Guam Home Inspection Services Contract - Self-Employed

Description

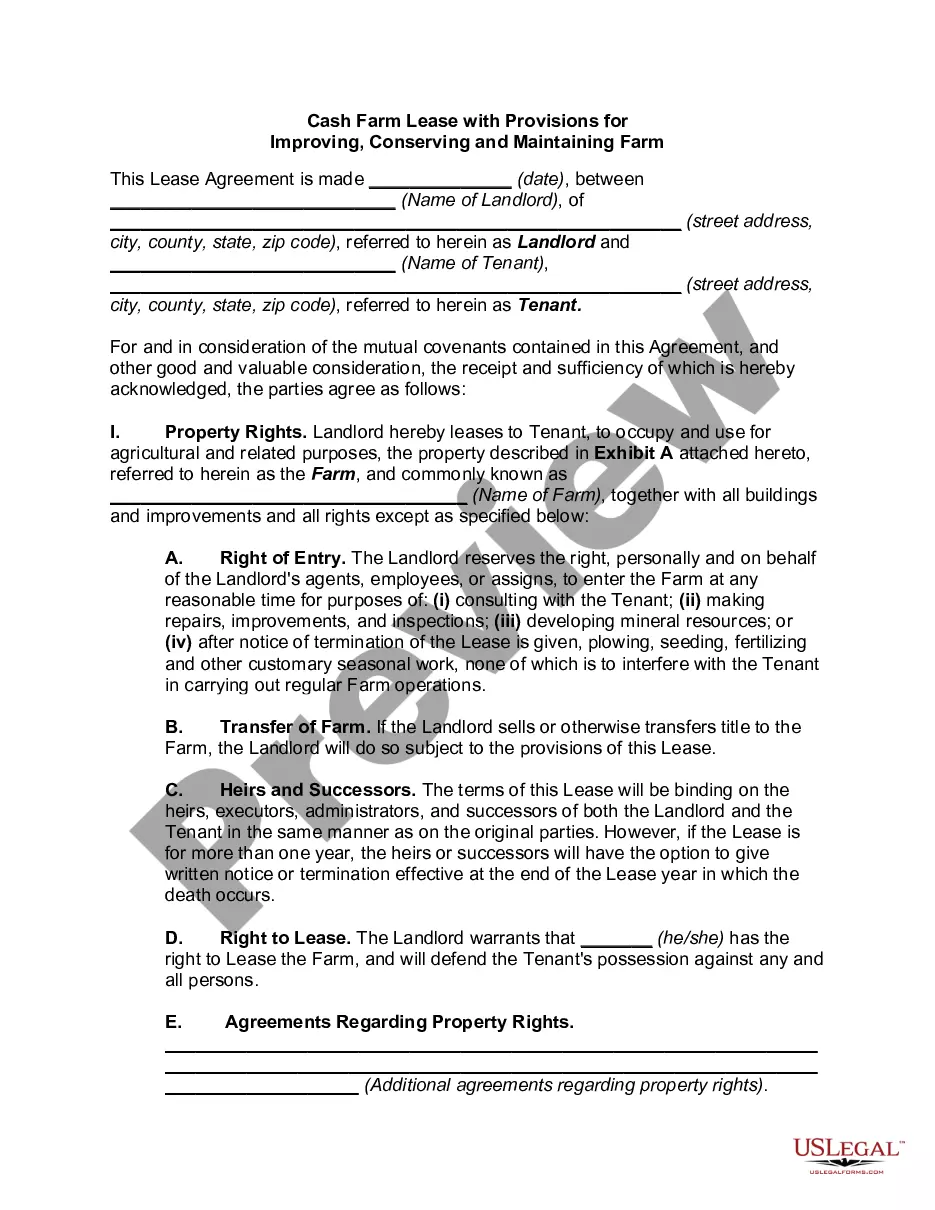

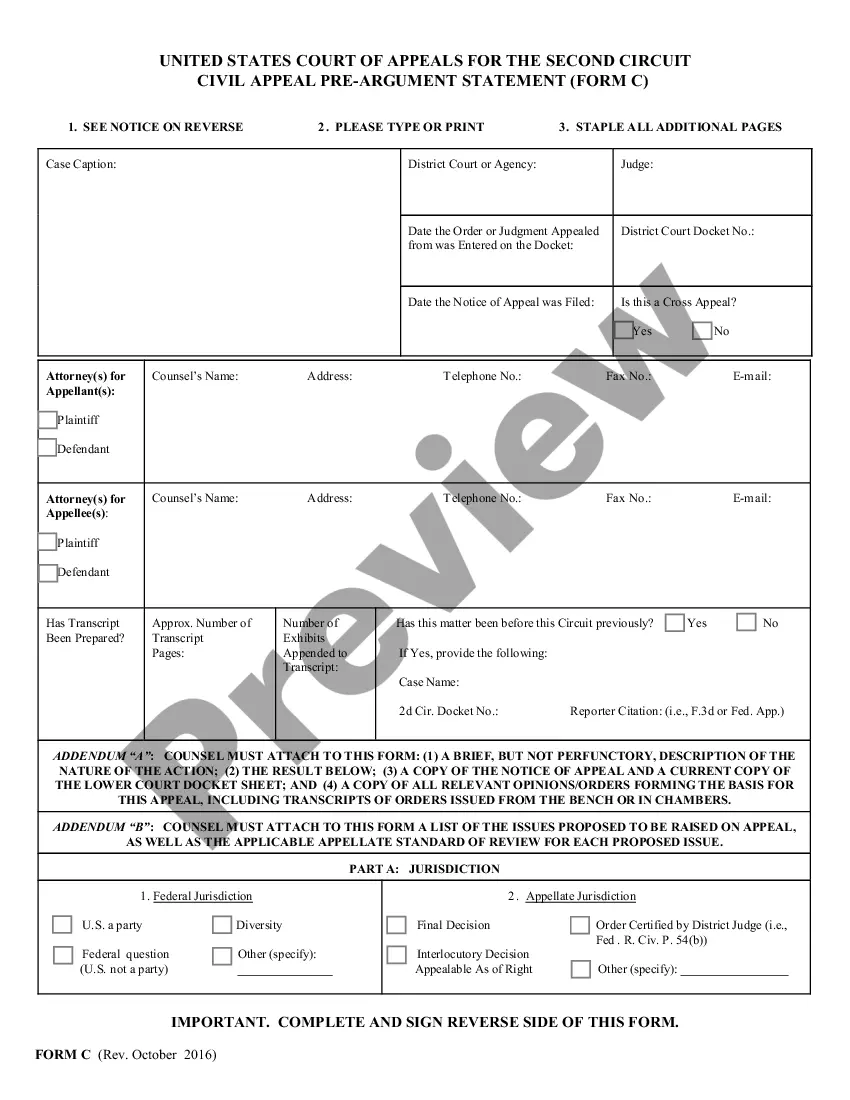

How to fill out Home Inspection Services Contract - Self-Employed?

US Legal Forms - one of the most important collections of legal documents in the USA - offers a broad selection of legal form templates that you can obtain or print. By using the website, you can discover thousands of forms for business and personal purposes, categorized by types, states, or keywords.

You can access the latest versions of forms such as the Guam Home Inspection Services Contract - Self-Employed in moments. If you already possess a membership, Log In and obtain Guam Home Inspection Services Contract - Self-Employed from the US Legal Forms catalog. The Download option will appear on every form you view. You have access to all previously downloaded forms within the My documents tab of your account.

If you are using US Legal Forms for the first time, here are straightforward steps to get you started: Make sure you have selected the right form for your city/region. Click the Preview option to examine the form’s content. Review the form details to ensure that you have selected the correct form. If the form does not meet your needs, use the Search field at the top of the screen to find one that does. If you are satisfied with the form, confirm your selection by clicking the Purchase now button. Next, select your preferred pricing plan and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the purchase. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Guam Home Inspection Services Contract - Self-Employed. Each template you added to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need.

- Access the Guam Home Inspection Services Contract - Self-Employed with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal requirements and specifications.

- Navigate through various categories for easier access to the desired forms.

- Ensure that you have the latest version of the forms available.

- Enjoy permanent access to your downloaded forms without any expiration.

- Streamline your legal document needs with a user-friendly platform.

Form popularity

FAQ

A home inspector often functions as an independent contractor, depending on their business structure and agreement with clients. They typically work under their own guidelines and are responsible for their own business expenses. To formalize this relationship, a Guam Home Inspection Services Contract - Self-Employed is vital, ensuring both parties understand their roles and responsibilities.

Yes, a home inspector can be classified as a contractor if they operate independently and provide services according to a contract. This allows them greater flexibility and autonomy in their business. Establishing a Guam Home Inspection Services Contract - Self-Employed confirms their status and outlines specific terms of service.

