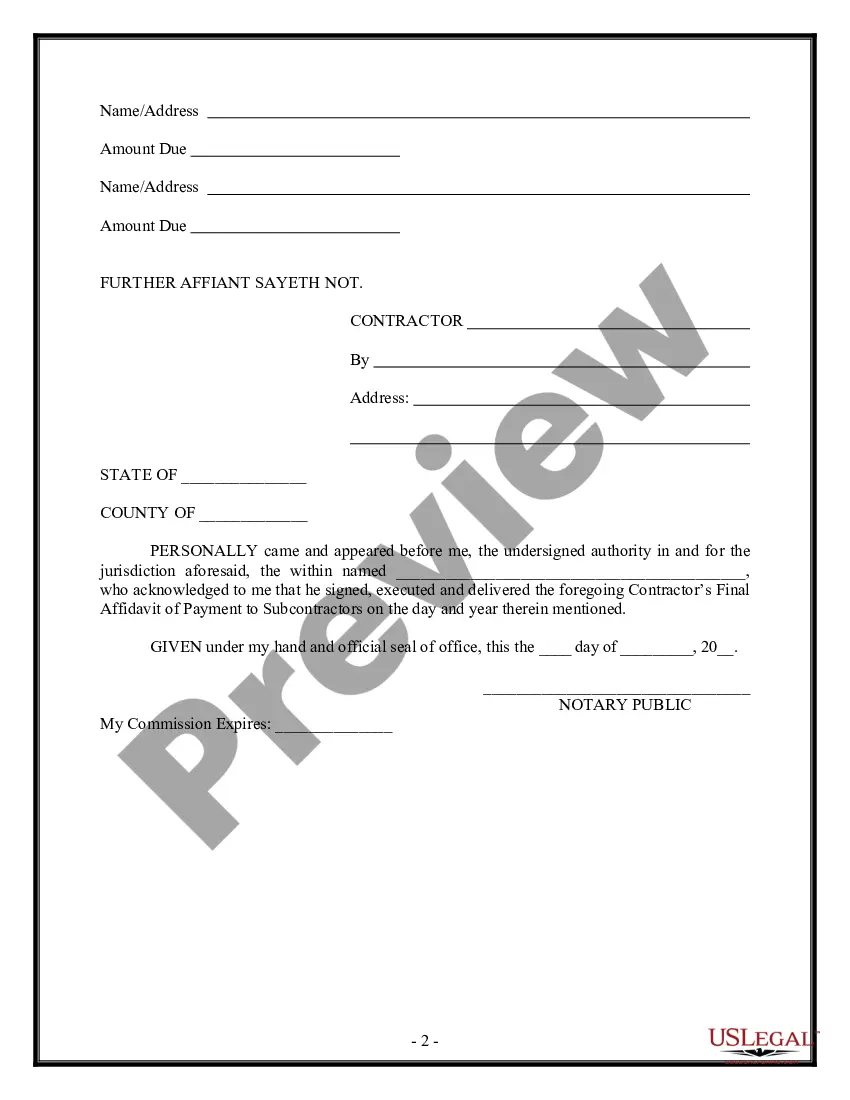

Guam Contractor's Final Affidavit of Payment to Subcontractors

Description

How to fill out Contractor's Final Affidavit Of Payment To Subcontractors?

US Legal Forms - one of the largest collections of legal documents in the United States - provides an extensive selection of legal form templates available for download or printing.

By utilizing the website, you can access thousands of forms for both business and personal purposes, organized by categories, states, or keywords. You can quickly find the latest versions of forms such as the Guam Contractor's Final Affidavit of Payment to Subcontractors.

If you are an existing subscriber, Log In to download the Guam Contractor's Final Affidavit of Payment to Subcontractors from the US Legal Forms library. The Download button will appear on every form you view. You will have access to all your previously saved forms in the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

Select the format and download the form to your device. Edit as needed. Fill out, modify and print, then sign the saved Guam Contractor's Final Affidavit of Payment to Subcontractors.

Each template saved in your account has no expiration date and belongs to you indefinitely. To download or print another version, simply navigate to the My documents section and click on the required form.

Access the Guam Contractor's Final Affidavit of Payment to Subcontractors with US Legal Forms, one of the most extensive libraries of legal document templates. Leverage a vast array of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure that you have selected the appropriate form for your city/state.

- Click the Preview button to review the form's details.

- Check the form description to confirm you have chosen the correct form.

- If the form does not suit your needs, utilize the Search box at the top of the page to find one that does.

- Once you find a satisfactory form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

When the subcontractor does not get paid then they have grounds to pursue the contractor for monies owed. This could be in the form of wages or unpaid invoices for services rendered. In the USA, the owner of the property can be held liable for payment under a Mechanics Lien.

The most typical payment term for contractors (and businesses, overall) is net payment. It means that an invoice is due in a specific amount of days from the invoice date.

If a subcontractor doesn't get paid, they can file what is known as a "mechanic's lien" against the property they've been working on. The first thing they'll need to do is notify the owner of the property. If the owner then fails to pay, the subcontractor can then file the lien.

If the contractor does not pay the subcontractor at all, or makes only a partial payment, the prompt payment provision states that the subcontractor still has to pay the sub-subcontractors whose work was included in the proper invoice (even if subject to a dispute), and those payments must be made within 42 days of the

Can a Contractor Sue for Non-Payment? The short answer is yes. If you've exhausted all other means, you can bring the case to a small claims court. It's a good idea to speak to a lawyer first to see what your options are and whether it's worth it.

The main contractor is able to withhold payment if the work or goods supplied by a subcontractor are deemed unsuitable. Evidence of this should always be provided along with the option to rectify any shortcomings.

The payment terms of a contract are the result of an agreement between a contractor and subcontractor. They two set the terms when they negotiate the contract. Any part of the contract is up for negotiation pay schedules, price, discounts so, ideally, the parties will reach terms that work for both sides.

A payment schedule should contain all of the information you need to plan out anticipated and actual payments:The name of the contractor or vendor.Description of the work or materials.Amount of the payment due.Due date for the payment.Actual amount paid.Actual payment date.Payment method.Notes.

How to get paid (faster) on every construction projectGet licensed.Write a credit policy.Prequalify potential customers.Get the contract in writing.Collect information about the property and other parties.Track your deadlines.Send Preliminary Notice.Submit Detailed Pay Applications or Invoices.More items...?

The law creates payment deadlines for all contractors and suppliers on federal projects. Once a proper invoice has been received by the federal agency contracting the work, they have 28 days to pay the prime contractor. The prime contractor then has an additional 7 days to pay their subcontractors.