Guam Promissory Note Assignment and Notice of Assignment

Description

How to fill out Promissory Note Assignment And Notice Of Assignment?

If you wish to complete, acquire, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms accessible online.

Leverage the website's simple and straightforward search feature to locate the documents you require.

Various templates for business and personal purposes are categorized by types and jurisdictions, or keywords.

Step 4. Once you have found the form you need, click on the Acquire now button. Select the payment method you prefer and provide your details to register for an account.

Step 5. Complete the transaction. You can utilize your Visa, Mastercard, or PayPal account to finalize the purchase.

- Employ US Legal Forms to discover the Guam Promissory Note Assignment and Notice of Assignment in just a few clicks.

- If you are already a US Legal Forms customer, sign in to your account and click on the Acquire button to locate the Guam Promissory Note Assignment and Notice of Assignment.

- You can also find forms you previously saved in the My documents section of your account.

- If you are utilizing US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct city/state.

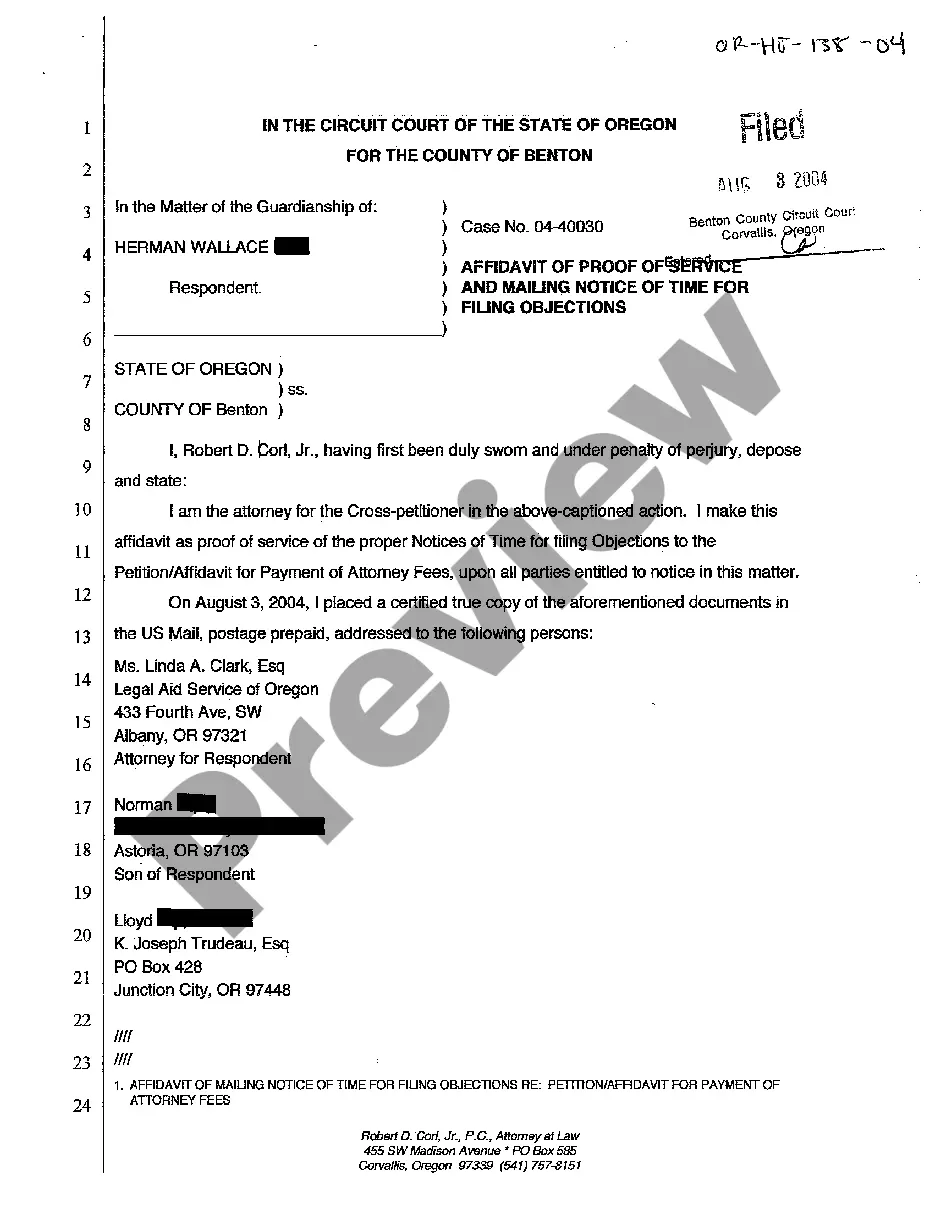

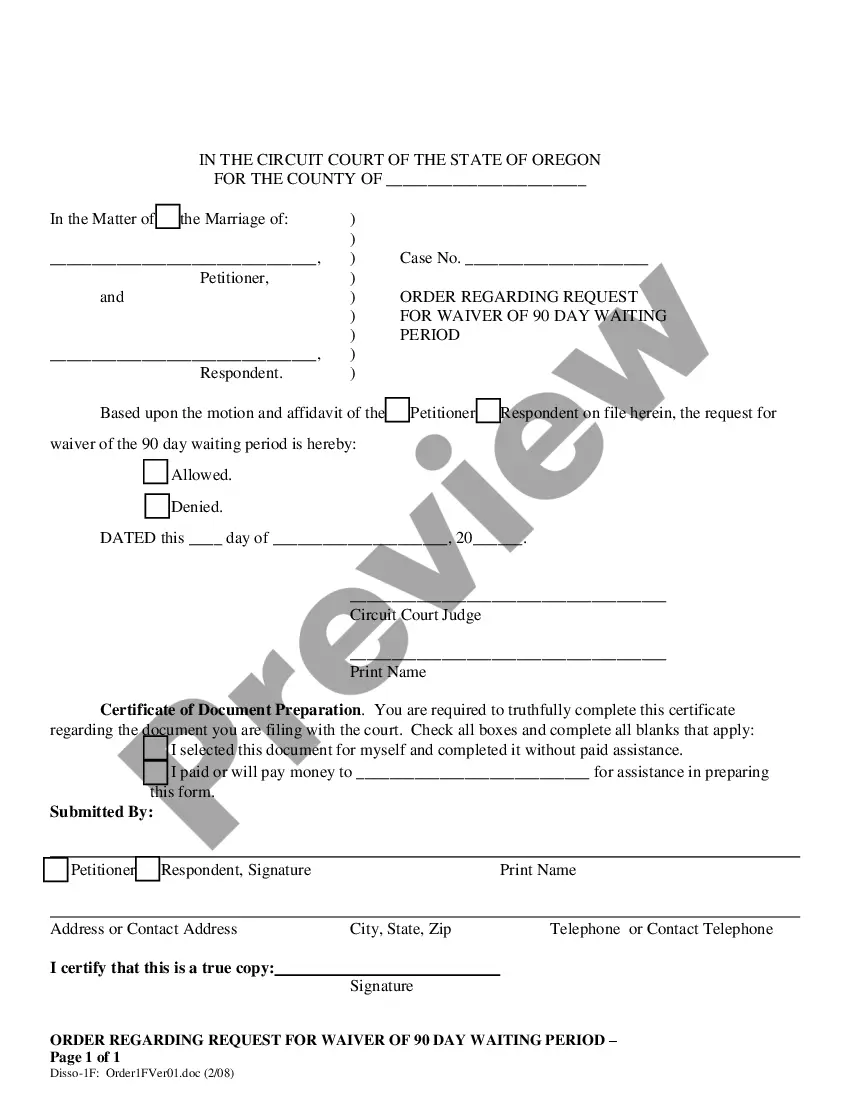

- Step 2. Use the Preview option to review the form's details. Be sure to read the instructions.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to locate alternative versions of the legal form template.

Form popularity

FAQ

Types of Promissory NotesSimple promissory note.Demand promissory note.Secured promissory note.Unsecured promissory note.

A banknote is frequently referred to as a promissory note, as it is made by a bank and payable to bearer on demand. Mortgage notes are another prominent example. If the promissory note is unconditional and readily saleable, it is called a negotiable instrument.

