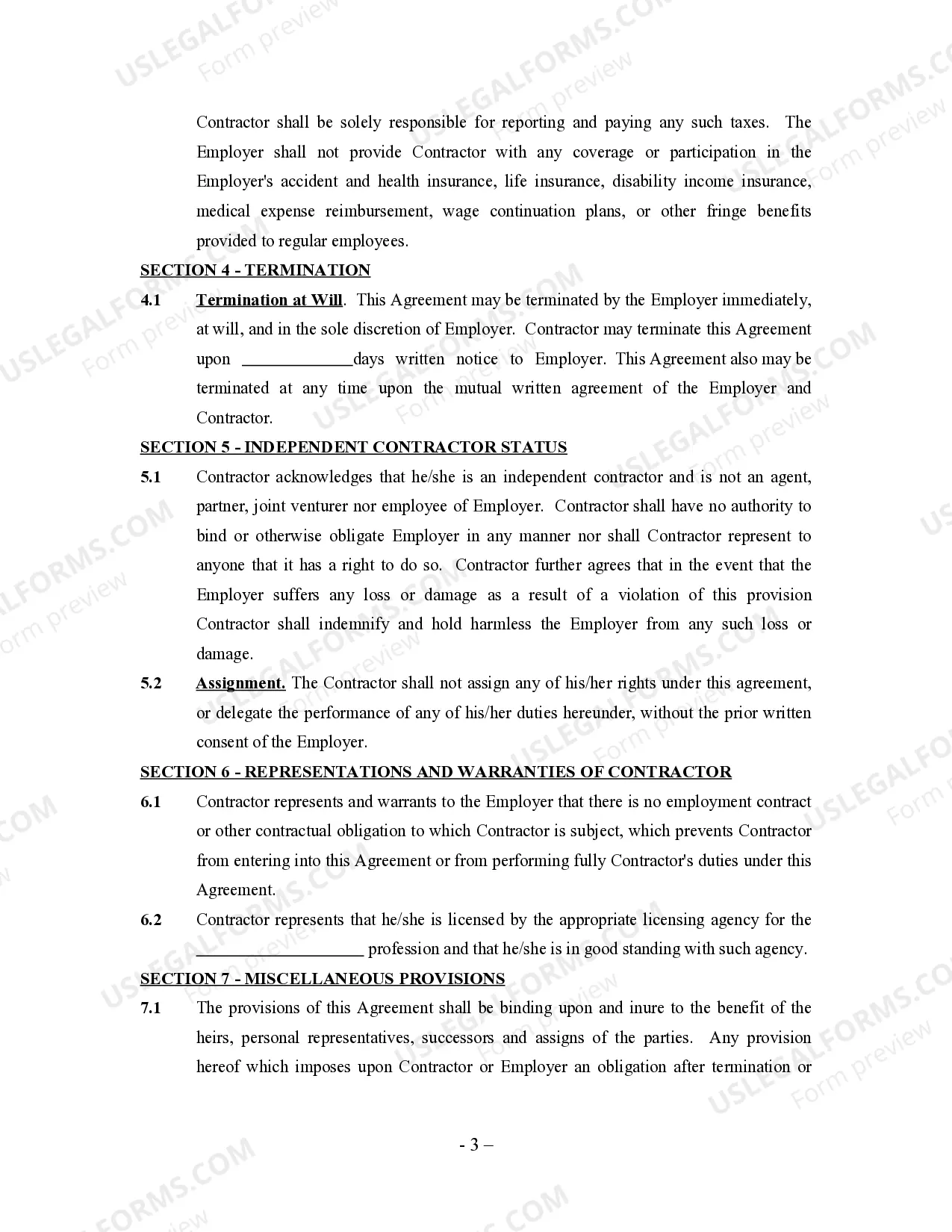

Guam Hotel And Hospitality Agreement - Self-Employed Independent Contractor

Description

How to fill out Hotel And Hospitality Agreement - Self-Employed Independent Contractor?

You can spend time on the Internet looking for the lawful file design that meets the federal and state specifications you want. US Legal Forms gives thousands of lawful kinds that happen to be examined by professionals. You can actually download or produce the Guam Hotel And Hospitality Agreement - Self-Employed Independent Contractor from the support.

If you already have a US Legal Forms account, you are able to log in and click on the Acquire key. After that, you are able to total, edit, produce, or indicator the Guam Hotel And Hospitality Agreement - Self-Employed Independent Contractor. Every lawful file design you purchase is yours for a long time. To acquire an additional duplicate associated with a obtained kind, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms internet site initially, stick to the straightforward directions beneath:

- Initially, make sure that you have selected the proper file design to the state/city that you pick. Read the kind description to ensure you have selected the right kind. If offered, utilize the Review key to search through the file design as well.

- If you would like locate an additional version from the kind, utilize the Lookup field to find the design that fits your needs and specifications.

- When you have identified the design you would like, just click Get now to continue.

- Pick the costs plan you would like, type your references, and register for an account on US Legal Forms.

- Full the transaction. You can utilize your Visa or Mastercard or PayPal account to cover the lawful kind.

- Pick the formatting from the file and download it for your device.

- Make modifications for your file if required. You can total, edit and indicator and produce Guam Hotel And Hospitality Agreement - Self-Employed Independent Contractor.

Acquire and produce thousands of file templates utilizing the US Legal Forms site, that provides the greatest variety of lawful kinds. Use skilled and condition-specific templates to handle your small business or specific requirements.

Form popularity

FAQ

To set yourself up as a self-employed taxpayer with the IRS, you simply start paying estimated taxes (on Form 1040-ES, Estimated Tax for Individuals) and file Schedule C, Profit or Loss From Business, and Schedule SE, Self-Employment Tax, with your Form 1040 tax return each April.

Becoming an independent contractor is one of the many ways to be classified as self-employed. By definition, an independent contractor provides work or services on a contractual basis, whereas, self-employment is simply the act of earning money without operating within an employee-employer relationship.

A 1099 employee is a US self-employed worker that reports their income to the IRS on a 1099 tax form. Freelancers, gig workers, and independent contractors are all considered 1099 employees.

Independent contractors are self-employed workers who provide services for an organisation under a contract for services. Independent contractors are not employees and are typically highly skilled, providing their clients with specialist skills or additional capacity on an as needed basis.

Remember that an independent contractor is considered to be self-employed, so in effect, you are running your own one-person business. Any income that you earn as an independent contractor must be reported on Schedule C. You'll then pay income taxes on the total profit.

If you are an independent contractor, then you are self-employed. The earnings of a person who is working as an independent contractor are subject to self-employment tax. To find out what your tax obligations are, visit the Self-Employed Individuals Tax Center.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Freelancers are independent contractors who should receive 1099 from the company using their services and are subject to paying their own taxes, including self-employment tax.

Here's what you need to know to start and build a successful business as a self-employed contractor.Be Sure You Want to Be Self-Employed.Get Financing in Place Beforehand.Create a Business Plan.Name, Register, and Insure Your Contracting Business.Market Your Business.Be Your Own Accountant, for Starters.More items...?