This form is a sample letter in Word format covering the subject matter of the title of the form.

Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions

Description

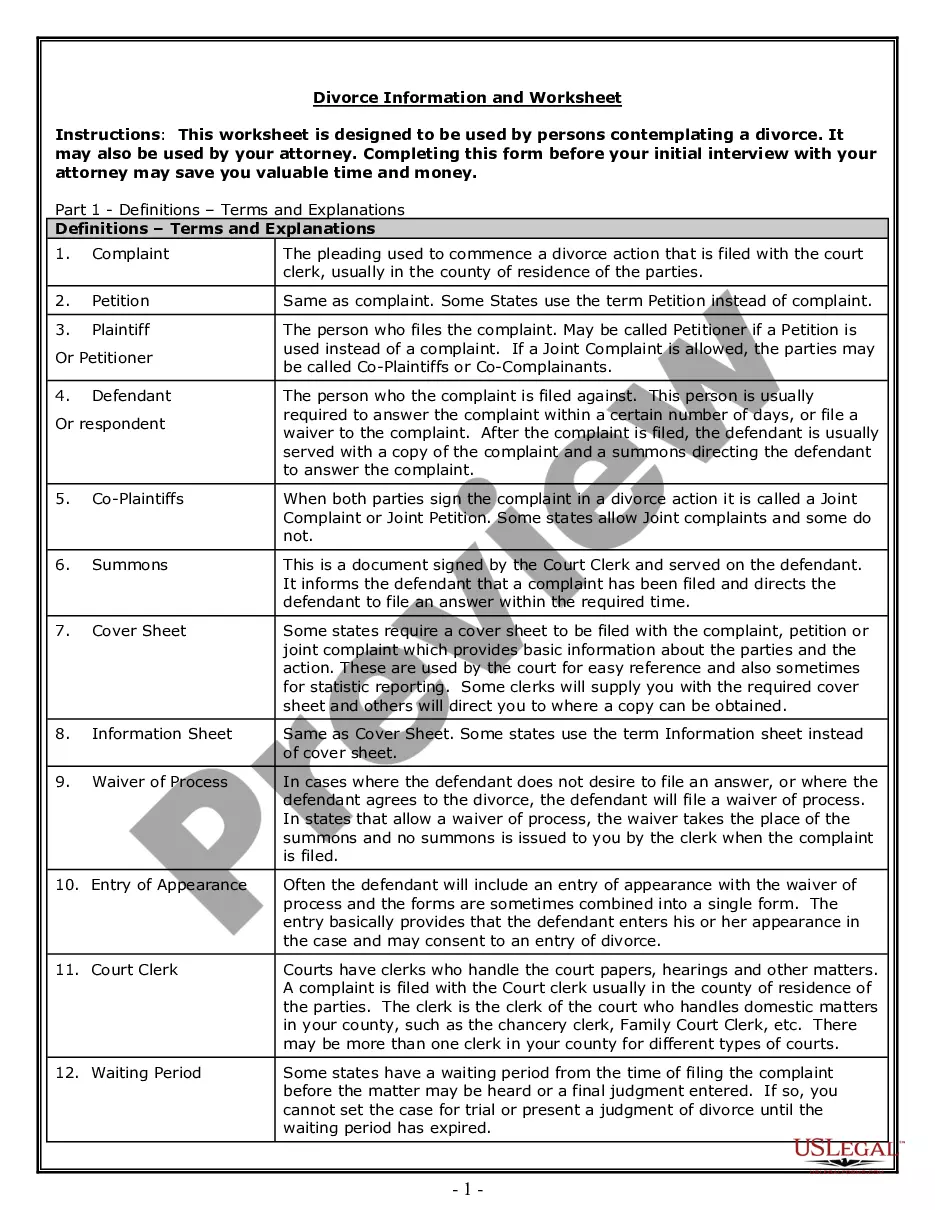

How to fill out Sample Letter For Settlement Offer - Instructions To Settle With Conditions?

You can spend several hours online searching for the official document template that fulfills the state and federal requirements you need. US Legal Forms offers a vast array of official forms that are reviewed by experts.

You can obtain or print the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions from my service. If you already have a US Legal Forms account, you may Log In and click the Acquire option.

Then, you can fill out, modify, print, or sign the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions. Every official document template you purchase is yours permanently. To get another copy of any purchased form, visit the My documents tab and select the relevant option.

Choose the format of the document and download it to your device. Make modifications to your document if necessary. You can fill out, adjust, sign, and print the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions. Download and print a multitude of document templates using the US Legal Forms website, which provides the largest selection of official forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have chosen the correct document template for the state/city that you select. Review the form description to confirm you have chosen the right form.

- If available, utilize the Review option to examine the document template as well.

- If you wish to find another version of the form, use the Search field to locate the template that meets your needs and specifications.

- Once you have identified the template you require, click Purchase now to continue.

- Select the pricing plan you wish, enter your details, and register for your account on US Legal Forms.

- Complete the transaction. You can use your credit card or PayPal account to purchase the official form.

Form popularity

FAQ

To request a settlement, begin your letter by clearly stating your intent and the context of the situation. Outline the key points of your claim and specify the settlement amount you desire. A Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions can provide helpful guidance in structuring your request. It's important to maintain a respectful tone throughout the letter, as this encourages constructive dialogue.

When asking for a full and final settlement, be direct and precise in your request. Clearly state the reasons for your request and the specific amount you seek to settle. Utilizing a Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions can guide you in crafting a professional letter. Make sure to express your willingness to discuss the terms further, as this can lead to a favorable resolution.

Writing a settlement offer letter involves outlining your proposal clearly and concisely. Begin with a brief introduction stating the purpose of your letter, followed by the terms you are proposing. Including a Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions can help you format your letter effectively. Conclude with a call to action, encouraging the recipient to respond positively to your offer.

To write a settlement counter offer letter, start by clearly stating the original offer and your reasons for countering it. Ensure that you specify the terms you agree with and the conditions you would like to adjust. Referencing a Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions can provide you with a solid structure. Ending your letter with a polite invitation to discuss further can foster a cooperative atmosphere.

To write a letter to settle a payment, start by clearly stating your intention to negotiate a settlement. Use the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions as a guide to structure your letter. Include key details such as the amount owed, the reasons for your request, and any conditions you wish to propose. Lastly, ensure that you maintain a professional tone throughout the letter, which will help facilitate a constructive dialogue.

Writing a settlement negotiation letter involves being clear, concise, and respectful while outlining your position. Begin with a brief introduction, then refer to the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions to frame your arguments effectively. Clearly state your settlement proposal, include any relevant details, and express your willingness to discuss the offer further. Utilizing a resource like USLegalForms can provide you with templates and insights to improve your letter's impact.

To write a strong settlement letter, start by clearly stating your intention to settle and the main points of your case. Incorporate the Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions as a guide for structure and tone. Make sure to include relevant facts, supporting documentation, and a specific offer to encourage the other party to engage in negotiation. A well-organized and respectful letter can significantly enhance your chances of a successful outcome.

A settlement offer letter outlines the terms and conditions under which one party proposes to resolve a dispute. For instance, you might reference a Guam Sample Letter for Settlement Offer - Instructions to Settle with Conditions that includes details such as the amount offered, the reasoning behind the offer, and any conditions that must be met. This letter serves as a formal communication to initiate negotiations and seek an amicable resolution.