Guam Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

You can spend time on the web attempting to find the authorized record design which fits the federal and state demands you require. US Legal Forms supplies 1000s of authorized varieties that are reviewed by pros. It is possible to down load or print the Guam Proposal to approve material terms of stock appreciation right plan from the service.

If you have a US Legal Forms bank account, you are able to log in and click on the Obtain switch. Following that, you are able to complete, revise, print, or sign the Guam Proposal to approve material terms of stock appreciation right plan. Each and every authorized record design you acquire is the one you have for a long time. To obtain one more copy of any bought type, visit the My Forms tab and click on the related switch.

If you work with the US Legal Forms internet site the very first time, adhere to the simple guidelines beneath:

- Very first, make sure that you have chosen the correct record design for your state/area of your choosing. See the type information to ensure you have chosen the right type. If accessible, utilize the Preview switch to check through the record design also.

- If you want to get one more variation in the type, utilize the Search industry to find the design that meets your requirements and demands.

- Once you have located the design you need, simply click Purchase now to move forward.

- Find the prices plan you need, enter your accreditations, and register for your account on US Legal Forms.

- Complete the financial transaction. You may use your charge card or PayPal bank account to fund the authorized type.

- Find the file format in the record and down load it for your product.

- Make alterations for your record if possible. You can complete, revise and sign and print Guam Proposal to approve material terms of stock appreciation right plan.

Obtain and print 1000s of record web templates making use of the US Legal Forms site, that offers the most important assortment of authorized varieties. Use skilled and express-certain web templates to take on your organization or specific requirements.

Form popularity

FAQ

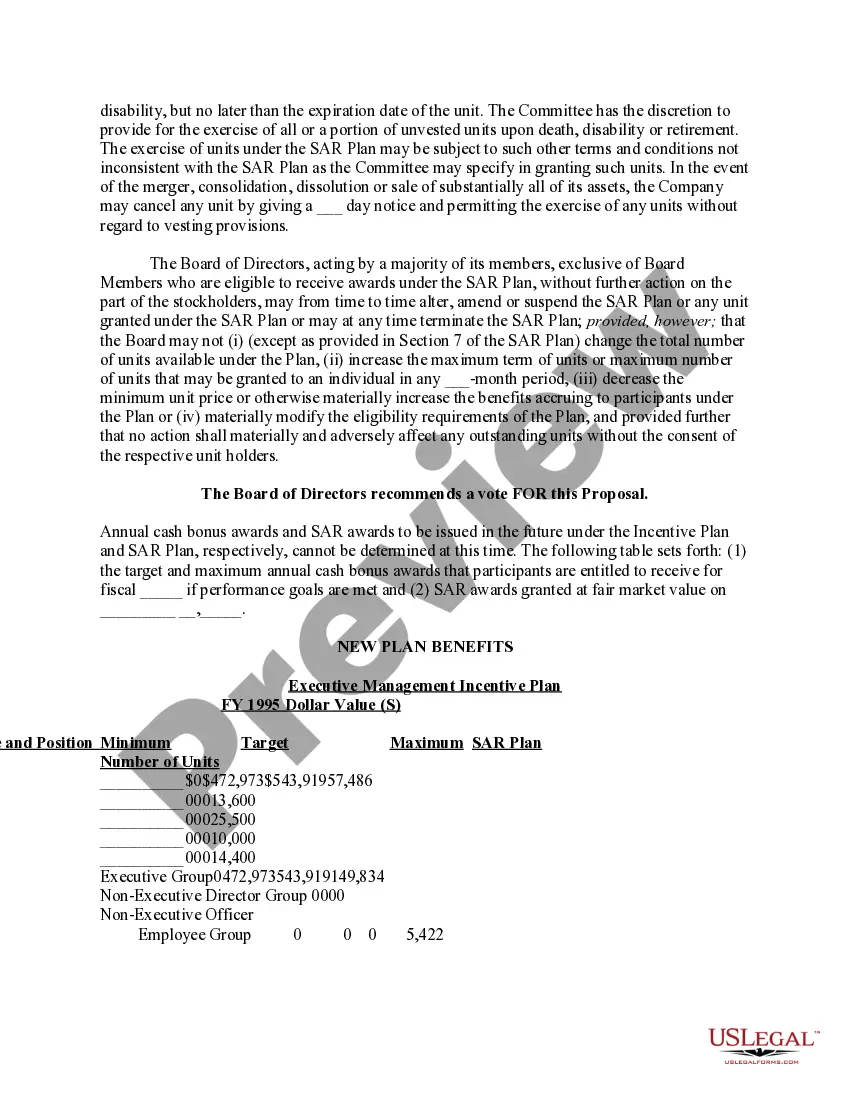

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

Stock Appreciation Rights are similar to Stock Options in that they are granted at a set price, and they generally have a vesting period and an expiration date. Once a SAR vests, an employee can exercise it at any time prior to its expiration.

However, when a stock appreciation right is exercised, the employee does not have to pay to acquire the underlying security. Instead, the employee receives the appreciation in value of the underlying security, which would equal the current market value less the grant price.

Employee stock ownership plans (ESOPs), which can be stock bonus plans or stock bonus/money purchase plans, are qualified defined contribution plans under IRC section 401(a). Similar to stock options, stock appreciation rights are given at a predetermined price and often have a vesting period and expiration date.

Stock Appreciation Rights plans do not result in equity dilution because actual shares are not being transferred to the employee. Participants do not become owners. Instead, they are potential cash beneficiaries in the appreciation of the underlying company value.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock Appreciation Right (SAR) entitles an employee, who is a shareholder in a company, to a cash payment proportionate to the appreciation of stock traded on a public exchange market. SAR programs provide companies with the flexibility to structure the compensation scheme in a way that suits their beneficiaries.

Stock appreciation rights are a corporate method used by companies to reward their employees when the company reaches a specific performance goal. These stock appreciation rights are directly linked to the performance of the company stock.