Guam Sample Letter for Insufficient Amount to Reinstate Loan

Description

How to fill out Sample Letter For Insufficient Amount To Reinstate Loan?

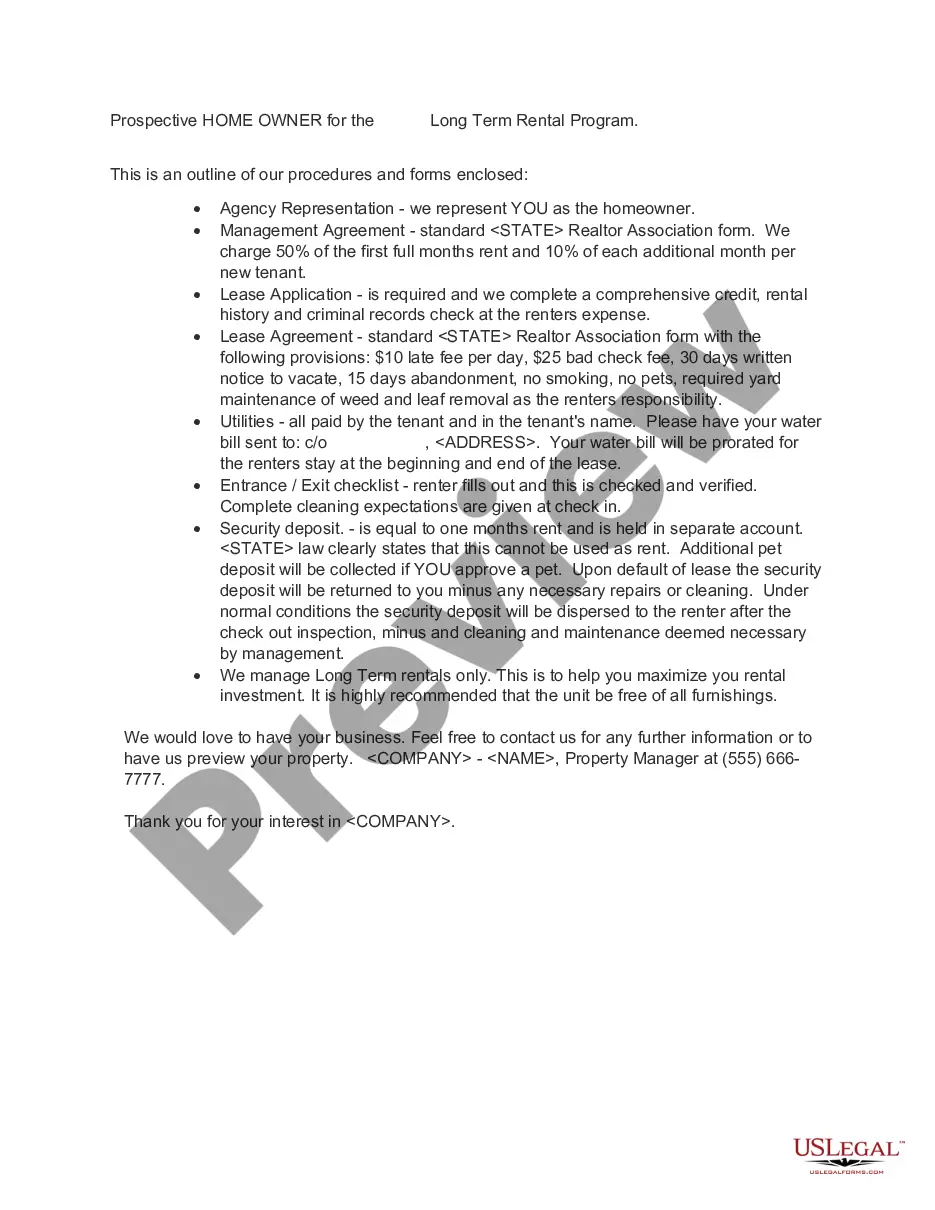

US Legal Forms - one of the largest collections of legal templates in the USA - offers a range of legal document templates that you can download or print. By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain up-to-date versions of forms such as the Guam Sample Letter for Insufficient Amount to Reinstate Loan within moments. If you already have a subscription, Log In and retrieve the Guam Sample Letter for Insufficient Amount to Reinstate Loan from the US Legal Forms library. The Download button appears on every form you view. You can access all previously saved forms in the My documents section of your account.

