Guam Pledge of Personal Property as Collateral Security

Description

As the pledge is for the benefit of both parties, the pledgee is bound to exercise only ordinary care over the pledge. The pledgee has the right of selling the pledge if the pledgor make default in payment at the stipulated time. In the case of a wrongful sale by a pledgee, the pledgor cannot recover the value of the pledge without a tender of the amount due.

How to fill out Pledge Of Personal Property As Collateral Security?

If you're looking for extensive, acquire, or create official document templates, utilize US Legal Forms, the most extensive collection of legal forms available online.

Employ the site's user-friendly and efficient search to find the documents you need.

Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Every legal document template you purchase is yours for a lifetime. You have access to every form you've obtained within your account. Click the My documents section and select a form to print or download again.

Complete and obtain, and print the Guam Pledge of Personal Property as Collateral Security with US Legal Forms. Numerous professional and state-specific forms are available for your business or personal requirements.

- Use US Legal Forms to obtain the Guam Pledge of Personal Property as Collateral Security in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and then click the Download button to retrieve the Guam Pledge of Personal Property as Collateral Security.

- You can also access forms you previously obtained in the My documents tab in your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

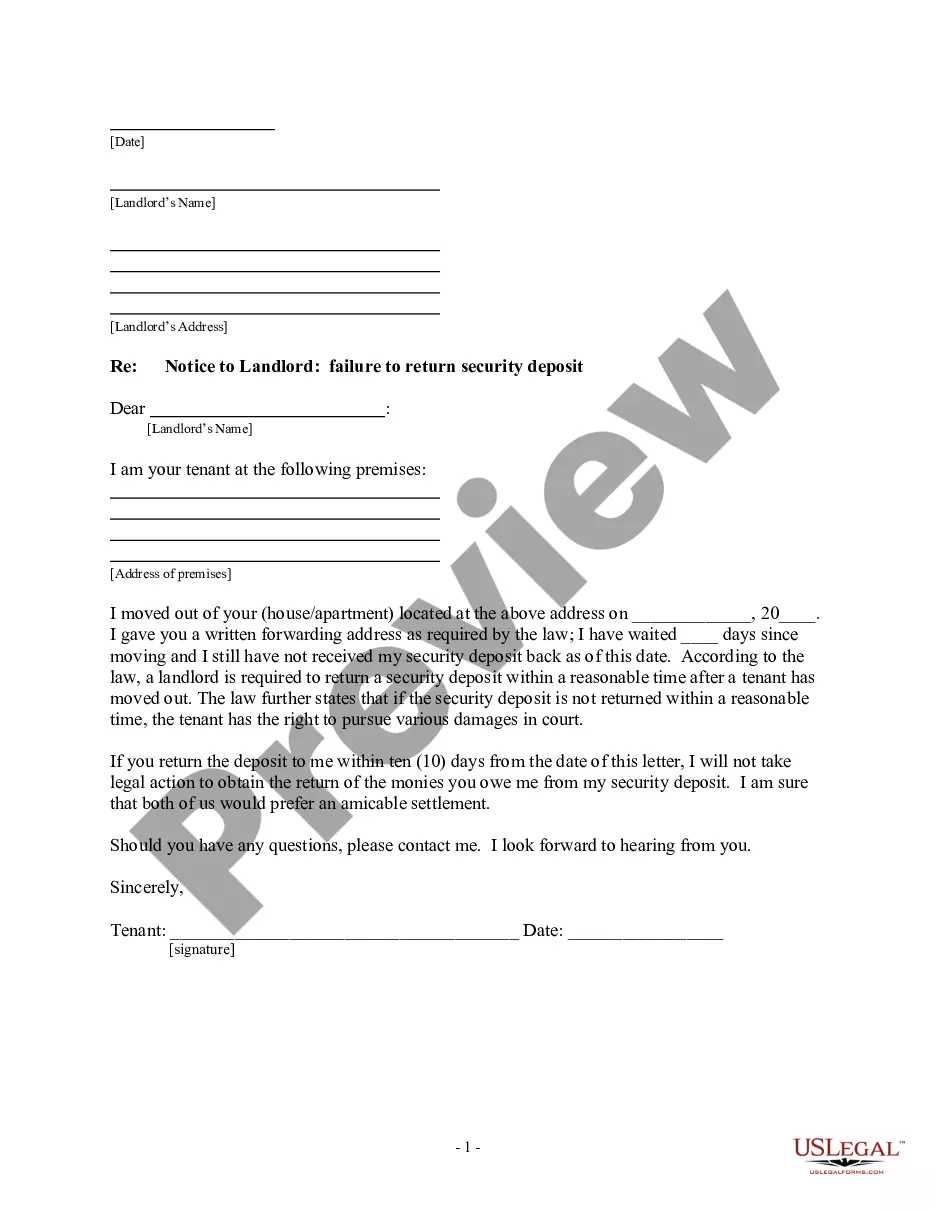

- Step 1. Make sure you've selected the form for your respective city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you're not satisfied with that form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you've found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Guam Pledge of Personal Property as Collateral Security.

Form popularity

FAQ

The key legal document for perfecting a security interest in personal property is the Guam Pledge of Personal Property as Collateral Security. This document allows a lender to secure an interest in the borrower's personal property, ensuring that they have a claim to that property in case of default. By filing this pledge, you solidify your security interest, prioritizing your rights over the asset. Using platforms like USLegalForms can simplify the process, providing you with the necessary templates and guidance to ensure compliance.

To create a security interest in personal property, begin with a clear, comprehensive security agreement that specifies the collateral under the Guam Pledge of Personal Property as Collateral Security. Following this, secure possession of the collateral or file the necessary documents to perfect your interest. If you need assistance, US Legal Forms offers templates and guidance to navigate this process efficiently.

