Guam Affidavit of Mailing

Description

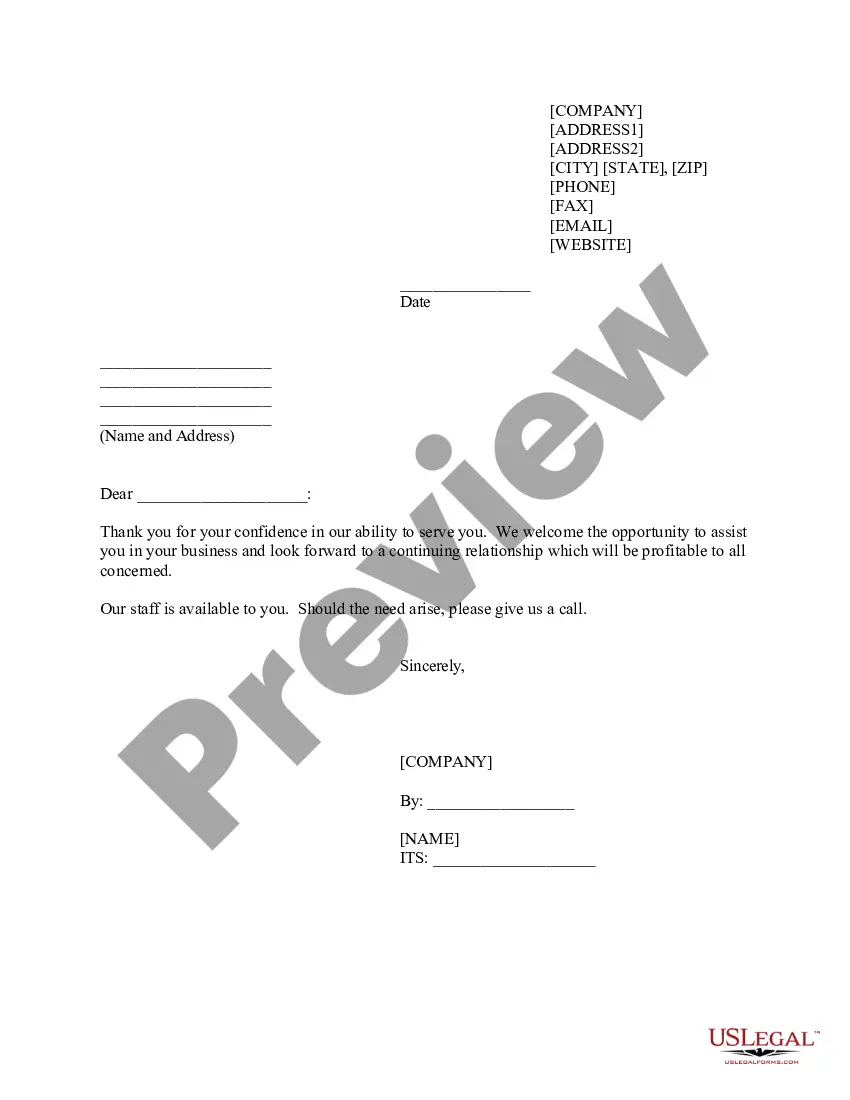

How to fill out Affidavit Of Mailing?

You can spend several hours online searching for the legal document template that meets the federal and state standards you require.

US Legal Forms offers thousands of legal forms that can be examined by professionals.

You can download or print the Guam Affidavit of Mailing from the service.

If available, utilize the Preview button to look through the document template as well.

- If you have a US Legal Forms account, you may Log In and click on the Acquire button.

- After that, you can complete, modify, print, or sign the Guam Affidavit of Mailing.

- Every legal document template you purchase is yours indefinitely.

- To get an additional copy of any purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions outlined below.

- First, ensure you have selected the correct document template for the state/region of your choice.

- Review the form description to confirm that you have chosen the right form.

Form popularity

FAQ

Individuals who earn income in Guam generally need to file a Guam tax return. This includes residents and those who perform services or have property in Guam. Proper filing helps maintain compliance with local tax laws, and for documentation, a Guam Affidavit of Mailing can support the submission process. Make sure to check specific requirements based on your unique situation.

You can contact Guam tax by reaching out to the Guam Department of Revenue and Taxation. They provide various communication options, including phone calls and email. It is helpful to have your relevant tax information ready when you reach out. Additionally, utilizing a Guam Affidavit of Mailing may ensure your communication gets documented appropriately.

As of 2025, the sales tax in Guam is expected to remain around 4% for most products and services. This rate can be subject to change based on local legislation. When making purchases, always verify current rates and ensure you maintain proper documentation, like a Guam Affidavit of Mailing, if you are dealing with refunds or related transactions.

Typically, the turnaround time for Guam tax returns varies, depending on the volume of submitted returns. Often, if you submit your return along with a Guam Affidavit of Mailing, you should expect processing within a few weeks. However, delays can occur, so it's wise to monitor your status if you do not receive updates.

Yes, Guam is considered a part of the United States for tax purposes. However, it has its tax laws and regulations. When dealing with tax documents, such as a Guam Affidavit of Mailing, it is essential to adhere to local guidelines for correct processing.

You can track your refund status through the Guam Department of Revenue and Taxation's online platform. By entering your details, including information from your Guam Affidavit of Mailing, you can see where your refund is in the processing stages. If you encounter issues, contacting their office can provide clarity.

To send your tax refund by mail, first, ensure that you complete the necessary paperwork accurately. Include your Guam Affidavit of Mailing to serve as documentation of your mailing process. Once everything is in order, mail it to the appropriate address indicated on the form.

You can contact Guam's Department of Revenue and Taxation via their official website or by phone. They offer multiple channels to reach out and provide assistance. When you call, have your pertinent information ready, like details of your Guam Affidavit of Mailing, to expedite the process.

To find your tax refund in Guam, you can visit the Guam Department of Revenue and Taxation website. It provides tools to help track your refund status efficiently. If you have submitted a Guam Affidavit of Mailing, ensure you have the receipt for verification. Additionally, you can contact their office directly for more personalized assistance.

Yes, submitting your tax return online in Guam is an option available to you. This method not only saves time but also allows for easier tracking of your submission status. Remember, if you prefer traditional methods, incorporating the Guam Affidavit of Mailing with your return offers an added layer of assurance that your documents arrive safely.