Georgia Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans

Description

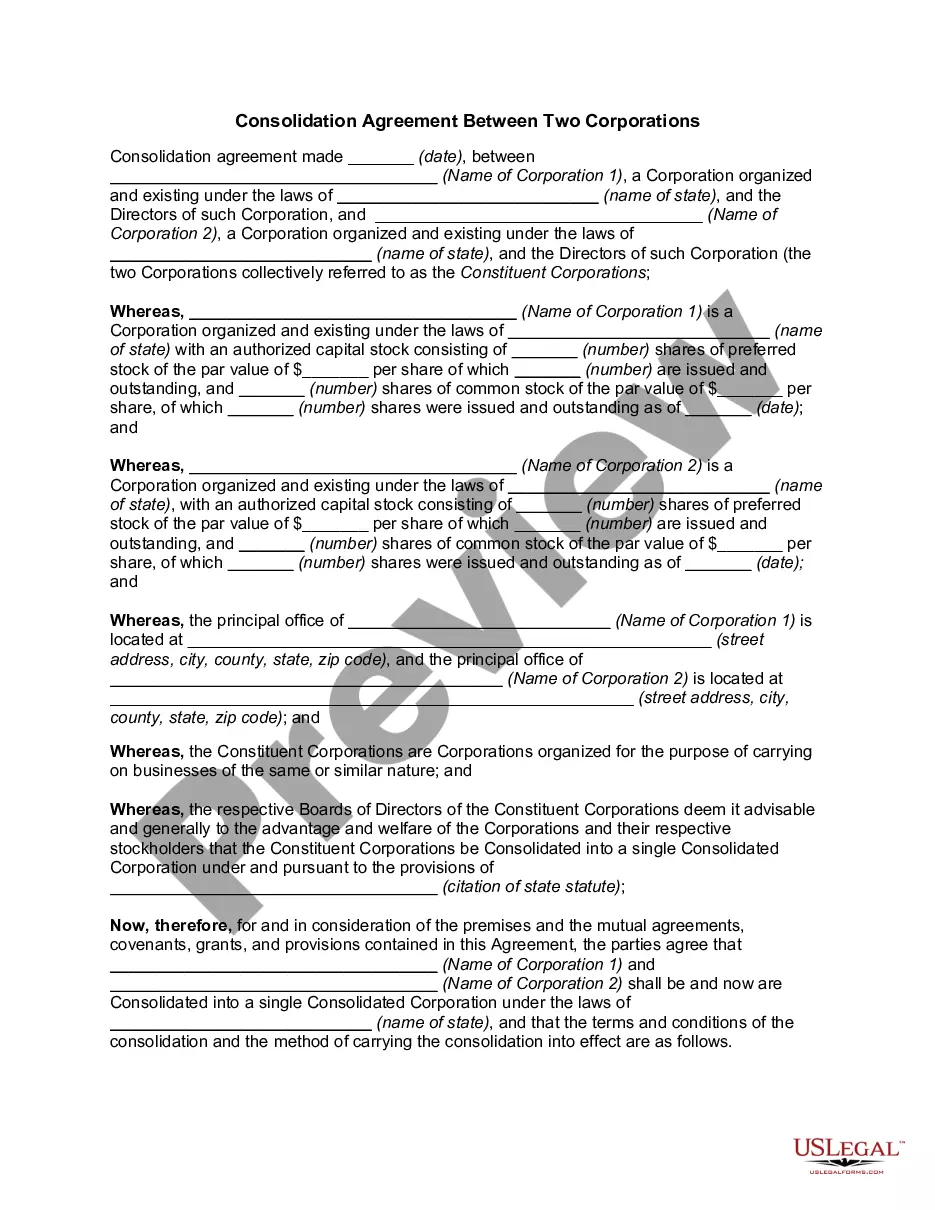

How to fill out Subsequent Transfer Agreement Between MLCC Mortgage Investors, Inc. And Bankers Trust Of CA, N.A. Regarding Consummation For Purchase And Sale Of Mortgage Loans?

You may commit hours on-line searching for the lawful papers template which fits the federal and state demands you require. US Legal Forms provides thousands of lawful forms that happen to be evaluated by specialists. It is simple to download or print the Georgia Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans from your support.

If you currently have a US Legal Forms bank account, you can log in and click on the Down load button. Following that, you can total, revise, print, or sign the Georgia Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans. Each lawful papers template you get is yours forever. To obtain another duplicate of the acquired kind, proceed to the My Forms tab and click on the corresponding button.

If you are using the US Legal Forms internet site the first time, follow the straightforward instructions under:

- Very first, ensure that you have selected the right papers template for your county/town that you pick. See the kind information to ensure you have picked out the proper kind. If accessible, take advantage of the Preview button to check from the papers template as well.

- If you would like discover another edition from the kind, take advantage of the Lookup field to discover the template that meets your needs and demands.

- Upon having found the template you desire, click Purchase now to carry on.

- Find the costs prepare you desire, type in your credentials, and register for a merchant account on US Legal Forms.

- Total the transaction. You should use your credit card or PayPal bank account to fund the lawful kind.

- Find the structure from the papers and download it to the device.

- Make alterations to the papers if required. You may total, revise and sign and print Georgia Subsequent Transfer Agreement between MLCC Mortgage Investors, Inc. and Bankers Trust of CA, N.A. regarding consummation for purchase and sale of mortgage loans.

Down load and print thousands of papers layouts making use of the US Legal Forms website, that provides the largest collection of lawful forms. Use specialist and state-specific layouts to handle your business or specific needs.

Form popularity

FAQ

The "lender" is the financial institution that loaned you the money. The lender owns the loan and is also called the "note holder" or "holder." Sometime later, the lender might sell the mortgage debt to another entity, which then becomes the new loan owner (holder).

A personal loan can work well if you need funds for the short term and want flexibility in how you use the money. A mortgage might be the better choice if you want to buy real estate and have a long repayment period, along with a potentially lower interest rate.

What's The Difference Between A Loan And A Mortgage? The term ?loan? can be used to describe any financial transaction where one party receives a lump sum and agrees to pay the money back. A mortgage is a type of loan that's used to finance property. Mortgages are ?secured? loans.

A mortgage is an agreement between you and a lender that gives the lender the right to take your property if you fail to repay the money you've borrowed plus interest. Mortgage loans are used to buy a home or to borrow money against the value of a home you already own.

Conventional mortgages, on the other hand, usually aren't assumable. Instead, conventional mortgages typically come with a due-on-sale clause?meaning the loan must be paid off if you want to transfer the property title.

?Mortgagee? is a term you'll likely see in your mortgage documentation. It refers to the lender, whether that's a bank, credit union, other financial institution or specialized mortgage originator like Rocket Mortgage®. Put simply, the mortgagee is the entity giving you the home loan.