Yes, property that is subject to a security interest is referred to as collateral. In the scenario of the Guam Pledge of Personal Property as Collateral Security, this collateral serves as assurance to the lender against the borrower's obligation. Understanding this concept is vital before entering any agreements involving security interests.

The process of creating a security interest in collateral is known as 'attachment.' In the context of the Guam Pledge of Personal Property as Collateral Security, attachment occurs when the lender has a valid security agreement, value is given, and the borrower has rights in the collateral. This is a key step in securing an interest in the property.

To create personal security, start by establishing a clear security agreement that identifies the personal property at stake, aligning with the Guam Pledge of Personal Property as Collateral Security. Ensure both parties understand the agreement's terms and conditions. It’s wise to document this process thoroughly, as this helps in minimizing disputes later.

Creating a security interest in personal property involves drafting a security agreement that specifies the property involved under the Guam Pledge of Personal Property as Collateral Security. It's crucial to detail how and when the secured party can assert their rights should the borrower default. You might also consider filing a financing statement with the appropriate authority to perfect your security interest.

A security interest is created through the execution of a security agreement that designates the collateral being used for the Guam Pledge of Personal Property as Collateral Security. This step is essential as it provides clarity on what property serves as security. Additionally, the secured party may need to perfect the security interest, ensuring their legal right to the collateral.

To create a valid security interest under the Guam Pledge of Personal Property as Collateral Security, there are a few requirements you must meet. First, you need a security agreement in writing, outlining the terms. Second, the secured party must have possession of the collateral, or there must be a clear agreement indicating the collateral involved.

Under UCC Article 9, certain criteria must be met for a security interest to attach. This includes the existence of a valid security agreement, the debtor’s rights in the collateral, and the creditor's value given to secure the interest. These elements ensure that the security interest is recognized legally and can be enforced, which is vital when considering the Guam Pledge of Personal Property as Collateral Security. Using platforms like uslegalforms can help you navigate these requirements efficiently.

A pledge of personal property as collateral for a debt is commonly referred to as a 'pledge agreement.' In this relationship, the debtor offers personal property to the creditor as a guarantee for repayment of the debt. Should the debtor fail to meet their obligations, the creditor has the right to seize the pledged property. This arrangement is notably significant within the context of the Guam Pledge of Personal Property as Collateral Security.