Guam Restricted Endowment to Religious Institution

Description

How to fill out Restricted Endowment To Religious Institution?

Have you ever been in a situation where you require documentation for either business or personal activities almost constantly? There are numerous legal document templates available online, but finding ones you can trust isn’t simple.

US Legal Forms offers thousands of document templates, such as the Guam Restricted Endowment to Religious Institution, that are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and possess an account, simply Log In. Then, you can obtain the Guam Restricted Endowment to Religious Institution template.

- Locate the document you need and verify it is for the correct city/area.

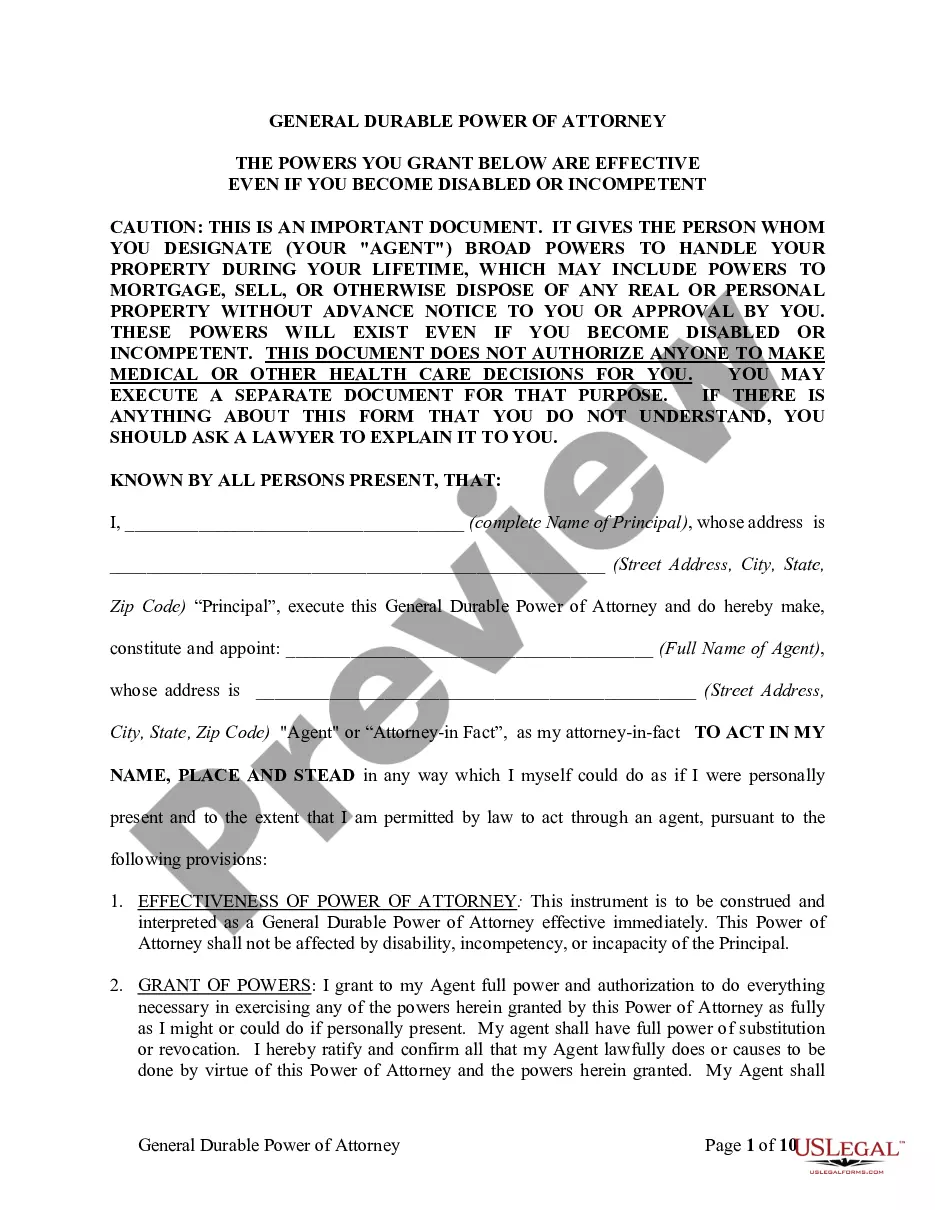

- Use the Review option to examine the document.

- Examine the summary to ensure you have selected the accurate document.

- If the document isn’t what you’re looking for, use the Search field to find one that meets your requirements.

- Once you find the correct document, click Purchase now.

- Select the pricing plan you desire, complete the required information to create your account, and make the payment using your PayPal, Visa, or Mastercard.

- Choose a suitable file format and download your copy.

Form popularity

FAQ

The turnaround time for Guam tax returns generally takes several weeks, depending on the volume of returns being processed. It’s essential to file early to avoid delays. If your return involves a Guam Restricted Endowment to Religious Institution, preparation and timely submission can help you stay on track.

You can email the Guam Department of Revenue and Taxation for assistance with your tax queries. Ensure you provide clear information about your concern to receive a prompt response. This is particularly helpful if you are managing aspects related to a Guam Restricted Endowment to Religious Institution.

The Gross Receipts Tax (GRT) in Guam is typically around 4%, but it can vary depending on the nature of your business. This tax applies to all businesses operating in the territory. If your organization relates to a Guam Restricted Endowment to Religious Institution, understanding GRT helps in budgeting and compliance.

Guam follows a tax policy based on local governance and federal laws, impacting individuals and businesses alike. The policy includes income tax, gross receipts tax, and various other taxes. Ensuring compliance is essential for organizations linked to a Guam Restricted Endowment to Religious Institution.

The current business tax rate in Guam varies based on the nature of the business and the income level. Generally, businesses are subject to income tax rates that are aligned with federal guidelines. If you are involved with a Guam Restricted Endowment to Religious Institution, understanding these rates can influence your financial strategies.

You can mail your Guam tax return to the Department of Revenue and Taxation for processing. Always check for the latest mailing address on their official website to ensure you send it to the correct location. Proper filing is essential, especially for organizations benefiting from a Guam Restricted Endowment to Religious Institution.

Starting an LLC in Guam involves choosing a unique name, filing articles of organization, and paying the required fees. Additionally, you may need to secure an employer identification number (EIN) from the IRS. If your LLC relates to a Guam Restricted Endowment to Religious Institution, you can effectively support your mission.

Privilege tax is a tax imposed on businesses for the privilege of doing business within a jurisdiction, such as Guam. This tax may vary based on your business activities and revenue. If your organization involves a Guam Restricted Endowment to Religious Institution, understanding privilege tax can impact your financial planning.

If you earn income in Guam, you usually need to file a Guam tax return. This applies whether you are a resident or non-resident. Understanding the requirements helps ensure compliance, especially if you manage a Guam Restricted Endowment to Religious Institution.

Yes, a non-US citizen can open a nonprofit organization in Guam. However, certain requirements need to be met, such as obtaining the necessary permits and licenses. This can be particularly beneficial if your nonprofit relates to a Guam Restricted Endowment to Religious Institution, addressing community needs.