Georgia Lien and Tax Search Checklist

Description

How to fill out Lien And Tax Search Checklist?

Finding the right authorized papers format might be a battle. Of course, there are a variety of web templates available on the Internet, but how do you discover the authorized kind you will need? Take advantage of the US Legal Forms website. The service delivers a large number of web templates, including the Georgia Lien and Tax Search Checklist, that you can use for company and personal demands. All the forms are inspected by pros and satisfy state and federal demands.

Should you be already registered, log in in your profile and then click the Acquire button to obtain the Georgia Lien and Tax Search Checklist. Make use of your profile to check with the authorized forms you have acquired formerly. Go to the My Forms tab of the profile and obtain another backup from the papers you will need.

Should you be a whole new consumer of US Legal Forms, here are simple instructions for you to stick to:

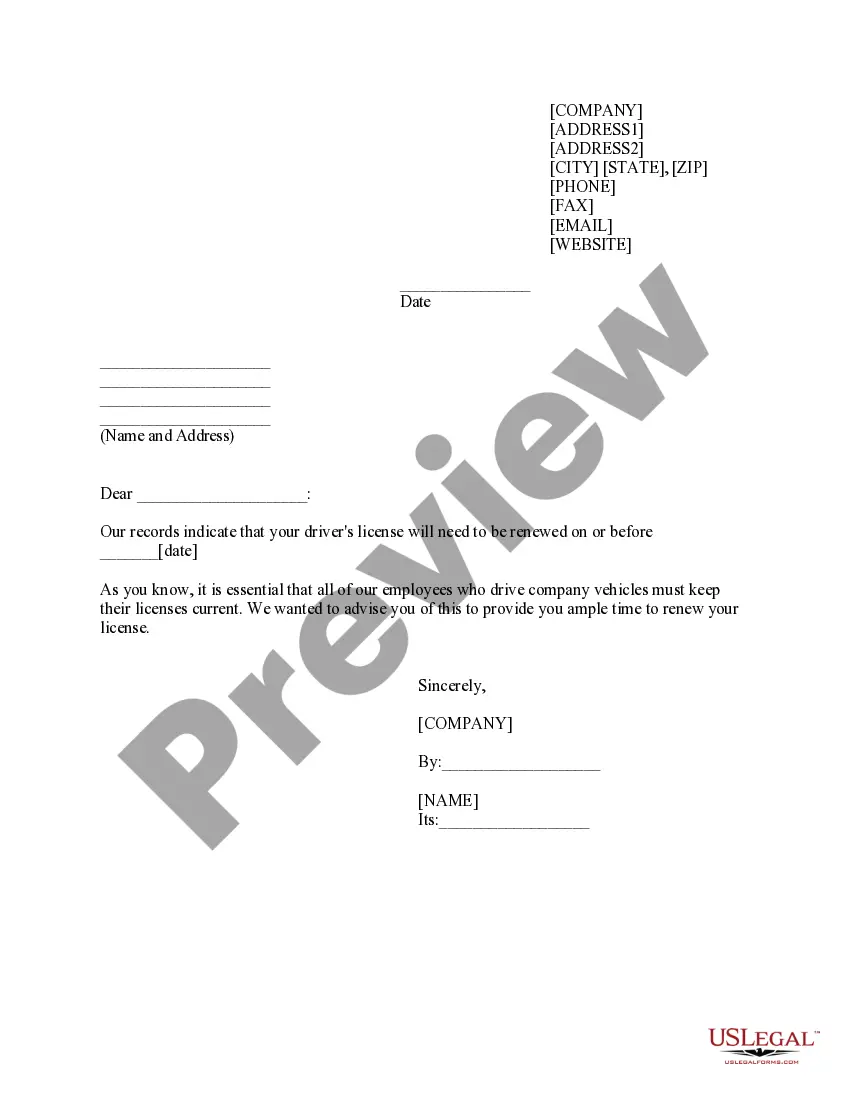

- Initial, make sure you have selected the right kind to your city/county. You can check out the form utilizing the Preview button and study the form description to make certain it is the best for you.

- When the kind will not satisfy your expectations, utilize the Seach industry to get the appropriate kind.

- Once you are positive that the form is proper, click on the Buy now button to obtain the kind.

- Pick the prices strategy you need and enter the needed information. Design your profile and pay for an order making use of your PayPal profile or credit card.

- Pick the data file format and download the authorized papers format in your system.

- Full, change and produce and indicator the received Georgia Lien and Tax Search Checklist.

US Legal Forms will be the most significant library of authorized forms where you can discover different papers web templates. Take advantage of the service to download expertly-created papers that stick to status demands.

Form popularity

FAQ

Once the tax sale is concluded and the high bidder fulfills their obligation to pay, the tax commissioner issues a tax deed to the purchaser. The buyer should keep in mind that a tax deed has the following limitations and restrictions. The tax deed is not a warranty deed.

GSCCCA.org - Lien Search. This tool allows for searching for state tax liens and related documents that have been submitted by the Georgia Department of Revenue for subsequent acceptance and filing by a clerk of superior court.

FACT: Paying current or back taxes does not increase your legal ownership of any real property, including heirs property. MYTH: Buying heirs property at a tax sale clears the title. FACT: When property is bought at a tax sale, the buyer obtains the title in whatever condition the title was in at the time of the sale.

If you don't pay the delinquent taxes that are due, the sheriff may eventually: hold a tax sale without going to court (called a "nonjudicial tax sale"), or. foreclose the lien in court (a "judicial tax sale") and then sell the home.

Tax Deeds. The pitch is simple: A County in Georgia is owed property taxes that go unpaid. The County files a lien, and then auctions off a deed. You win at the auction, and purchase it (a portion of your purchase price goes to pay the taxes that were in arrears).

How Long Can Property Taxes Go Unpaid in Georgia? Georgia property owners usually have 60 days after the due date on their tax bills to pay taxes. If they fail to pay within the required time frame, they could receive a property tax lien, which would prevent them from refinancing or reselling the taxed property.

Individual investors can purchase the tax deeds at public auction. For non-judicial tax sales, the county commissioners hold Sheriff's Sales, or auctions, on the steps of the county courthouse the first Tuesday of the month. (You can contact the county tax commissioner to find auction information).

Recorded liens are public information. Mortgage companies, financial institutions and taxpayers may obtain payoff information from the Department upon request by going to Georgia Tax Center and searching for a liens' payoff information using the SOLVED (Search for a Lien) database.