Guam Subsidiary Guaranty Agreement

Description

How to fill out Subsidiary Guaranty Agreement?

Are you currently in a situation where you require documents for either business or personal purposes almost every day.

There is a plethora of legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms provides thousands of form templates, including the Guam Subsidiary Guaranty Agreement, designed to satisfy state and federal requirements.

Once you have the correct document, click Buy now.

Select the pricing plan you desire, complete the necessary information to create your account, and pay for the order using your PayPal or credit card.

- If you're already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Subsidiary Guaranty Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these instructions.

- Acquire the form you need and ensure it is for the correct city/county.

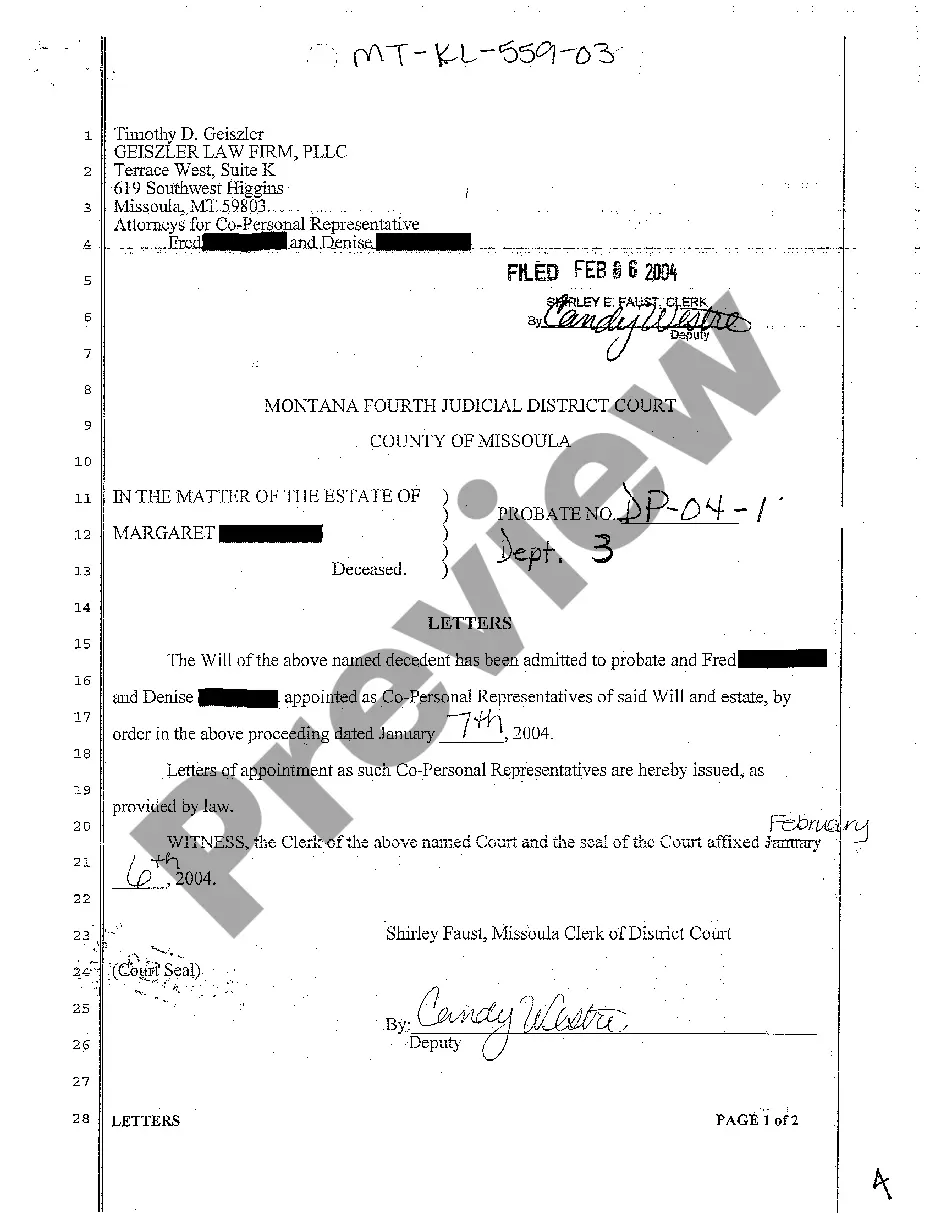

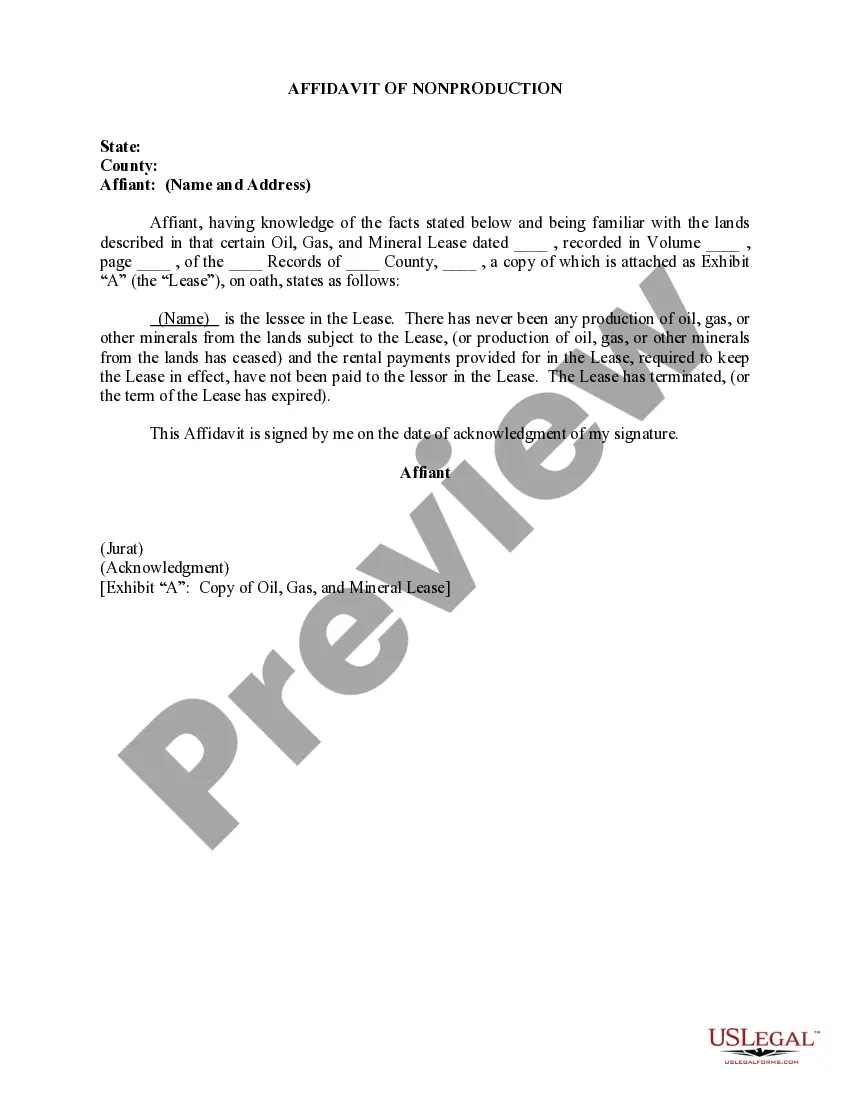

- Use the Preview button to review the form.

- Check the description to confirm that you have selected the right document.

- If the document isn't what you are looking for, use the Search field to find the form that suits your needs.

Form popularity

FAQ

One example of a guarantor could occur when someone who is under 21 applies for a credit card but is unable to provide proof that they are capable of making minimum payments on the card. The card company may require a guarantor, who becomes liable for repaying any charges on the credit card.

Guaranty Agreement a two-party contract in which the first party agrees to perform in the event that a second party fails to perform. Unlike a surety, a guarantor is only required to perform after the obligee has made every reasonable and legal effort to force the principal's performance.

