This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Loan Application - Review or Checklist Form for Loan Secured by Real Property

Description

How to fill out Loan Application - Review Or Checklist Form For Loan Secured By Real Property?

US Legal Forms - one of the biggest libraries of legitimate varieties in the USA - offers an array of legitimate file layouts you are able to download or printing. Using the internet site, you will get thousands of varieties for business and specific reasons, categorized by classes, claims, or key phrases.You can get the most recent models of varieties just like the Guam Loan Application - Review or Checklist Form for Loan Secured by Real Property within minutes.

If you already possess a monthly subscription, log in and download Guam Loan Application - Review or Checklist Form for Loan Secured by Real Property in the US Legal Forms catalogue. The Download button will appear on each and every develop you view. You get access to all previously acquired varieties inside the My Forms tab of your own profile.

If you would like use US Legal Forms the very first time, listed below are easy instructions to help you get began:

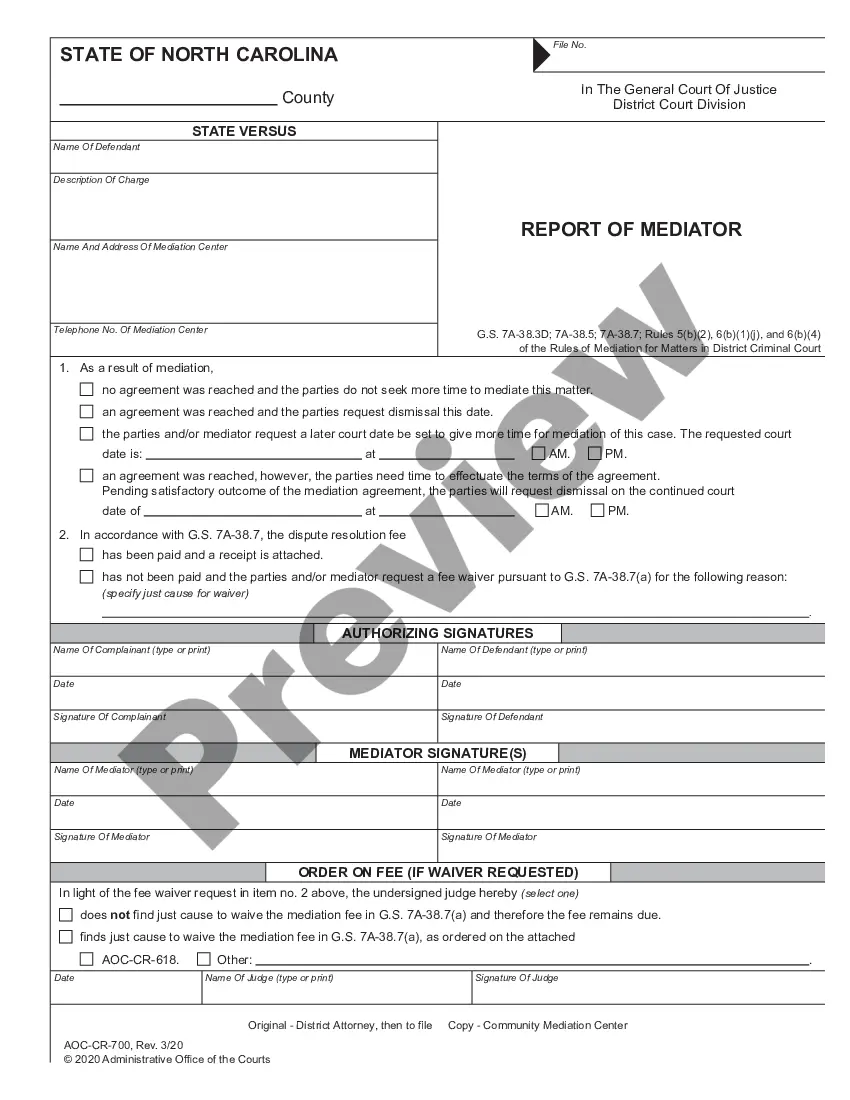

- Be sure to have selected the proper develop for your area/state. Click on the Preview button to review the form`s content material. See the develop explanation to actually have chosen the appropriate develop.

- When the develop does not satisfy your requirements, use the Search discipline towards the top of the screen to obtain the one who does.

- Should you be pleased with the shape, verify your selection by clicking the Buy now button. Then, select the costs program you favor and offer your credentials to register to have an profile.

- Process the purchase. Use your Visa or Mastercard or PayPal profile to complete the purchase.

- Find the formatting and download the shape on your product.

- Make changes. Fill up, revise and printing and indicator the acquired Guam Loan Application - Review or Checklist Form for Loan Secured by Real Property.

Each and every web template you added to your bank account lacks an expiry particular date and is the one you have for a long time. So, if you would like download or printing another duplicate, just visit the My Forms area and click on in the develop you need.

Gain access to the Guam Loan Application - Review or Checklist Form for Loan Secured by Real Property with US Legal Forms, probably the most comprehensive catalogue of legitimate file layouts. Use thousands of expert and express-particular layouts that fulfill your organization or specific requires and requirements.

Form popularity

FAQ

Collateral refers to an asset that a borrower offers as a guarantee for a loan or debt. For a mortgage (or a deed of trust, exclusively used in some states), the collateral is almost always the property you're buying with the loan. Obtaining the financing puts a lien on the property.

An application is defined as the submission of six pieces of information: (1) the consumer's name, (2) the consumer's income, (3) the consumer's Social Security number to obtain a credit report (or other unique identifier if the consumer has no Social Security number), (4) the property address, (5) an estimate of the ...

Borrower Documents means the Financing Documents and the Mortgage Loan Documents to which the Borrower is a party. Based on 10 documents. 10.

TILA disclosures include the number of payments, the monthly payment, late fees, whether a borrower can prepay the loan without penalty and other important terms.

MDIA. Timing Requirements ? The ?3/7/3 Rule? The initial Truth in Lending Statement must be delivered to the consumer within 3 business days of the receipt of the loan application by the lender. The TILA statement is presumed to be delivered to the consumer 3 business days after it is mailed.

In a mortgage loan, the borrower always creates two documents: a note and a mortgage.

Lenders require a few documents that can serve as proof of your identity and financial information to approve you for a loan. Some of the documents you'll be asked to provide include, copies of your state- or government-issued ID, copies of paystubs, tax returns or bank statements.

Pay stubs, W-2s or other proof of income Lenders generally ask for documentation of other income streams, such as spousal support or child support payments, Social Security benefits, investment or rental income, and income from a business or side gig.