Guam Sample Letter for Erroneous Information on Credit Report

Description

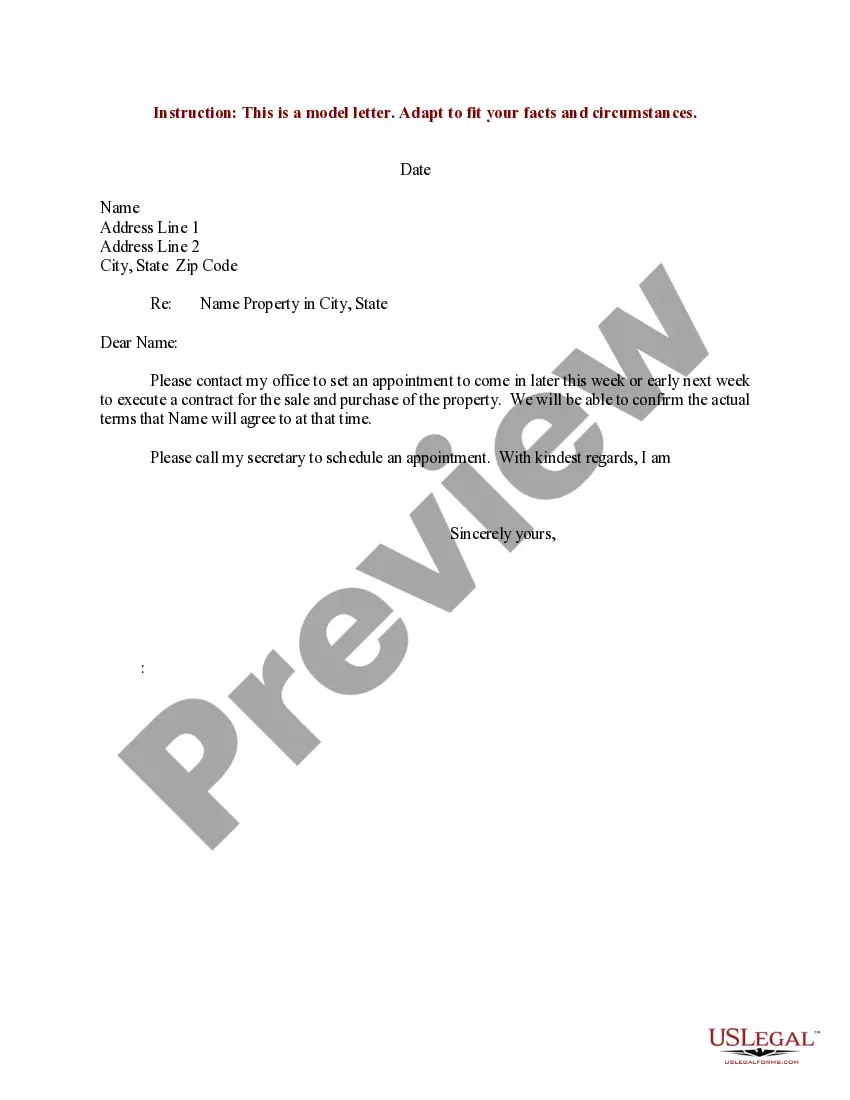

How to fill out Sample Letter For Erroneous Information On Credit Report?

If you need to finalize, acquire, or produce legal document templates, utilize US Legal Forms, the foremost collection of legal forms available online.

Take advantage of the site's straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are categorized by types and states, or by keywords.

Step 4. Once you have found the form you need, select the Get now button. Choose the payment method you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the payment. Step 6. Select the format of the legal form and download it to your device. Step 7. Fill out, modify, and print or sign the Guam Sample Letter for Incorrect Information on Credit Report. Each legal document template you acquire is yours permanently. You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again. Stay proactive and download, and print the Guam Sample Letter for Incorrect Information on Credit Report with US Legal Forms. There are thousands of professional and state-specific forms you can use for your business or personal needs.

