Guam Shoring Services Contract - Self-Employed

Description

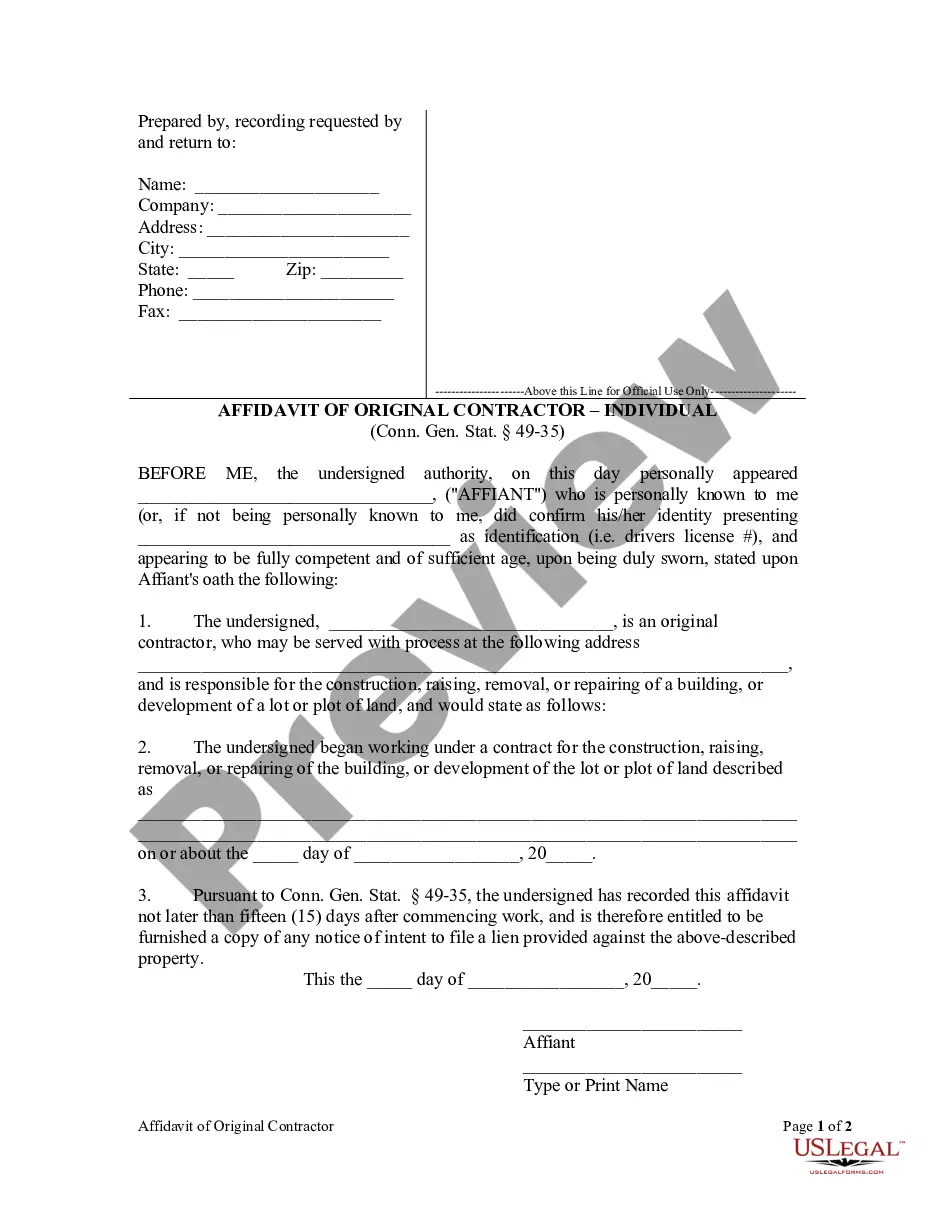

How to fill out Shoring Services Contract - Self-Employed?

If you seek thorough, obtain, or generating authentic document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Employ the site's user-friendly and efficient search to find the documents you require.

A range of templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have identified the form you need, click on the Purchase now button. Select your preferred pricing plan and enter your credentials to register for an account.

Step 5. Complete the transaction. You may use your credit card or PayPal account to finish the transaction.

- Utilize US Legal Forms to find the Guam Shoring Services Contract - Self-Employed in just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and press the Download button to access the Guam Shoring Services Contract - Self-Employed.

- You can also retrieve forms you previously downloaded from the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have chosen the form suitable for your city/region.

- Step 2. Utilize the Preview option to review the form's contents. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, employ the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

The Dave Santos Amendment modifies existing laws related to self-employment regulations in Guam. This amendment can impact how you manage your Guam Shoring Services Contract - Self-Employed. Staying informed on this amendment is crucial for compliance and for maximizing your business's potential.

The Dave Santos exemption allows certain self-employed individuals to be exempt from specific business taxes under defined circumstances. If you are working under a Guam Shoring Services Contract - Self-Employed, understanding this exemption can help you optimize your tax liabilities. Always consult with a tax professional to determine your eligibility.

Public Law 34-87 focuses on workers' safety and welfare within the construction industry, including shoring services. For anyone operating under a Guam Shoring Services Contract - Self-Employed, this law emphasizes safety regulations that must be followed. Compliance helps protect you and your clients while promoting a safer work environment.

Public Law 27-41 addresses the rights and responsibilities of individuals engaged in construction, including those under a Guam Shoring Services Contract - Self-Employed. This law aims to clarify work practices and ensure fair treatment for both contractors and subcontractors. Knowing this law can benefit you by providing greater clarity on your rights.

The business privilege tax in Guam applies to all business activities, including those under a Guam Shoring Services Contract - Self-Employed. This tax is typically based on the gross revenue generated by your business. Self-employed individuals should understand this obligation, as it impacts their financial planning and compliance with local laws.

Yes, if you're planning to operate under a Guam Shoring Services Contract - Self-Employed, you will need a business license. This license ensures that you comply with local regulations and helps to establish your legitimacy in the market. Obtaining a business license is a fundamental step for self-employed contractors in Guam, so make sure to check the specific requirements.

In North Carolina, General Contractors (GC) are classified into different levels based on their qualifications. These include Limited, Intermediate, and Unlimited classifications, each requiring specific experience and financial responsibility levels. Understanding these classifications can help you navigate the requirements and potentially enhance your options under a Guam Shoring Services Contract - Self-Employed.

To work as an independent contractor in the USA, start by defining your service offerings and identifying your target market. Next, establish your business structure, such as a sole proprietorship or LLC, then register and acquire any necessary licenses. Finally, consider utilizing a Guam Shoring Services Contract - Self-Employed to outline your responsibilities and protect your interests.

Yes, independent contractors require work authorization to operate legally in the US. This includes obtaining necessary licenses that vary by state and industry. If you are a non-US citizen, you must secure a visa that permits independent contracting work. This ensures you comply with all regulations while engaging in a Guam Shoring Services Contract - Self-Employed.

Getting authorized as an independent contractor involves a few key steps. Start by researching your state's licensing requirements based on your trade. After completing any necessary training or certifications, apply for your licenses. This will empower you to work under a Guam Shoring Services Contract - Self-Employed confidently.