If you are using US Legal Forms for the first time, here are some simple tips to get started.

Choose the format and download the form to your device.

Make edits. Fill out, modify, print, and sign the saved Guam Sample Letter for Insufficient Amount to Reinstate Loan. Each template you add to your account has no expiration date and remains yours indefinitely. Thus, if you wish to download or print another copy, simply go to the My documents section and click on the form you need. Access the Guam Sample Letter for Insufficient Amount to Reinstate Loan with US Legal Forms, the most comprehensive library of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal needs and requirements.

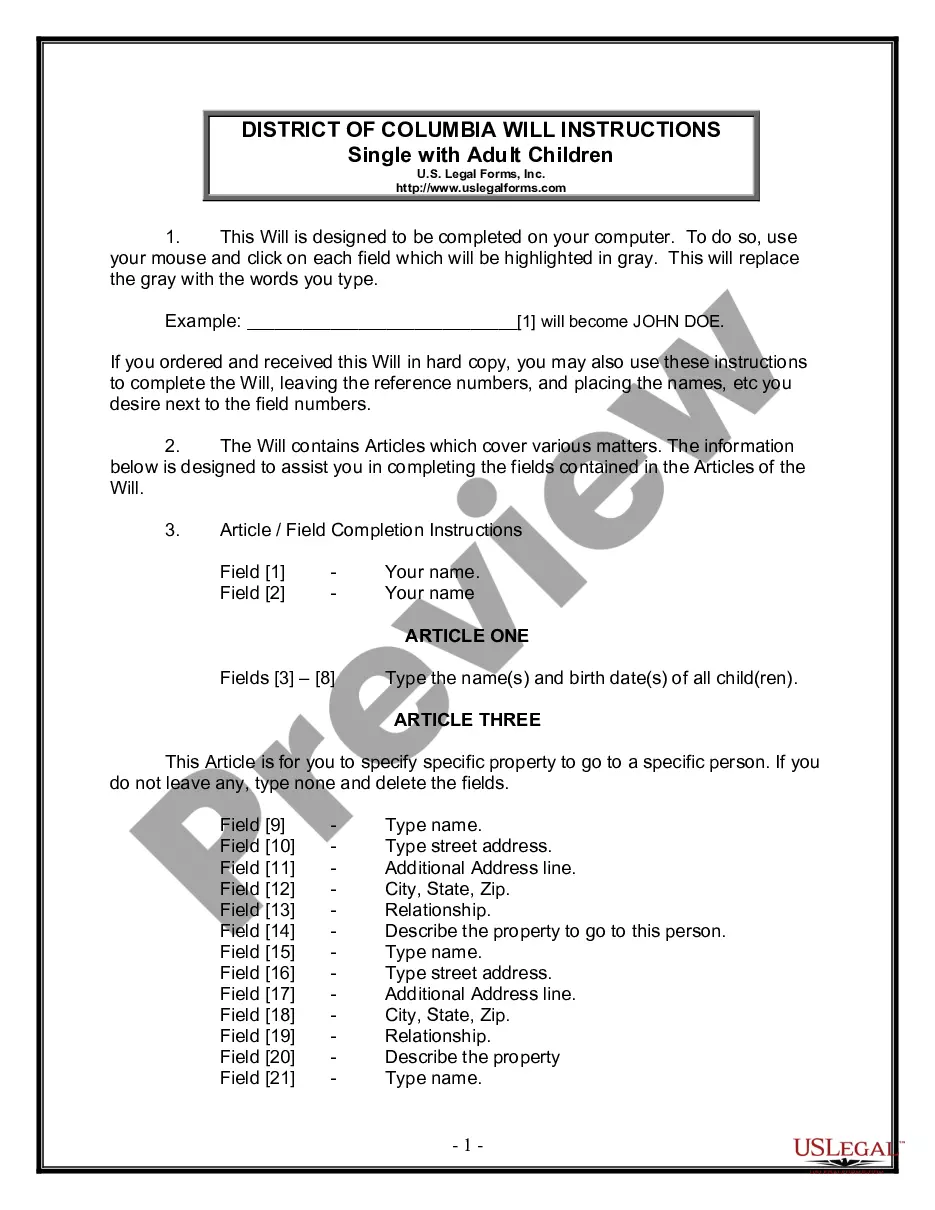

- Ensure you have selected the correct form for your city/region. Click the Preview button to review the content of the form.

