Georgia Chef Services Contract - Self-Employed

Description

How to fill out Chef Services Contract - Self-Employed?

You can spend numerous hours online attempting to locate the legal document template that meets the state and federal requirements you require.

US Legal Forms offers thousands of legal forms that have been evaluated by experts.

You can conveniently download or print the Georgia Chef Services Contract - Self-Employed from my service.

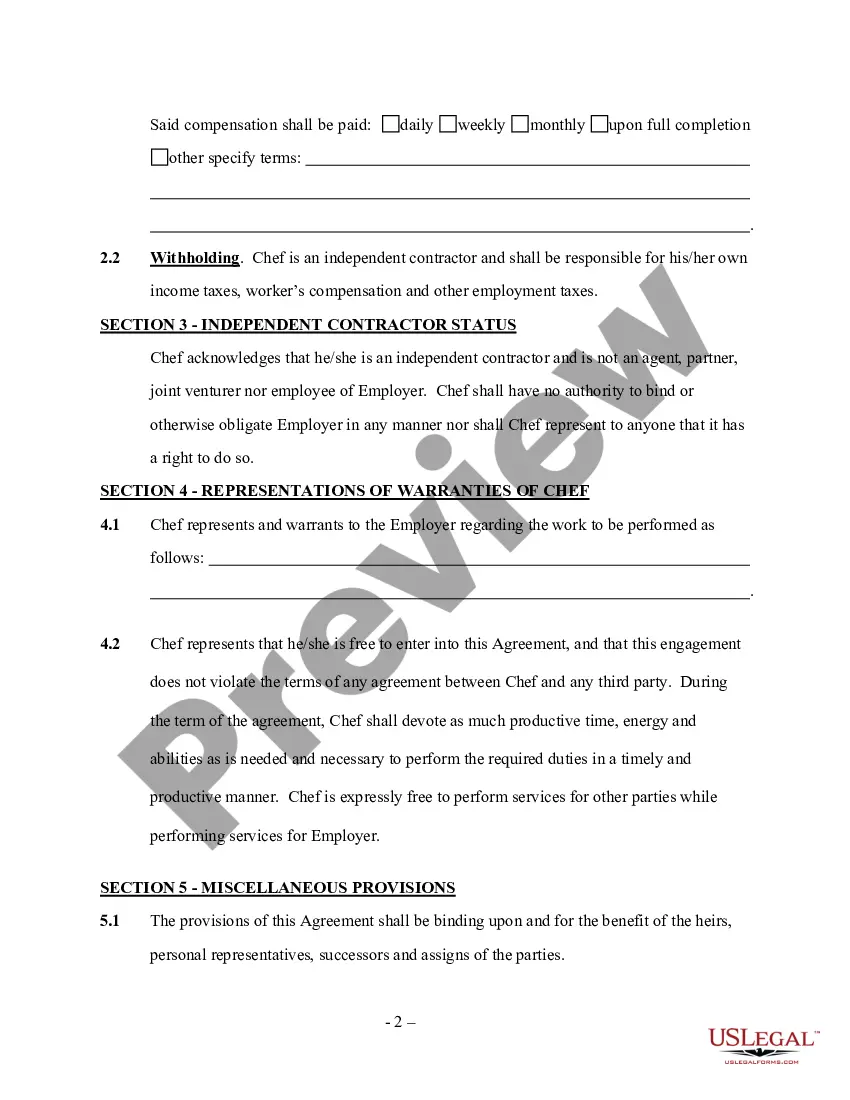

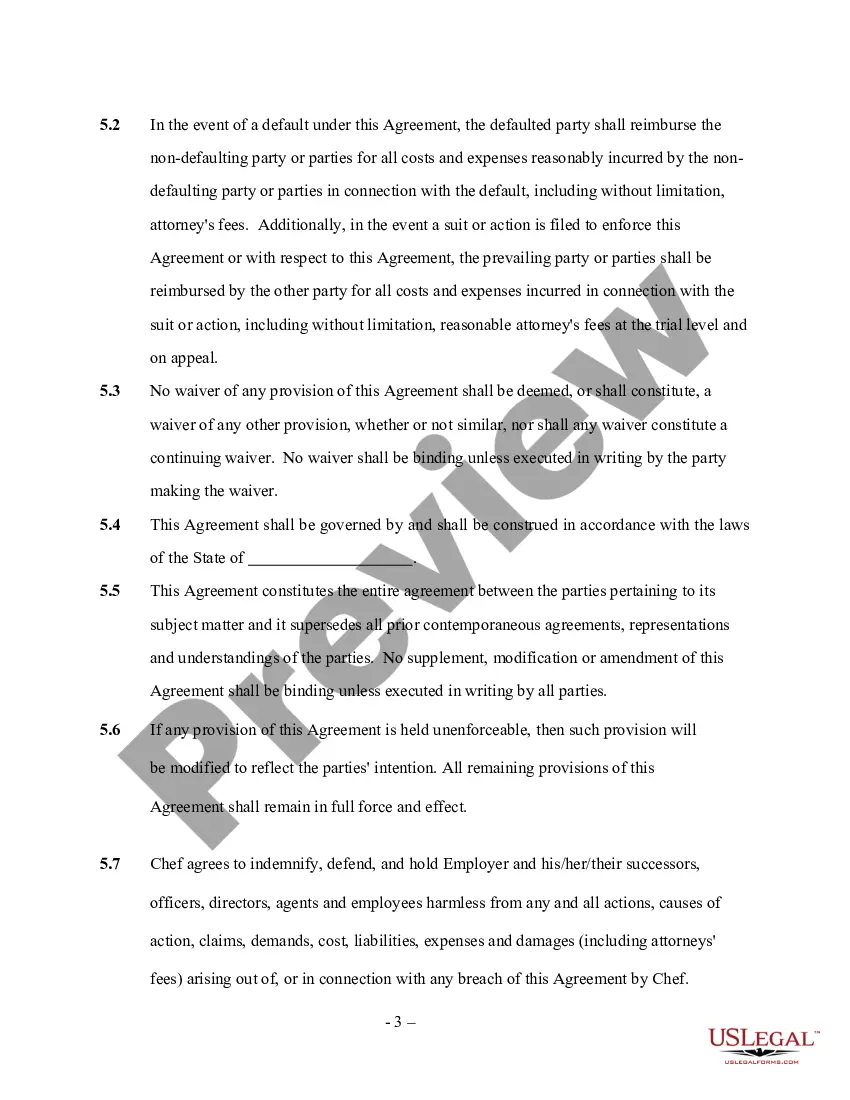

If available, utilize the Preview option to review the document template as well. If you wish to find another version of the form, use the Lookup section to find the template that suits your needs and requirements. Once you have found the template you desire, click Get now to proceed. Select the pricing plan you prefer, enter your information, and register for your account on US Legal Forms. Complete the payment. You may use your credit card or PayPal account to pay for the legal form. Choose the format of the document and download it to your device. Make adjustments to your document if required. You can complete, modify, sign, and print the Georgia Chef Services Contract - Self-Employed. Download and print thousands of document templates using the US Legal Forms site, which offers the largest selection of legal forms. Utilize professional and state-specific templates to address your business or personal needs.

- If you already have a US Legal Forms account, you can Log In and click the Acquire option.

- After that, you can complete, modify, print, or sign the Georgia Chef Services Contract - Self-Employed.

- Every legal document template you download is yours permanently.

- To obtain another copy of any downloaded form, go to the My documents tab and click the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the area/city of your choice.

- Review the form description to confirm you have chosen the right form.

Form popularity

FAQ

When writing a contract for a 1099 employee, specify the scope of work, payment structure, and duration of the employment. It is also crucial to clarify that the contractor is not an employee but responsible for their tax obligations. Integrating a Georgia Chef Services Contract - Self-Employed can help outline the necessary details while keeping the agreement compliant.

You can write your own legally binding contract, as long as it includes essential elements such as mutual agreement, clear terms, and signatures from both parties. Ensure that the contract complies with local laws, particularly if you operate in Georgia. For guidance, consider using a Georgia Chef Services Contract - Self-Employed as a foundational resource.

