Guam List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005

Description

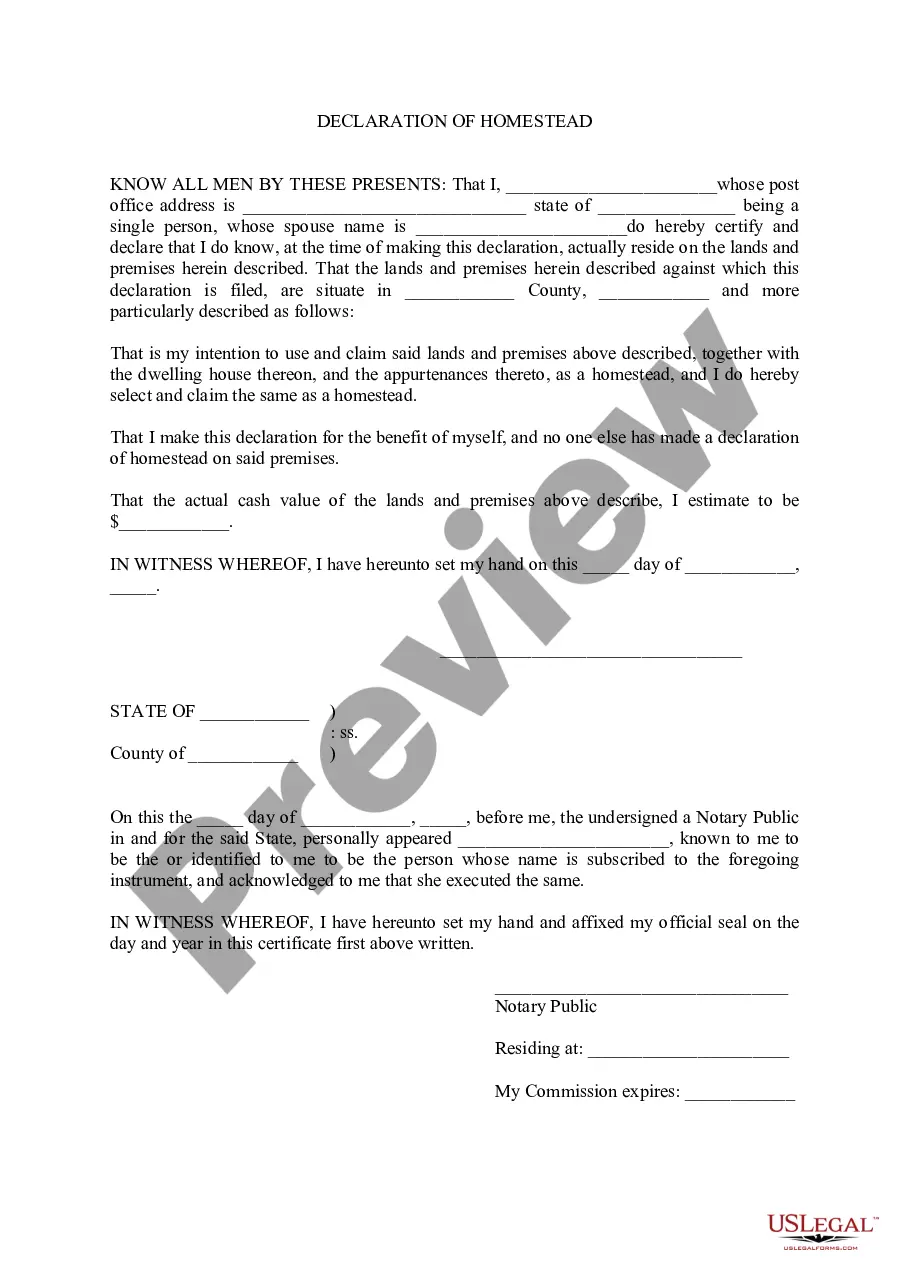

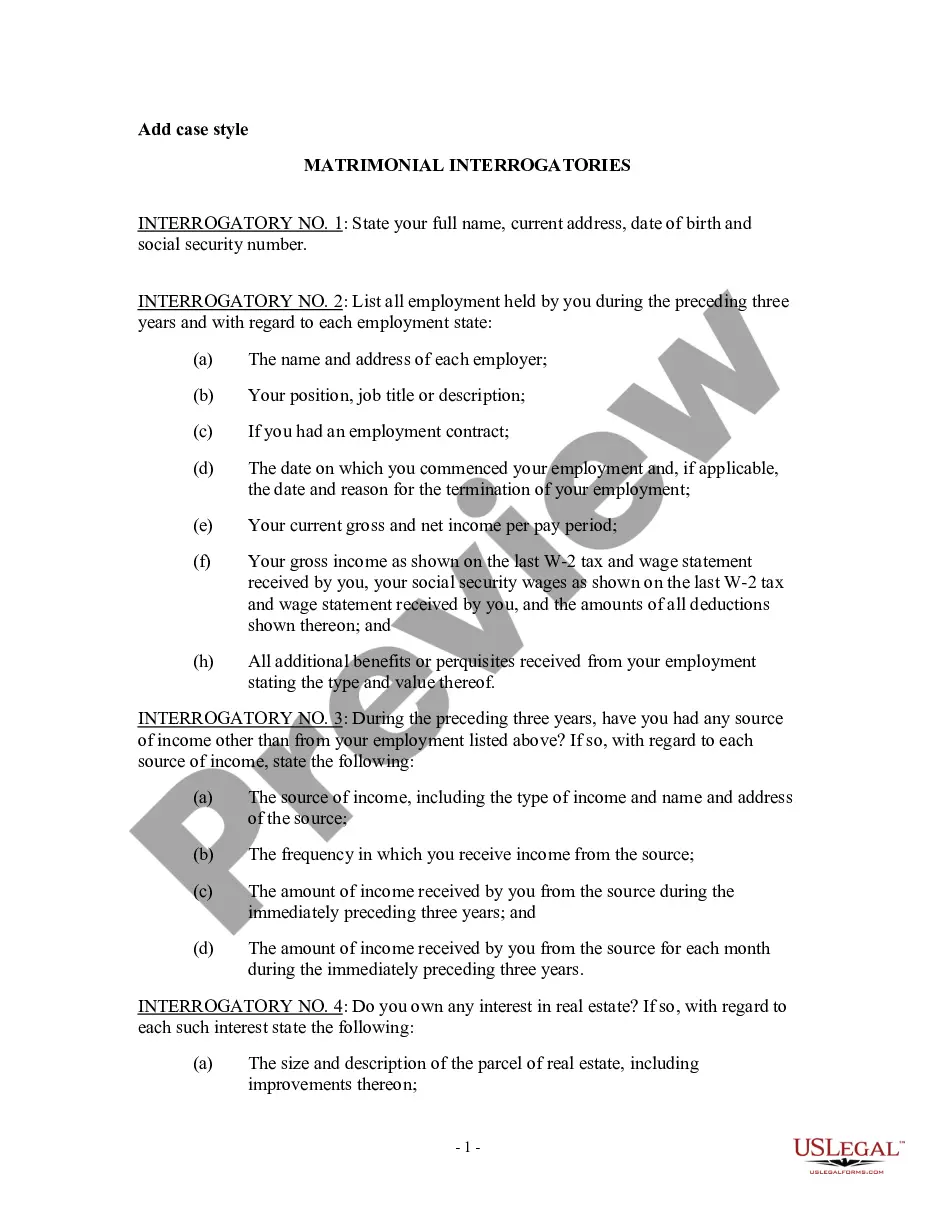

How to fill out List Of Creditors Holding 20 Largest Secured Claims - Not Needed For Chapter 7 Or 13 - Form 4 - Post 2005?

Are you currently in the place in which you need to have documents for sometimes business or specific reasons virtually every working day? There are a variety of authorized papers layouts available online, but locating types you can rely isn`t easy. US Legal Forms provides a large number of kind layouts, just like the Guam List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005, which are published to fulfill federal and state needs.

In case you are presently knowledgeable about US Legal Forms website and also have an account, just log in. After that, you are able to obtain the Guam List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 template.

If you do not provide an account and want to begin using US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is for your proper city/area.

- Take advantage of the Review switch to analyze the shape.

- Read the description to ensure that you have chosen the appropriate kind.

- In case the kind isn`t what you are looking for, take advantage of the Lookup industry to find the kind that meets your needs and needs.

- Whenever you find the proper kind, simply click Buy now.

- Select the rates program you want, complete the specified info to create your account, and buy your order utilizing your PayPal or Visa or Mastercard.

- Select a convenient file structure and obtain your copy.

Discover every one of the papers layouts you have purchased in the My Forms menu. You can get a extra copy of Guam List of creditors holding 20 largest secured claims - Not needed for Chapter 7 or 13 - Form 4 - Post 2005 any time, if possible. Just click on the necessary kind to obtain or printing the papers template.

Use US Legal Forms, the most extensive selection of authorized types, to save lots of time as well as steer clear of faults. The support provides skillfully created authorized papers layouts which you can use for an array of reasons. Create an account on US Legal Forms and start making your daily life a little easier.

Form popularity

FAQ

