Guam First Meeting Minutes of Shareholders

Description

How to fill out First Meeting Minutes Of Shareholders?

Are you in a place where you require papers for both organization or individual reasons just about every day? There are tons of authorized file themes available on the net, but getting versions you can depend on is not simple. US Legal Forms gives a large number of form themes, such as the Guam First Meeting Minutes of Shareholders, which are published in order to meet state and federal demands.

Should you be currently acquainted with US Legal Forms site and also have a merchant account, merely log in. Next, you may down load the Guam First Meeting Minutes of Shareholders template.

Unless you have an profile and want to start using US Legal Forms, abide by these steps:

- Find the form you need and make sure it is for your proper town/region.

- Make use of the Preview key to analyze the form.

- Look at the outline to actually have selected the right form.

- When the form is not what you are looking for, take advantage of the Search area to find the form that suits you and demands.

- Once you discover the proper form, click Buy now.

- Pick the rates plan you need, fill out the necessary info to make your account, and pay for your order using your PayPal or charge card.

- Choose a handy paper file format and down load your duplicate.

Locate each of the file themes you possess purchased in the My Forms menus. You can obtain a more duplicate of Guam First Meeting Minutes of Shareholders anytime, if required. Just select the needed form to down load or print the file template.

Use US Legal Forms, probably the most considerable variety of authorized kinds, to conserve time as well as prevent blunders. The services gives expertly made authorized file themes which can be used for an array of reasons. Generate a merchant account on US Legal Forms and initiate creating your way of life a little easier.

Form popularity

FAQ

As the lone attendee you must document the date, time and location of the meeting. You must also list the discussion items, summarize the key points and document the decisions made. You must note all the positions in attendance, even if you occupy all of them.

The Companies Act 2013 defines Minutes of the Meeting as a "record containing the proceedings of a meeting." The minutes of the meeting are prepared by the company secretary or any person authorized by the board of directors.

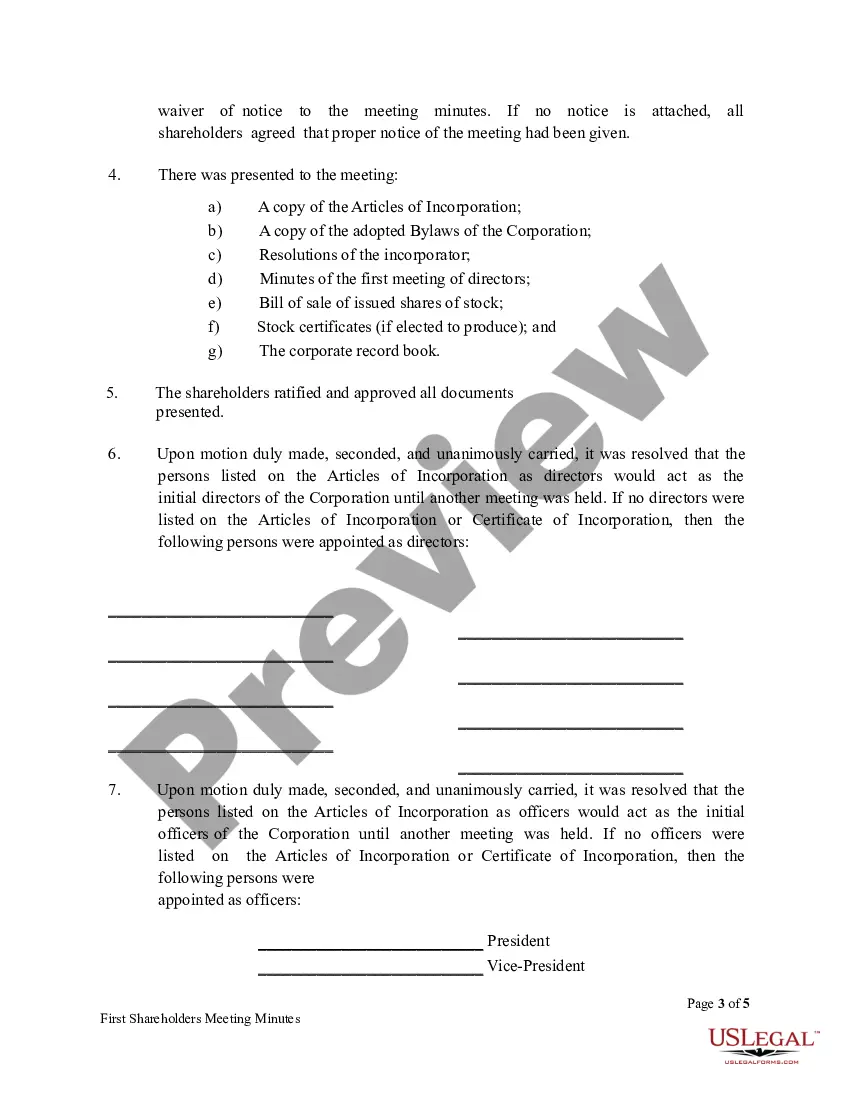

Minutes of the first board meeting of directors the appointment of an appropriate chairperson. share capital. issuing share certificates. deciding whether to appoint a company secretary. finances and accounting, including budgets, operating costs, bank accounts, loans, investments, and salaries.

