Guam Net Lease of Equipment (personal Propety Net Lease) with no Warranties by Lessor and Option to Purchase

Description

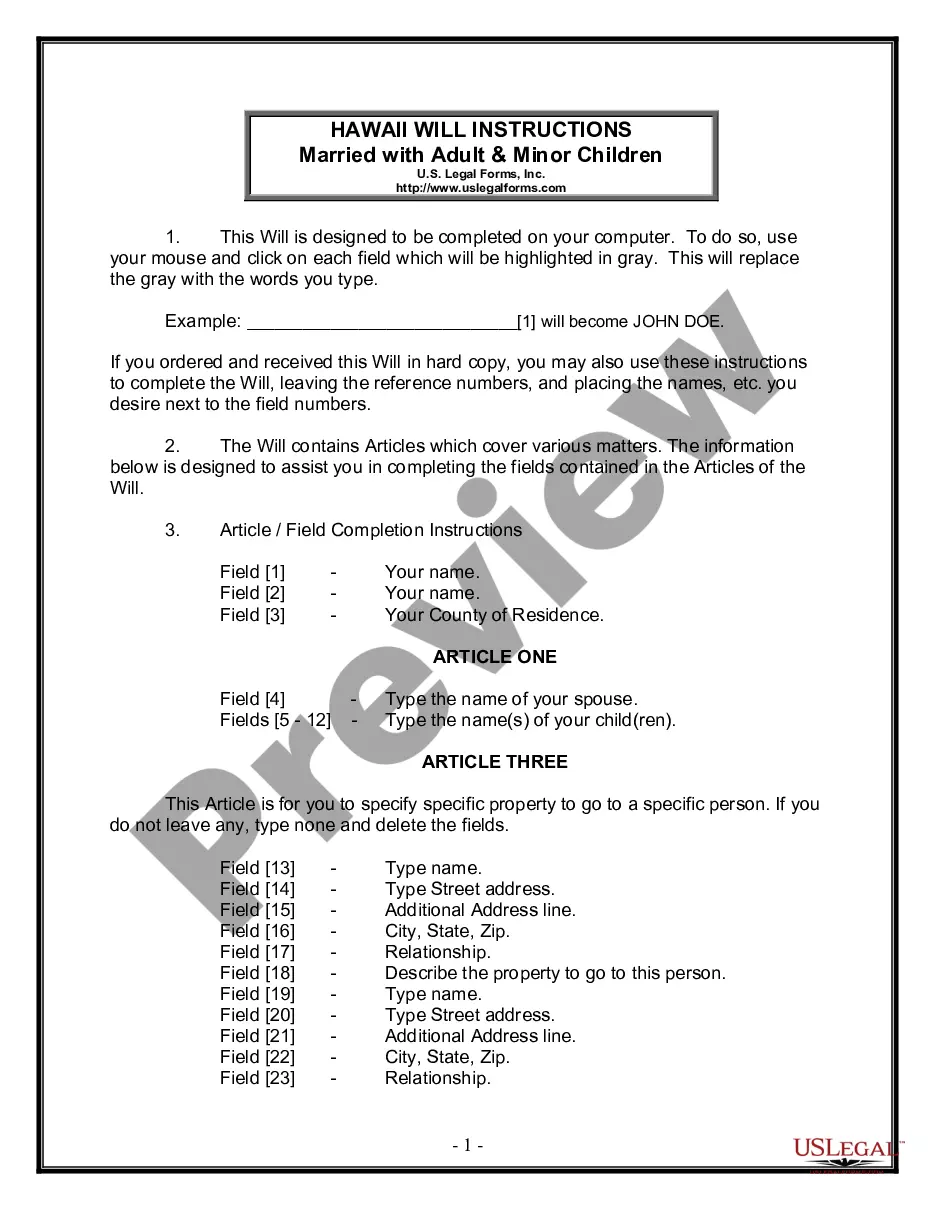

How to fill out Net Lease Of Equipment (personal Propety Net Lease) With No Warranties By Lessor And Option To Purchase?

You can spend hours on the web looking for the legal document format that meets the federal and state requirements you will need.

US Legal Forms provides thousands of legal templates that are reviewed by experts.

It is easy to download or print the Guam Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase from your services.

If available, use the Review button to check through the document format as well.

- If you have a US Legal Forms account, you may Log In and click the Download button.

- After that, you may complete, modify, print, or sign the Guam Net Lease of Equipment (personal Property Net Lease) without Warranties by Lessor and Option to Purchase.

- Every legal document format you acquire is yours permanently.

- To get another copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document format for your county/city of your choice.

- Review the form description to make sure you have picked the correct type.

Form popularity

FAQ

To record a lease to own equipment under the Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, start by drafting a lease agreement that clearly outlines the terms and conditions. Ensure the document includes details about the equipment, payment schedule, and transfer of ownership options. Once completed, file the lease with the appropriate local government office to secure your rights to the equipment. Using platforms like USLegalForms can simplify this process, providing templates and guidance tailored to your leasing needs.

The rule of 78 is a method of calculating prepayment penalties on loans, which often applies to leases as well. Under this rule, you might face higher penalties if you terminate your lease early. When engaging with a Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, it's crucial to understand this rule. This knowledge helps you navigate potential costs if you need to adjust your leasing terms early.

The 90% rule in leasing, similar to the 90% lease rule, dictates that a lease must allow the lessee to use the equipment for at least 90% of its economic life for it to be classified as a finance lease. Understanding this rule is essential when considering a Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase. It helps ensure that you maximize the equipment's utility while complying with financial regulations.

The five rules for finance leases include specifying payment duration and frequency, ensuring the lessee understands ownership transfer implications, outlining responsibilities for maintenance, confirming the lease terms align with asset life cycles and establishing conditions for asset return. By adhering to these rules, your Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase will have a solid foundation, ensuring clarity for both parties. This reduces potential disputes and enhances operational efficiency.

To structure an equipment lease effectively, start by determining the lease term, payment structure, and maintenance responsibilities. For a Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, consider adding clauses that define conditions for equipment return or purchase options at the end of the lease. This clarity fosters a mutually beneficial agreement that aligns with your operational needs.

The five criteria for a finance lease include the transfer of ownership at the end of the lease, a bargain purchase option, the lease term covering the majority of the asset's useful life, present value of lease payments equaling or exceeding the fair value of the asset, and the asset being specialized for the lessee's needs. When structuring a Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, these criteria help in classifying your lease appropriately for financial reporting. A good grasp of these factors aids in compliance and strategic planning.

The 90% lease rule refers to a guideline that states a lease must allow the lessee to use the equipment for at least 90% of its economic life. When considering a Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, this rule ensures that you can effectively utilize the equipment before deciding to purchase or return it. This rule helps in making strategic decisions related to asset management.

A finance lease is classified based on five key conditions. These include transfer of ownership at the end of the lease, a bargain purchase option, lease term that covers the majority of the asset's economic life, present value of lease payments that equals or exceeds the asset's fair value, and specialized nature of the leased asset. In the context of the Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, meeting these conditions is essential for effective lease management. Understanding these terms helps lessors and lessees navigate their financial obligations more clearly.

Under ASC 842, lessors classify leases into two primary categories: operating leases or finance leases. For the Guam Net Lease of Equipment (personal Property Net Lease) with no Warranties by Lessor and Option to Purchase, understanding this classification is crucial. Operating leases maintain the asset on the lessor's balance sheet, while finance leases effectively transfer ownership risks and rewards. This classification impacts how lessors report revenue and manage their assets.