This office lease provision refers to a tenant that is a partnership or if the tenant's interest in the lease shall be assigned to a partnership. Any such partnership, professional corporation and such persons will be held by this provision of the lease.

Georgia Standard Provision to Limit Changes in a Partnership Entity

Description

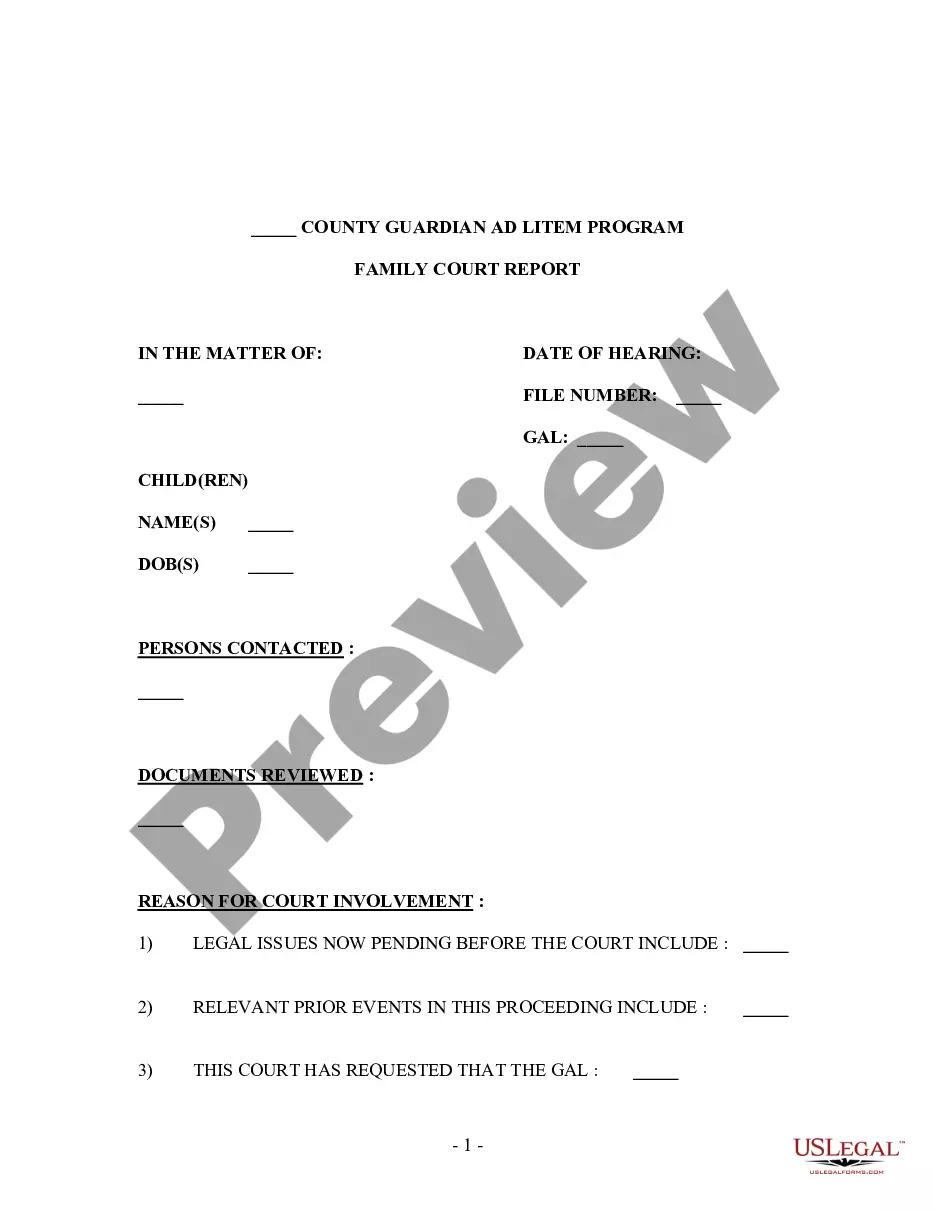

How to fill out Standard Provision To Limit Changes In A Partnership Entity?

Have you been within a place where you need paperwork for either business or person purposes virtually every day? There are plenty of authorized papers web templates available on the Internet, but finding versions you can trust is not easy. US Legal Forms gives 1000s of form web templates, such as the Georgia Standard Provision to Limit Changes in a Partnership Entity, which are published to fulfill state and federal specifications.

If you are presently acquainted with US Legal Forms website and get a free account, simply log in. Next, you are able to obtain the Georgia Standard Provision to Limit Changes in a Partnership Entity format.

Should you not have an bank account and wish to begin to use US Legal Forms, adopt these measures:

- Discover the form you require and make sure it is to the correct city/state.

- Use the Review option to check the form.

- Browse the description to actually have chosen the appropriate form.

- In case the form is not what you are looking for, utilize the Search area to get the form that meets your needs and specifications.

- Once you get the correct form, just click Purchase now.

- Pick the prices program you would like, submit the necessary information and facts to produce your bank account, and pay for your order with your PayPal or charge card.

- Choose a hassle-free document formatting and obtain your duplicate.

Discover every one of the papers web templates you may have bought in the My Forms food list. You may get a extra duplicate of Georgia Standard Provision to Limit Changes in a Partnership Entity anytime, if needed. Just go through the required form to obtain or produce the papers format.

Use US Legal Forms, by far the most considerable assortment of authorized kinds, to save efforts and steer clear of blunders. The support gives professionally created authorized papers web templates which you can use for a variety of purposes. Produce a free account on US Legal Forms and start making your way of life easier.

Form popularity

FAQ

Georgia's SALT cap workaround also incorporates a novel mechanism, providing that the individual owners subtract the income subject to the entity-level income tax from their individual Georgia return.

Assets Placed in Service during Tax Years Beginning on or after January 1, 2008. Georgia's I.R.C. Section 179 deduction is $250,000 for 2008 through 2013, $500,000 for 2014 through 2016, $510,000 for 2017, $1,000,000 for 2018, $1,020,000 for 2019, $1,040,000 for 2020, $1,050,000 for 2021, and $1,080,000 for 2022.

Several states (including California) implemented a tax workaround that could be valuable for some taxpayers. There is a new Pass-through Entity tax (PTE tax) that enables your (assuming you have a pass-through entity) partnership, S Corporation (S Corp), to avoid the cap on the SALT deduction.

§ 48-7-129. Tax withheld at one level can be claimed on a composite return at another level. (c) A member which is an entity or a corporation must include its pro rata share of the entity's gross receipts in its own single factor apportionment formula in determining how much of its income is Georgia income.

States Workaround SALT Limit Georgia enacted this type of provision in May 2021. It allows S Corporations, partnerships and LLCs taxed as partnerships to elect to pay the tax due on business income at the entity level instead of passing through the tax liability to the owners, beginning in 2022.

Georgia also adopts the 80% limitation on the use of NOLs, with the state 80% limitation based on Georgia taxable net income. Georgia has not adopted the Sec. 199A passthrough deduction of 20% of qualified business income deduction, nor the 30% limitation on net business interest.

States Workaround SALT Limit Georgia enacted this type of provision in May 2021. It allows S Corporations, partnerships and LLCs taxed as partnerships to elect to pay the tax due on business income at the entity level instead of passing through the tax liability to the owners, beginning in 2022.

California's recently enacted ?SALT workaround? legislation enables owners of pass-through entities to bypass the $10,000 federal limit on state and local tax deductibility by allowing their businesses to pay an elective entity level tax of 9.3% of qualified California taxable income for tax years 2021 through 2025.