Subsidiary Guarantors Subsidiary Guarantor means each Subsidiary of the Company that executes this Indenture as a guarantor on the Issue Date and each other Subsidiary of the Company that thereafter guarantees the Securities pursuant to the terms of this Indenture.

Non-Guarantor Subsidiaries means (x) any Unrestricted Subsidiary, (y) any Receivables Subsidiary and (z) any Subsidiary of the Company that does not guarantee the Company's Obligations under the Credit Agreement and does not guarantee any Indebtedness of the Company or a Subsidiary Guarantor of $25.0 million or more.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.

The surety, or guarantor, is the underwriter of the bond, which provides the financial backing. Because in essence they ensures payments, financial guarantee bonds work much like an extra line of credit for the bonded party.

Guaranty Documents means those certain documents, if any, entered into between the Guarantor and any Lender to evidence the guaranty for the repayment of any Loan which may be requested by the Lender to be provided by the Guarantor.

Purpose of GuarantyThe guarantor agrees to pay the obligations of the borrower under the loan agreement in the event that the borrower does not pay. In addition to being an alternate source of repayment, guaranties provide evidence that the guarantor intends to stand behind the borrower.

A guarantor is a party to a transaction or credit agreement who voluntarily takes responsibility for ensuring the payment of another party's debts in the event that they fail to meet their obligations to the vendor.

A guaranty agreement is a contract between two parties where one party agrees to pay a debt or perform a duty in the event that the original party fails to do so. The party who makes the guaranty is called the guarantor. An agreement of this nature is often used in real estate, insurance, or financial transactions.