A loan promissory note sets out all the terms and details of the loan. The promissory note form should include: The names and addresses of the lender and borrower. The amount of money being borrowed and what, if any, collateral is being used. How often payments will be made in and in what amount.

Use promissory notes in routine and straight-forward contractual relationships between parties to avoid costly legal expertise. Next time you are entering into an agreement for goods or money, turn that handshake and bar napkin into a legally enforceable promise with a promissory note.

A Promissory Note is a document that is signed by an individual that details the amount of money borrowed from another individual or organization (Lender). A promissory note is also referred to as a Promise to Pay note or a Note payable.

How To Write a Promissory NoteStep 1 Full names of parties (borrower and lender)Step 2 Repayment amount (principal and interest)Step 3 Payment plan.Step 4 Consequences of non-payment (default and collection)Step 5 Notarization (if necessary)Step 6 Other common details.

You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

Simple Promissory Note SampleInclude the date you are writing or the date you plan to send the note at the top. Write the total amount due in both numeric and long-form. Add a detailed description of the loan or note terms. For example, you'll need to include what the loan or payment is for, who will pay it and how.

Assigned Loan means a Loan originated by a Person other than a Subsidiary of the Initial Borrower and in which a constant percentage has been assigned to any Pledgor in accordance with the Credit and Collection Policy.