Guam Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan

Description

How to fill out Authorization To Adopt A Plan For Payment Of Accrued Vacation Benefits To Employees With Company Stock With Copy Of Plan?

Are you presently inside a position in which you require documents for sometimes company or person purposes virtually every time? There are tons of lawful document layouts available on the net, but finding kinds you can rely on is not straightforward. US Legal Forms offers thousands of kind layouts, like the Guam Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan, which can be created in order to meet state and federal requirements.

Should you be presently knowledgeable about US Legal Forms internet site and possess an account, simply log in. Afterward, you are able to obtain the Guam Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan template.

If you do not offer an account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the kind you require and make sure it is for the correct city/state.

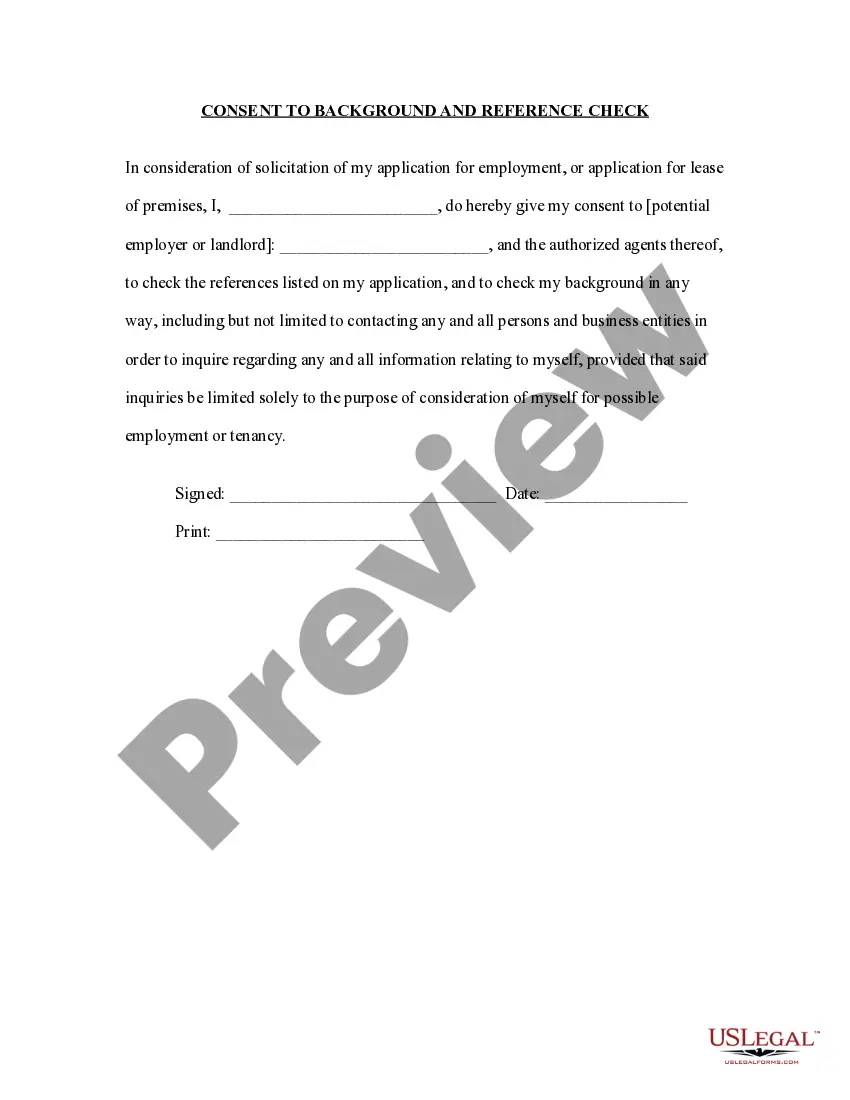

- Use the Review key to check the shape.

- Browse the outline to actually have chosen the appropriate kind.

- When the kind is not what you are trying to find, make use of the Research area to discover the kind that fits your needs and requirements.

- Whenever you discover the correct kind, click Get now.

- Select the prices program you need, complete the necessary details to generate your account, and buy the transaction utilizing your PayPal or Visa or Mastercard.

- Choose a convenient data file formatting and obtain your duplicate.

Get each of the document layouts you possess purchased in the My Forms menus. You can aquire a more duplicate of Guam Authorization to adopt a plan for payment of accrued vacation benefits to employees with company stock with copy of plan at any time, if necessary. Just select the required kind to obtain or produce the document template.

Use US Legal Forms, one of the most extensive selection of lawful varieties, to save time as well as prevent blunders. The support offers appropriately produced lawful document layouts which can be used for a range of purposes. Generate an account on US Legal Forms and start producing your way of life a little easier.

Form popularity

FAQ

Depending on your business's personal time off policy, employees may earn PTO after a certain number of hours worked, weeks, or months. For example, an employee earns one hour of paid time off for every 20 hours worked. After working 400 hours, the employee has 20 hours of accrued time off.

PTO accrual is the accumulation or gradual increase of your paid time off hours during the year. Accrued PTO is the type of leave employees earn over time, based on the number of days or hours they've worked.

First, let's start by defining what we're talking about. Vacation accrued refers to the amount of paid time off that an employee has earned, but hasn't yet used.

Vacation accrual rates may vary based on the length of service. Many organizations offer two weeks of annual leave. This often increases after a stated length of service. For example, after five years of service, vacation leave may increase to three weeks per year.

Since the two-week vacation benefit is considered to be earned by work performed in the first year, an accrual for vacation pay shall be required for new employees during their first year of service.

Vacation accrual is the amount of paid time off (PTO) that an employee has built up over time in line with their company's PTO policy. For example, an employee may accrue eight hours of paid time off every two weeks.

When adding in vacation accrual, you will debit your Vacation Expense account and credit your Vacation Payable account. Credit Vacation Payable because vacation accrual is considered a liability. Liabilities are increased by credits and decreased by debits. Record the opposite by debiting the Vacation Expense account.

For example, an employee earns one hour of paid time off for every 20 hours worked. After working 400 hours, the employee has 20 hours of accrued time off. Any PTO that employees haven't earned is not accrued time off. As a result, you are not responsible for paying it out or rolling it over to the next year.