Yes, having a contract is highly recommended if you're self-employed. A contract protects both you and your clients by clearly defining the terms of the services offered. With a well-drafted Georgia Chef Services Contract - Self-Employed, you can avoid misunderstandings and ensure a professional relationship with your clients.

To write a self-employment contract, start by stating the parties involved and clearly define the services being provided. Include compensation details and the timeline for services. For a comprehensive approach, consider referencing a Georgia Chef Services Contract - Self-Employed template to ensure that you create a legally sound document.

Writing a self-employed contract involves outlining the services you will provide, the payment terms, and the duration of the agreement. Be sure to include both your and the client’s responsibilities, and any particular terms relevant to your cooking services. Using a Georgia Chef Services Contract - Self-Employed template can streamline this process by ensuring you cover all essential aspects.

To show proof of self-employment, you can provide various documents, such as tax returns, a business license, or invoices issued to clients. These documents demonstrate your activities as a self-employed chef. Additionally, maintaining a well-organized portfolio with client contracts, including a Georgia Chef Services Contract - Self-Employed, can support your claims of self-employment.

Yes, a chef can be self-employed. Many chefs choose this path to have more control over their work and business decisions. As a self-employed chef, you can offer services directly to clients, allowing for flexibility in your schedule and menu offerings. A Georgia Chef Services Contract - Self-Employed can help formalize your business arrangements.

Being a 1099 employee generally involves a contract that outlines the arrangement with a client. While you might technically operate without one, an absence of a contract can create confusion regarding work expectations and payment. Utilizing a Georgia Chef Services Contract - Self-Employed ensures both parties have a clear agreement, promoting a smoother working relationship.

Lacking a contract can lead to risks such as unpaid services, unclear job expectations, and potential legal disputes. Without a Georgia Chef Services Contract - Self-Employed, you may find it challenging to enforce your rights. It's best to create a contract to establish clear terms and minimize future conflicts.

Yes, having a contract is crucial even if you are self-employed. A written agreement helps specify the terms of your services and payment structure. Using a Georgia Chef Services Contract - Self-Employed can protect your business interests and ensure that clients understand their obligations.