- Check the form details to confirm you have chosen the correct form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

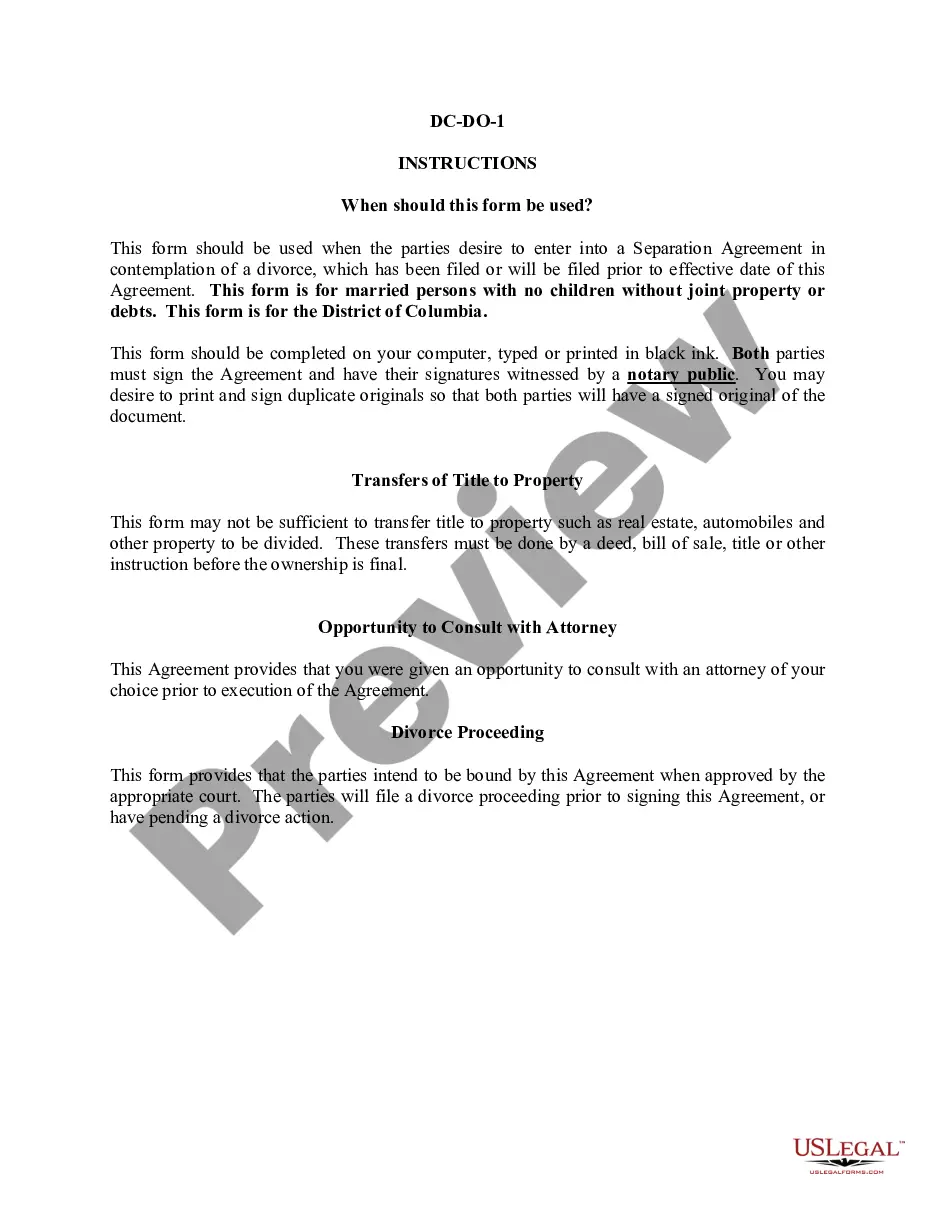

- If you are content with the form, confirm your choice by clicking the Buy now button.

