Guam Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

If you have to total, obtain, or produce authorized papers themes, use US Legal Forms, the largest assortment of authorized types, which can be found on the Internet. Utilize the site`s simple and handy lookup to discover the documents you want. A variety of themes for enterprise and person functions are sorted by classes and states, or key phrases. Use US Legal Forms to discover the Guam Certificate of Trust for Successor Trustee in just a handful of clicks.

In case you are previously a US Legal Forms buyer, log in to your bank account and click the Down load button to find the Guam Certificate of Trust for Successor Trustee. You can even accessibility types you previously delivered electronically in the My Forms tab of the bank account.

If you are using US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Be sure you have selected the form for that correct metropolis/country.

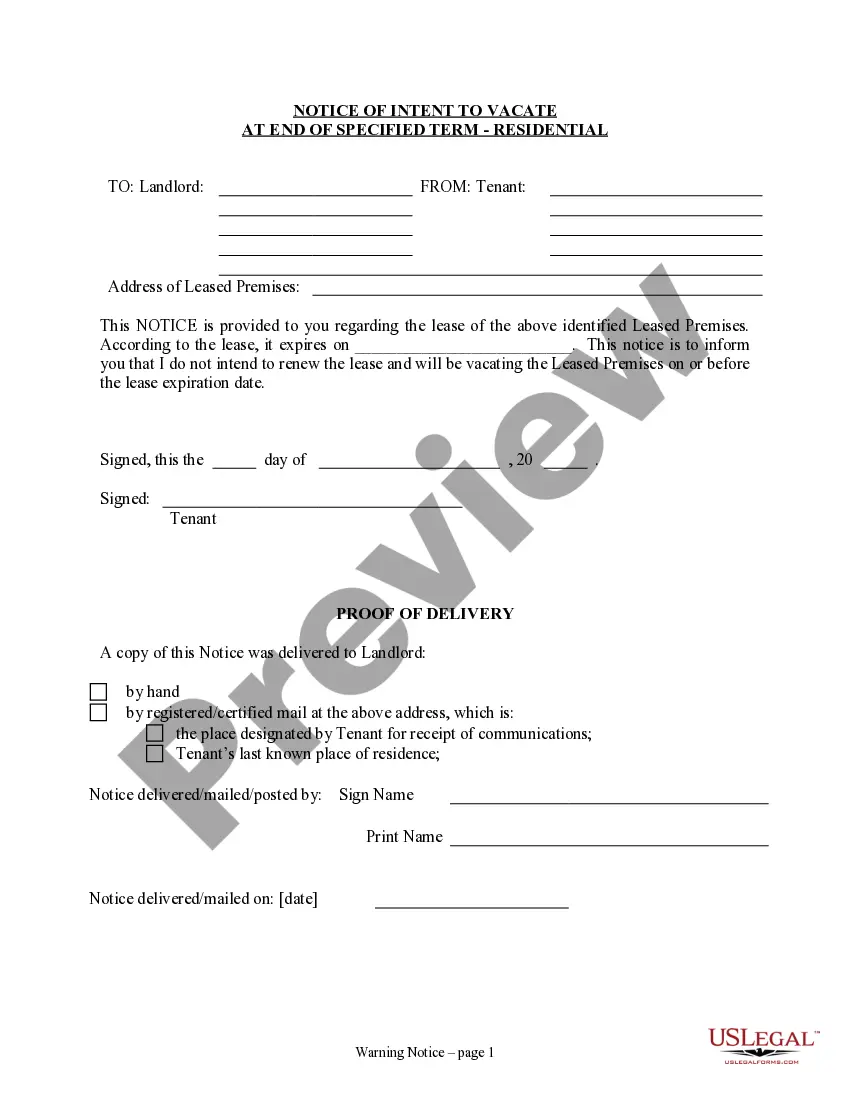

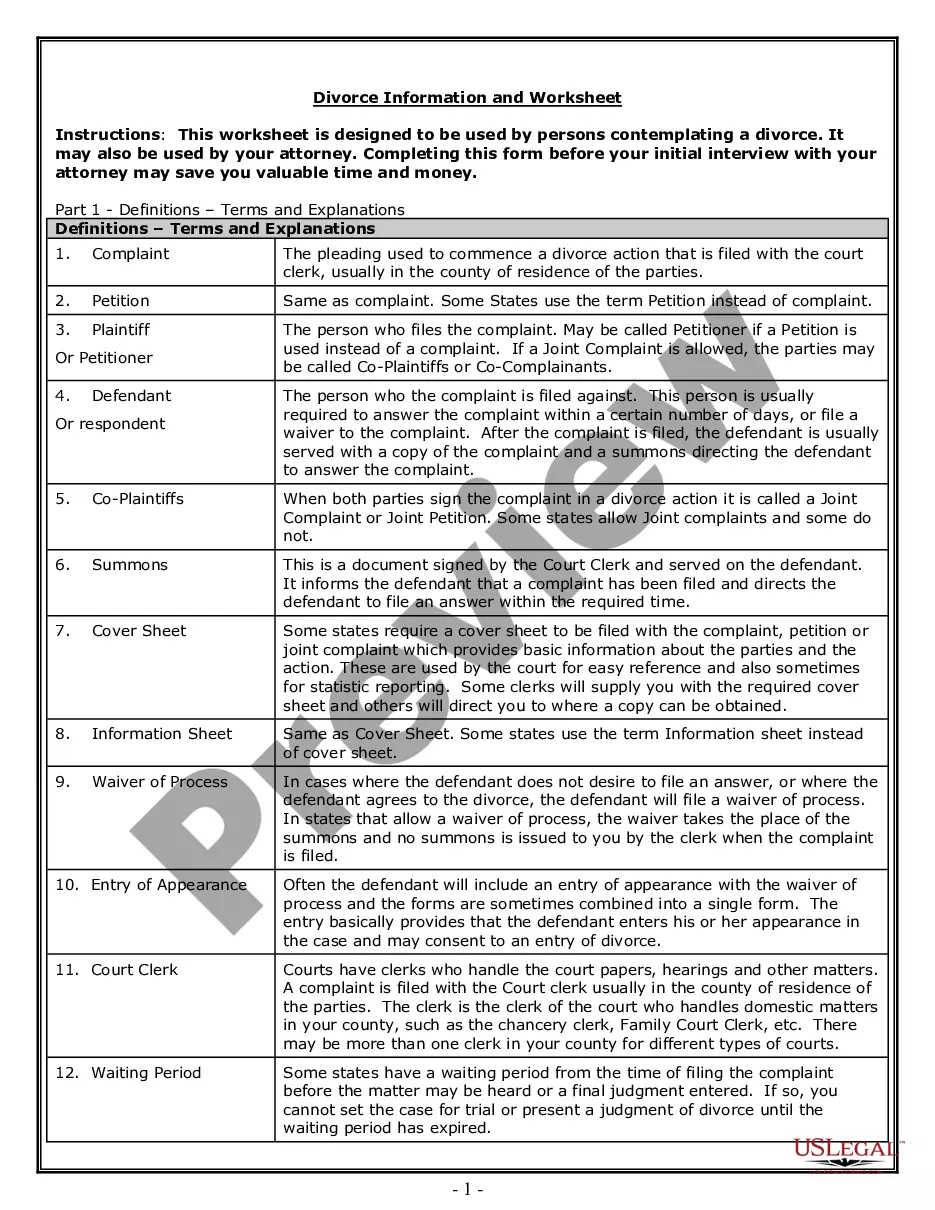

- Step 2. Make use of the Review choice to look over the form`s content. Do not forget about to read through the outline.

- Step 3. In case you are unhappy with all the form, utilize the Research field at the top of the monitor to discover other models of the authorized form template.

- Step 4. When you have identified the form you want, go through the Get now button. Opt for the pricing plan you like and include your references to sign up on an bank account.

- Step 5. Procedure the purchase. You may use your bank card or PayPal bank account to complete the purchase.

- Step 6. Find the file format of the authorized form and obtain it on your own device.

- Step 7. Comprehensive, change and produce or indicator the Guam Certificate of Trust for Successor Trustee.