The good news is that if you ? or the attorney you hire ? gets the paperwork right and the case moves through the court to the point where debt discharge is determined, the U.S. Bankruptcy Courts says that 99% of Chapter 7 cases succeed. Unfortunately, many don't make it that far and their petition is denied.

The good news is that if you ? or the attorney you hire ? gets the paperwork right and the case moves through the court to the point where debt discharge is determined, the U.S. Bankruptcy Courts says that 99% of Chapter 7 cases succeed.

Examples of nonexempt assets that can be subject to liquidation: Additional home or residential property that is not your primary residence. Investments that are not part of your retirement accounts. An expensive vehicle(s) not covered by bankruptcy exemptions.

A Chapter 7 bankruptcy usually takes about four to six months from filing to final discharge, as long as the person who's filing has all their ducks in a row. There are a lot of moving parts to filing for Chapter 7 bankruptcy, and missing or delaying any one of them can slow down or stop the process.

A total of 226,777 chapter 13 consumer cases were closed by dismissal or plan completion in 2020. Table 6 illustrates that 116,145 of these cases were dismissed. In 49 percent of the cases closed (110,632 cases), the debtors received a discharge after completing repayment plans, up from 43 percent in 2019.

However, each of your creditors must file a proof of claim (described below) within a certain time to prove how much you owe. If a creditor fails to do so, then the bankruptcy trustee will not make any payments to that creditor. In some cases, lack of a proof of claim may benefit you.

A Chapter 13 petition for bankruptcy will likely necessitate a $500 to $600 monthly payment, especially for debtors paying at least one automobile through the payment plan. However, since the bankruptcy court will consider a large number of factors, this estimate could vary greatly.

Bankruptcy cases get dismissed for a variety of reasons ranging from intentional misconduct (such as fraud) to simply failing to file the correct forms with the court.

In a Chapter 13 case, unsecured debt is part of your repayment plan. As long as you commit all ?disposable income? to your repayment plan and unsecured creditors receive at least as much as they would have in a Chapter 7 case, you do not have to fully repay all unsecured debts in Chapter 13.

In some cases, the plan payment is $200.00/month. Some clients pay 100% of their unsecured debt + 5.25% interest (the highest current maximum).