A required element of a home inspection contract includes a detailed description of services to be provided, including specific inspection areas and any exclusions. Clear terms on payment, liability, and the rights of both parties are essential as well. This clarity reinforces the integrity of the Guam Home Inspection Services Contract - Self-Employed.

The business code for home inspection falls under the North American Industry Classification System (NAICS) as 541350, which specifically relates to building inspection services. This code helps in identifying the home inspection business for taxes and compliance. Ensure your Guam Home Inspection Services Contract - Self-Employed references this code to clarify your business activities.

An independent contractor is someone who provides services to another entity under a contract but operates independently. They maintain control over how and when they complete tasks, which sets them apart from employees. It's essential to establish a clear Guam Home Inspection Services Contract - Self-Employed to outline the relationship and responsibilities.

To establish an LLC in Guam, you must file the necessary paperwork with the Guam Department of Revenue and Taxation. If you're planning to work under a Guam Home Inspection Services Contract - Self-Employed, forming an LLC provides personal liability protection and may offer tax advantages. Utilizing platforms like USLegalForms can simplify the process of creating your LLC, ensuring that you meet all requirements efficiently.

Definitely, a business license is required for all entities wishing to operate in Guam. For those engaged in activities related to the Guam Home Inspection Services Contract - Self-Employed, having this license not only complies with local laws but also builds trust with clients. It's a foundational step in launching a successful business.

Yes, obtaining a business license in Guam is a crucial step for legally operating your business. If you are pursuing a Guam Home Inspection Services Contract - Self-Employed, you will need to acquire the appropriate license relevant to your service. This helps you establish credibility while meeting local regulations.

The deadline for filing taxes in Guam generally aligns with the federal tax deadline, typically falling on April 15th. For those involved in self-employment, such as with a Guam Home Inspection Services Contract, it's vital to keep track of any potential extensions or specific requirements to avoid penalties. Staying organized and informed helps ensure a smooth filing process.

Yes, Guam has its own tax code, but it mirrors many aspects of the United States tax system. When you’re engaged in activities like a Guam Home Inspection Services Contract - Self-Employed, it’s important to report your income accordingly. Residents are required to file a Guam tax return, and the information is quite similar to federal guidelines.