Guam Complex Will - Income Trust for Spouse

Description

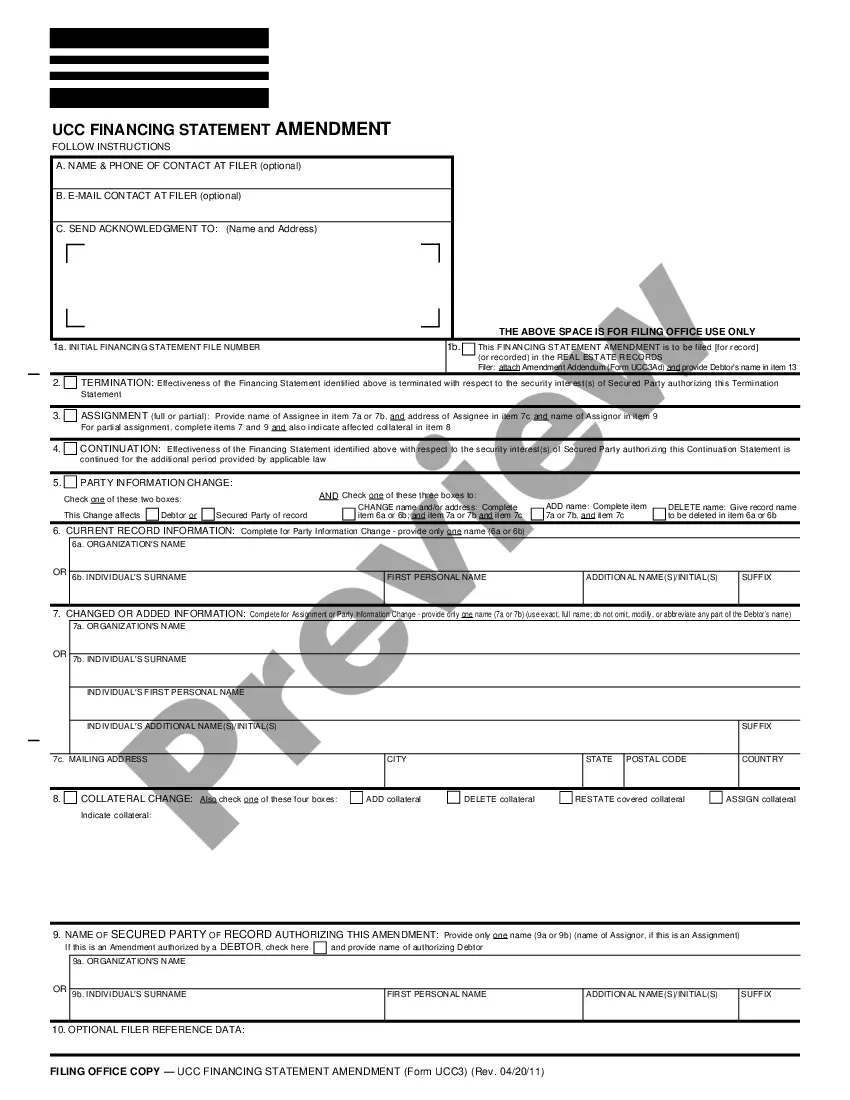

How to fill out Complex Will - Income Trust For Spouse?

US Legal Forms - among the most significant libraries of legitimate kinds in the United States - delivers a variety of legitimate file templates it is possible to download or print out. Making use of the website, you can get 1000s of kinds for organization and personal reasons, sorted by types, says, or search phrases.You will discover the most up-to-date types of kinds much like the Guam Complex Will - Income Trust for Spouse in seconds.

If you have a subscription, log in and download Guam Complex Will - Income Trust for Spouse from the US Legal Forms local library. The Down load option will appear on every type you look at. You gain access to all previously downloaded kinds within the My Forms tab of your account.

If you wish to use US Legal Forms for the first time, allow me to share simple recommendations to help you started out:

- Make sure you have chosen the correct type to your city/county. Go through the Review option to examine the form`s articles. Read the type outline to ensure that you have selected the proper type.

- If the type doesn`t fit your requirements, use the Search field towards the top of the display to obtain the one which does.

- When you are content with the shape, confirm your option by clicking on the Buy now option. Then, opt for the costs prepare you prefer and give your qualifications to register on an account.

- Procedure the financial transaction. Use your charge card or PayPal account to perform the financial transaction.

- Select the formatting and download the shape on your system.

- Make modifications. Fill up, change and print out and sign the downloaded Guam Complex Will - Income Trust for Spouse.

Each format you added to your account does not have an expiry date and is your own eternally. So, if you would like download or print out yet another copy, just go to the My Forms section and click around the type you require.

Get access to the Guam Complex Will - Income Trust for Spouse with US Legal Forms, by far the most comprehensive local library of legitimate file templates. Use 1000s of specialist and condition-distinct templates that satisfy your small business or personal requirements and requirements.

Form popularity

FAQ

U.S. territories can be divided into two groups: Those that have their own governments and their own tax systems (American Samoa, Guam, The Commonwealth of Puerto Rico, The Commonwealth of the Northern Mariana Islands and the U.S. Virgin Islands), and.

Here are ten common methods to minimize estate taxes for your estate upon your death. Marital Transfers. ... Lifetime Gifts to Children and Grandchildren. ... Gifting to Minors. ... Marital Trusts (AB Trusts and QTIP Trusts) ... Irrevocable Life Insurance Trust (ILIT) ... Family Limited Partnership. ... Private Annuity.

More In File An individual who has income from American Samoa, the Commonwealth of the Northern Mariana Islands (CNMI), Guam, Puerto Rico or the U.S. Virgin Islands will usually have to file a tax return with the tax department of one of these territories. Individuals Living or Working in U.S. Territories/Possessions IRS (.gov) ? international-taxpayers ? individ... IRS (.gov) ? international-taxpayers ? individ...

And the U.S. territories are American citizens who are taxed without representation in Congress. While citizens of all territories pay many federal taxes, D.C. is the only territory where people pay federal income taxes. An Explainer on Washington D.C., Puerto Rico, and the U.S. Territories medium.com ? ... medium.com ? ...

Here are 4 ways to protect your inheritance from taxes: See if the alternate valuation date will help. For tax purposes, the estates are evaluated based on their fair market value at the time of the decedent's death. ... Transfer your assets into a trust. ... Minimize IRA distributions. ... Make charitable gifts.

Definition of a complex trust The trust must retain some of its income and not distribute all of it to beneficiaries.

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam. Guam Tax Structure Guam Department of Revenue and Taxation ? info ? structure Guam Department of Revenue and Taxation ? info ? structure

Guam will rebate 75% of income taxes for 20 years on income from qualifying Guam businesses. If the business is conducted as an "S" corporation, the rebate is available to shareholders. Establishing Residency in the US Possessions parsonsbehle.com ? insights ? establishing-residen... parsonsbehle.com ? insights ? establishing-residen...