- Utilize US Legal Forms to find the Guam Sample Letter for Incorrect Information on Credit Report with just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Guam Sample Letter for Incorrect Information on Credit Report.

- You can also access forms you previously downloaded from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps listed below.

- Step 1. Ensure you have chosen the form for the correct region/state.

- Step 2. Use the Review option to browse through the form's content. Don’t forget to check the details.

- Step 3. If you are unsatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A dispute letter for a debt is a formal notice you send to creditors or credit reporting agencies, asserting that you do not owe a specific debt. This letter should include all pertinent details, such as account numbers and reasons for the dispute. You can create a clear and effective dispute letter using a Guam Sample Letter for Erroneous Information on Credit Report, ensuring that your concerns are addressed promptly and accurately.

A 623 letter refers to a communication sent under Section 623 of the Fair Credit Reporting Act. This letter addresses inaccuracies in your credit report, demanding correction from the furnisher of information. By using a Guam Sample Letter for Erroneous Information on Credit Report, you can ensure that your letter is comprehensive and adheres to the legal requirements, increasing the chance of a favorable outcome.

The 609 letter can be an effective tool for disputing erroneous information on your credit report. This Guam Sample Letter for Erroneous Information on Credit Report specifically empowers you to request the removal of inaccurate entries. By clearly outlining the discrepancies, you prompt credit reporting agencies to reevaluate the information. To simplify this process, you can use templates from US Legal Forms, ensuring you present your case professionally and effectively.

To remove erroneous information from your credit report, start by identifying the specific inaccuracies present in your file. Next, write a Guam Sample Letter for Erroneous Information on Credit Report, detailing the erroneous data and providing any evidence that supports your claim. Send your letter to the credit reporting agency, which is obligated to investigate and eliminate any verified inaccuracies from your report.

Yes, you can sue a company for putting false information on your credit report if they fail to correct the inaccuracies after being informed. It's essential to document all communications and attempts to resolve the issue. If you need guidance on legal terms and frameworks, using a Guam Sample Letter for Erroneous Information on Credit Report can help strengthen your case and clarify your concerns to the credit bureau and the company.

A 623 letter is a formal communication sent to a company that provided erroneous information to a credit reporting agency. In your letter, you explain the specifics of the misinformation and request that the company correct it based on the Fair Credit Reporting Act. You can utilize a Guam Sample Letter for Erroneous Information on Credit Report as a template to craft your 623 letter, ensuring you include all necessary details for clarity.

To correct erroneous information in your credit file, collect all relevant documentation that proves the inaccuracy. Write a well-structured Guam Sample Letter for Erroneous Information on Credit Report that outlines your case and includes your supporting materials. Send this letter to the appropriate credit reporting agency, and they are legally obligated to review your claim and rectify any proven errors within a specified timeframe.

You can get incorrect information removed from your credit report by challenging the inaccuracies directly with the credit reporting agencies. Begin by gathering evidence that supports your claim. Then, write a Guam Sample Letter for Erroneous Information on Credit Report to explain the errors clearly and provide your documentation. The agencies must investigate your dispute, typically within 30 days, and correct any verified errors.

To remove an incorrect collection from your credit report, first obtain a copy of your credit report to confirm the inaccuracies. Once you identify the erroneous entry, draft a Guam Sample Letter for Erroneous Information on Credit Report, clearly stating the incorrect information and providing supporting documentation. Send this letter to the credit reporting agency, and they are required to investigate and correct the information if it is proven wrong.

When writing a credit dispute letter, start by addressing the credit reporting agency, including your personal details, and clearly state the inaccuracies. Utilize the Guam Sample Letter for Erroneous Information on Credit Report as a template to ensure you provide all necessary information and documentation. Be concise and specific about the errors you are disputing. Close your letter with a call to action, urging them to investigate and correct your credit report.