- Then, select the pricing plan you prefer and provide your details to register for an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

Form popularity

FAQ

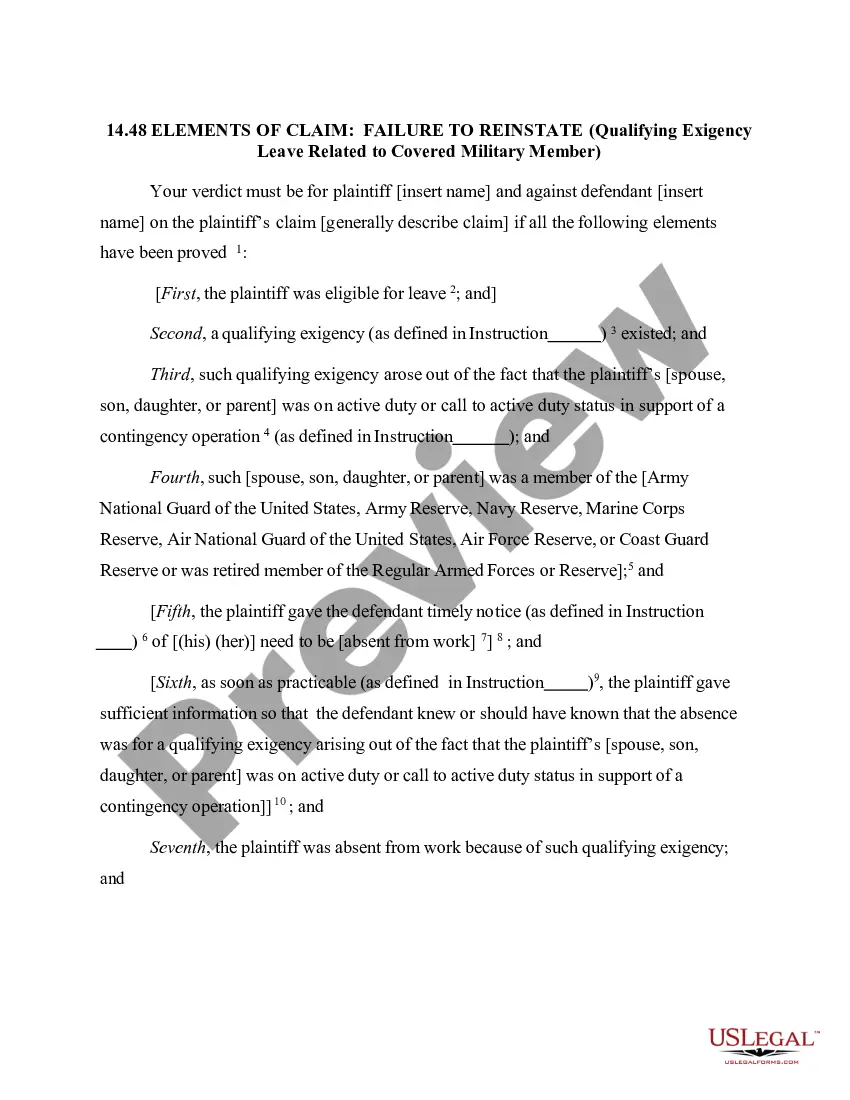

To write a successful hardship letter, start by clearly stating your financial difficulties and the reasons for them. Be honest and concise, providing specific details about your situation while focusing on how you plan to rectify it. Incorporating elements like a Guam Sample Letter for Insufficient Amount to Reinstate Loan can lend structure to your letter, ensuring you address all necessary points. Remember to express your commitment to resolving the issue and maintaining communication with your lender.

The FHA guidelines outline the requirements for insured loans and protect both lenders and borrowers. These guidelines include details on loan limits, eligibility criteria, and property standards. If you are facing challenges in reinstating a loan due to insufficient amounts, knowing the FHA guidelines can help you better understand your options. Utilizing a Guam Sample Letter for Insufficient Amount to Reinstate Loan can assist you in communicating effectively with your lender regarding your situation.

To craft a powerful appeal letter, begin with a respectful greeting and a clear statement of your appeal's purpose. Describe the situation in detail, focusing on facts and evidence that support your case, and consider integrating the Guam Sample Letter for Insufficient Amount to Reinstate Loan to enhance your argument. Keep your tone respectful, and conclude with a strong closing that invites further communication. By following these steps, you set yourself up for a more favorable outcome.

