Guam Notice of Returned Check

Description

How to fill out Notice Of Returned Check?

You might dedicate numerous hours online searching for the approved document template that meets the requirements of state and federal regulations you desire.

US Legal Forms provides a vast selection of legal documents that can be reviewed by experts.

You can easily download or print the Guam Notice of Returned Check from our service.

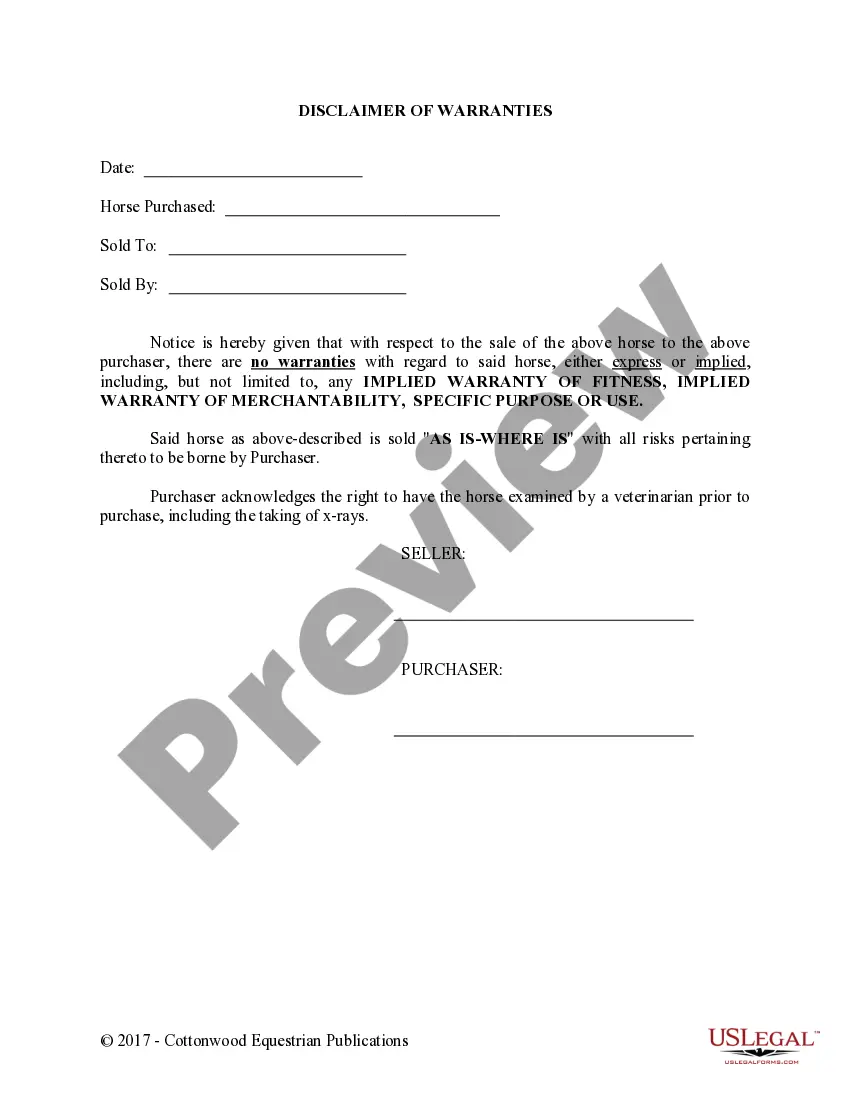

If available, utilize the Preview option to examine the document template as well.

- If you currently have an account with US Legal Forms, you can Log In and select the Obtain option.

- After that, you can fill out, modify, print, or sign the Guam Notice of Returned Check.

- Each legal document template you acquire is yours permanently.

- To receive another copy of any purchased form, navigate to the My documents tab and select the appropriate option.

- If you’re using US Legal Forms for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for your desired region/city.

- Check the form details to ensure you have selected the accurate document.

Form popularity

FAQ

When you receive a Guam Notice of Returned Check, it indicates that a check you submitted has bounced due to insufficient funds or other issues. This notice serves as an official communication that the financial institution has not honored the check. Thus, it is crucial to address this situation quickly to avoid further penalties or legal complications. With the help of US Legal Forms, you can find the necessary resources and forms to respond appropriately and manage any potential disputes effectively.

To mail your Guam tax return, you should send it to the address provided on the official Guam Department of Revenue and Taxation website. Properly addressing your envelope and including the necessary documentation will help avoid issues like the Guam Notice of Returned Check. Ensure you check for updates on mailing addresses regularly, as these can change.

You can email Rev and Tax Guam by visiting their official site, which lists various contact methods. If you have specific questions regarding the Guam Notice of Returned Check, including necessary documentation in your email may expedite the process. Always provide accurate information to assist them in addressing your concerns effectively.

To email Guam Rev and Tax, navigate to their official website, where you can find contact details including email addresses for different departments. Ensure your query is clear and concise, especially when discussing matters like the Guam Notice of Returned Check. This method will facilitate faster communication and a more efficient response.

The director of Revenue and Taxation in Guam oversees tax collection and policy implementation within the territory. This position is vital for managing tax matters, including handling issues like the Guam Notice of Returned Check. To get the most current information about the director, visiting the official Guam Department of Revenue and Taxation website is recommended.

You can email the Internal Revenue Service, but be aware that they typically do not respond to emails. Instead, you can visit their official website to find important contact information and resources. For specific inquiries related to Guam Notice of Returned Check, consider reaching out through their listed phone numbers or mailing addresses for timely assistance.

Guam does not file a standard US tax return, as it has its own tax laws and regulations. However, residents may be required to file federal tax returns if they earn income from outside Guam. It’s essential to understand these differences, especially when dealing with a Guam Notice of Returned Check.

A returned check notice is a communication issued when a check cannot be processed due to insufficient funds or an invalid account. This notice allows you to understand the issue and take corrective actions. Always keep a watchful eye for these notices to avoid further complications in your finances.

Filing your Gross Receipts Tax (GRT) in Guam involves completing the necessary forms available on the Guam Department of Revenue and Taxation website. You'll need to gather all relevant financial records and ensure timely submission to avoid penalties. If you encounter difficulties, remember that platforms like US Legal Forms can provide guidance.

You can contact the Guam Department of Revenue and Taxation through their official phone number or via email. They also provide physical office locations should you prefer speaking to someone in person. Their friendly staff is prepared to assist you with any inquiries, including matters related to a returned check notice.