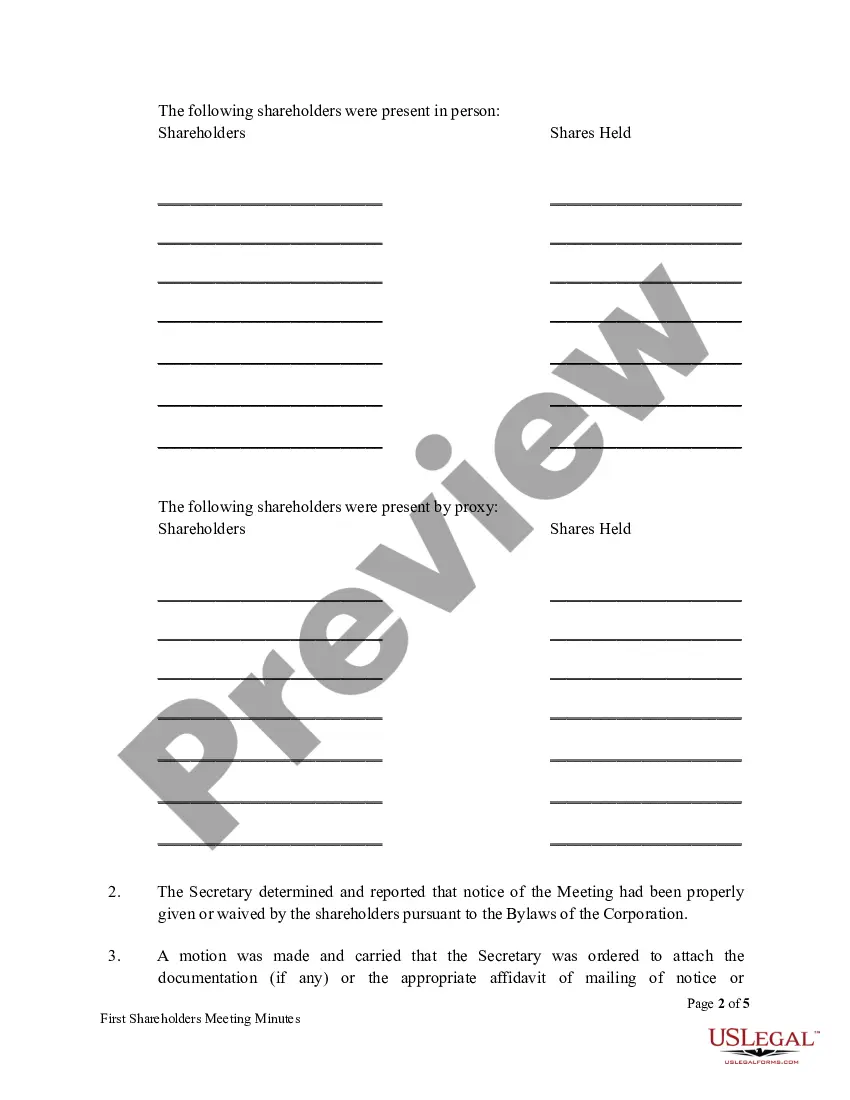

The first shareholder meeting is an organizational meeting where shareholders ratify and approve the actions of the incorporators. Shareholders also approve shares values, appoint directors and officers if needed, and wrap up other initial tasks.

Most states require that corporations hold regular shareholder meetings and keep minutes of such meetings. While S corporation meeting minutes are not required to be filed with the state, you should keep copies of meeting minutes with your corporate books and records.

In general, minutes should begin with the housekeeping aspects of the meeting: the name of the company, date, and location of the meeting. the type of meeting (annual board of directors meeting, special meeting, and so on.) the names and titles of the person chairing the meeting and the one taking minutes.

What should board of directors first meeting minutes include? Your corporation's first directors meeting typically focuses on initial organizational tasks, including electing officers, setting their salaries, resolving to open a bank account, and ratifying bylaws and actions of the incorporators.

The minutes of a shareholders' meeting are a written record of any actions or decisions, known as resolutions in company law, made during a meeting of a corporation's shareholders.