When writing a denial appeal letter, start by clearly stating your intent to appeal the denial. Mention the specific loan instance you are addressing, and include any relevant details that can support your position. It is beneficial to reference the Guam Sample Letter for Insufficient Amount to Reinstate Loan, as it provides a reliable format and language that can strengthen your appeal. Finally, express your appreciation for their consideration, and ensure your contact information is clear.

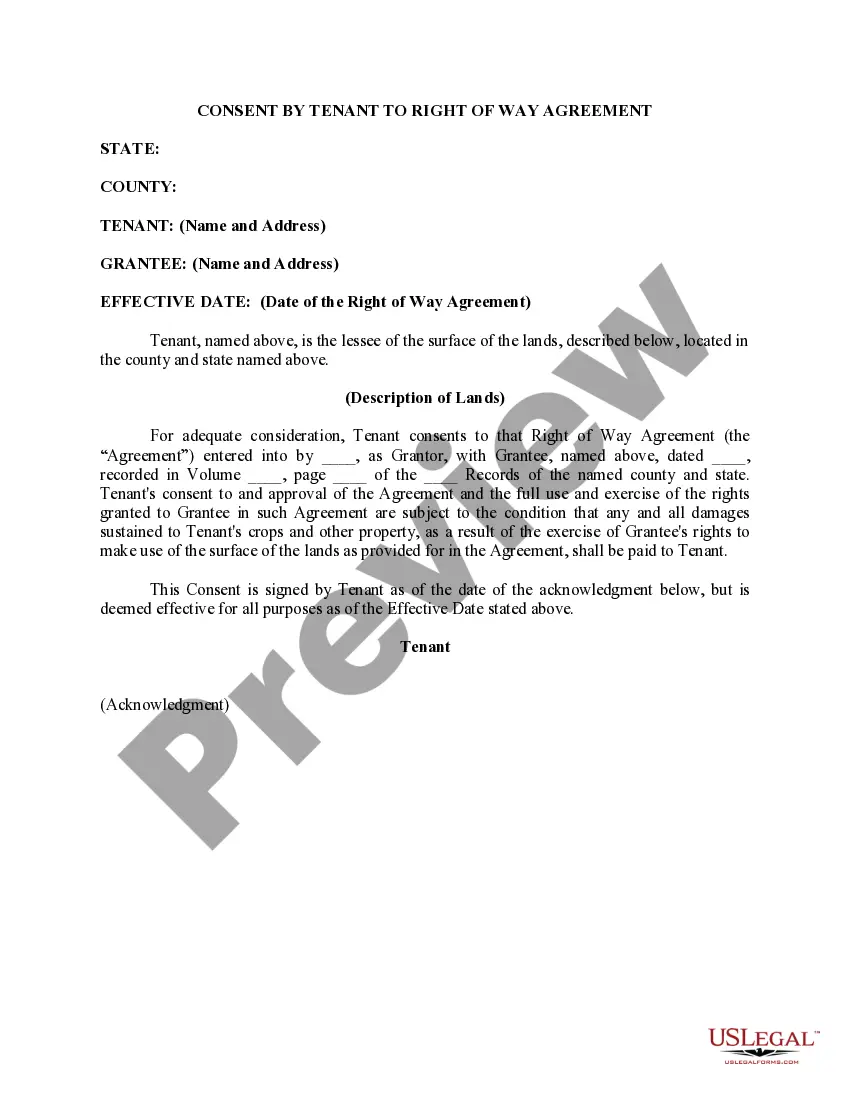

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)

Mortgage reinstatement, sometimes called loan reinstatement, is the process of restoring your mortgage after a mortgage default by paying the total amount past due. You will arrive at the point of a mortgage default after missing payments for several months.

In foreclosure, a house is sold as collateral after the homeowners default on their loan. Housing repossession is a more general term for when a mortgage lender or loan provider takes ownership of a property because the owners haven't paid their bills. It's a consequence of foreclosure.

The deadline for reinstating your loan is 90 days after you were served with a foreclosure notice. By this deadline, you will be required to make up the missed payments and pay other fees and expenses.

You may be able to reinstate the loan by catching up on payments. However, you will need to repay all past due bills, including late fees and the costs a lender incurs from repossession.

Reinstatement involves making a single payment to catch up with everything due on a loan. By contrast, payoff involves paying the lender the total remaining balance of the loan. (Payoff before a foreclosure sale is commonly known as redemption, which is an equitable right available in every state.)