Each and every authorized papers template you get is the one you have for a long time. You possess acces to every form you delivered electronically within your acccount. Select the My Forms area and decide on a form to produce or obtain yet again.

Contend and obtain, and produce the Guam Certificate of Trust for Successor Trustee with US Legal Forms. There are thousands of professional and express-distinct types you may use for the enterprise or person demands.

Form popularity

FAQ

Your successor will be able to do anything you could with your trust assets, as long as it does not conflict with the instructions in your trust document and does not breach fiduciary duty.

It is not unusual for the successor trustee of a trust to also be a beneficiary of the same trust. This is because settlors often name trusted family members or friends to both manage their trust and inherit from it.

Grantors can choose to nominate a close relative, family friend, or even financial institution to take on the role of Successor Trustee. A Grantor will name their Successor Trustee within a document called a Declaration of Trust, which is also where their role will be explained.

Successor Trustee is the person or institution who takes over the management of a living trust property when the original trustee has died or become incapacitated.

Under section 41 of the Trustee Act 1925, the court has a wide discretionary power to appoint new trustees either in addition to, or in substitution for existing trustees. The power may be exercised whenever the court considers it expedient to do so.

The successor trustee may be the primary beneficiary of the trust. However, the successor trustee can be anyone you trust. For example, the successor trustee can be a close friend, an adult child, your spouse, your lawyer, an accountant, or a corporate trustee.

Successor trustees are not the same as a co-trustees. Co-trustees duties are immediate, while a successor trustee waits until the trustee is incapacitated or dies to begin acting.