Georgia Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title

Description

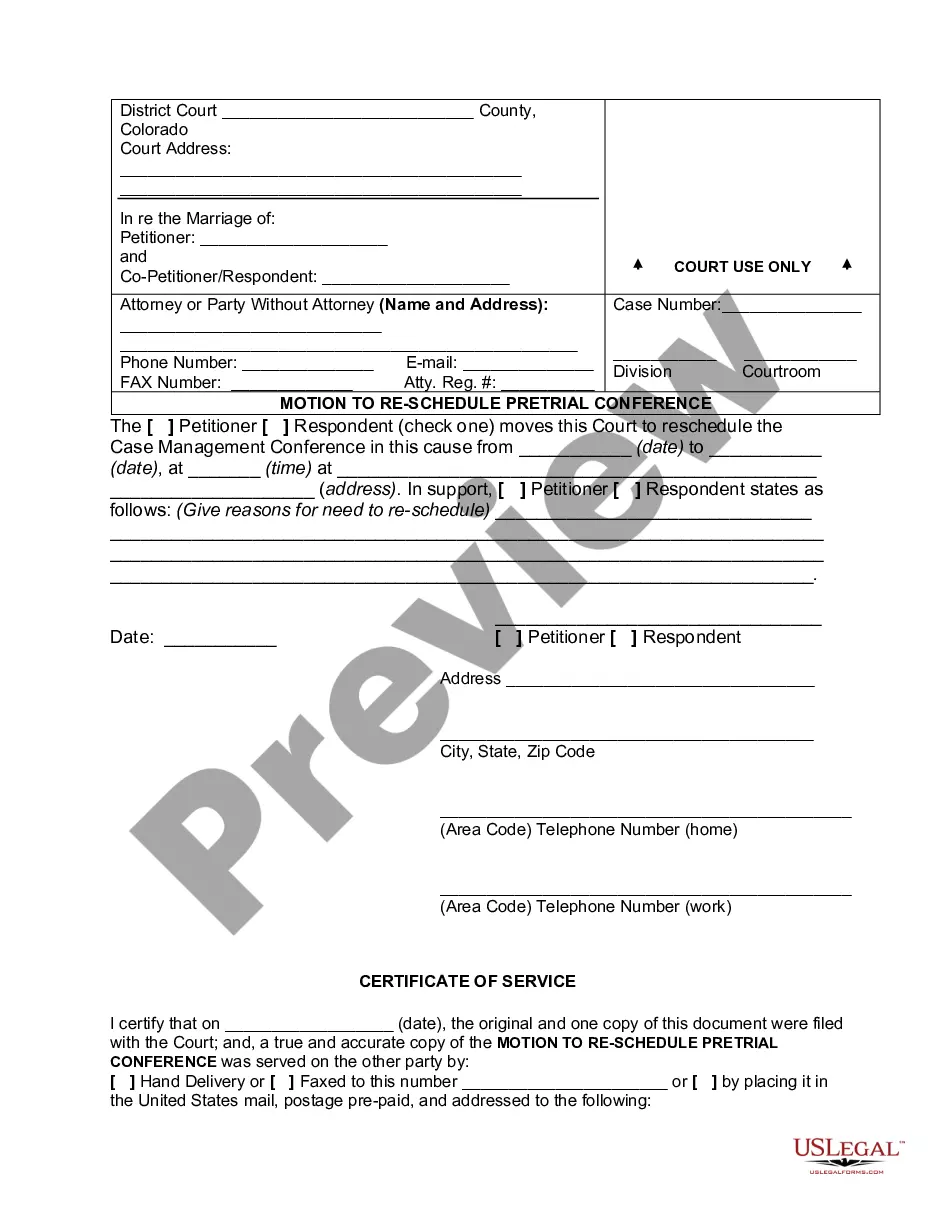

How to fill out Georgia Deed Of Trust, Mortgage, Security Agreement, Assignment Of Production, And Financing Statement Of Oil And Gas Properties Including After - Acquired Title?

You are able to spend hrs on-line trying to find the lawful papers format that fits the federal and state specifications you will need. US Legal Forms supplies a large number of lawful types that happen to be examined by experts. You can easily obtain or print out the Georgia Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title from our support.

If you currently have a US Legal Forms bank account, you are able to log in and click the Download button. Next, you are able to complete, modify, print out, or indicator the Georgia Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title. Each lawful papers format you purchase is your own property for a long time. To obtain one more duplicate for any bought kind, visit the My Forms tab and click the corresponding button.

If you work with the US Legal Forms website the first time, stick to the simple directions listed below:

- Very first, make sure that you have selected the proper papers format for that region/metropolis of your choosing. Look at the kind explanation to make sure you have picked the proper kind. If offered, use the Preview button to check with the papers format at the same time.

- If you wish to find one more variation from the kind, use the Research discipline to get the format that fits your needs and specifications.

- Once you have found the format you would like, simply click Purchase now to continue.

- Pick the pricing program you would like, type in your qualifications, and register for a free account on US Legal Forms.

- Comprehensive the transaction. You may use your charge card or PayPal bank account to purchase the lawful kind.

- Pick the file format from the papers and obtain it for your system.

- Make alterations for your papers if possible. You are able to complete, modify and indicator and print out Georgia Deed of Trust, Mortgage, Security Agreement, Assignment of Production, and Financing Statement of Oil and Gas Properties including After - Acquired Title.

Download and print out a large number of papers templates utilizing the US Legal Forms web site, that provides the greatest assortment of lawful types. Use specialist and state-distinct templates to take on your business or person requires.

Form popularity

FAQ

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded.

Under a security deed, the lender is automatically able to foreclose or sell the property when the borrower defaults. Foreclosing on a mortgage, on the other hand, involves additional paperwork and legal requirements, thus extending the process.

A trust deed is a legal agreement between you and your creditors to pay back part of what you owe over a set period. This is usually four years, but may vary.

What is the Difference Between a Deed and a Deed of Trust? The primary difference between a deed and a deed of trust is the purpose of each document. A deed transfers ownership of a property from one party to another, while a deed of trust secures a loan on a property.

A Grant Deed is an instrument that reflects a change in ownership of real property. A Deed of Trust is an instrument that secures a debt to real property.

A deed of trust is a document used in real estate transactions. It represents an agreement between the borrower and a lender to have the property held in trust by a neutral and independent third party until the loan is paid off.

A deed of trust, or security deed, as it is known in some jurisdictions, is a form of mortgage. A borrower of money signs a promissory note demonstrating the debt owed to the lender. The promissory note will generally recite the purpose of the loan and indicate that it is secured by real property.